Investment Team Voices Home Page

Investment Team Voices Home Page

For Investors Seeking Income, Calamos Closed-End Funds Provide Powerful Potential

John P. Calamos, Sr.

In 2020’s complex and uncertain environment, many investors have become increasingly worried about how to meet their needs for income and capital appreciation. Yields are low in many segments of the market, creating headwinds for traditional bond strategies. Meanwhile, the first quarter correction provided a powerful reminder of how quickly markets can sell off, but the subsequent rally has demonstrated the importance of staying invested, particularly with economic recovery underway. Finally, many investors have become concerned that inflation will rise (due to pent-up demand, massive monetary stimulus and the localization of supply chains), pressuring Treasury securities and investment-grade bonds even more.

Since the 1970s, Calamos Investments has provided innovative strategies to help investors pursue their goals through challenging environments. Drawing on this experience, we believe the Calamos closed-end funds are well positioned to address the search for stable income in a low yield, high volatility world.

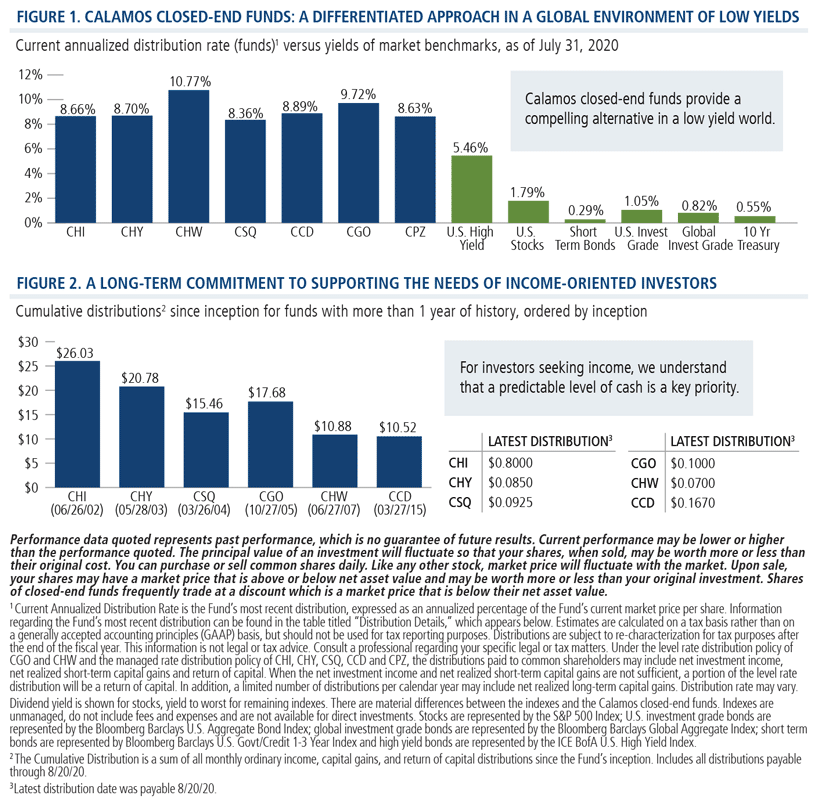

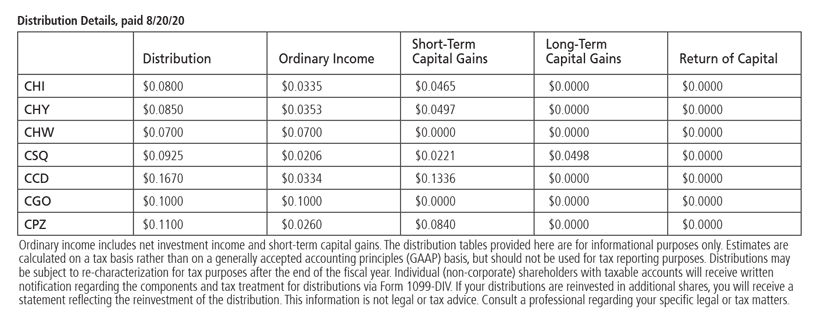

Through multiple market cycles, the Calamos closed-end funds have sought to provide a long-term solution for income-oriented investors. By dynamically allocating to investment strategies that have been less vulnerable to the pressures facing traditional bonds, Calamos closed-end funds offer a unique way to navigate a global landscape of low interest rates. As shown in Figure 1, the funds’ annualized distribution rates contrast sharply with the low yields of major asset classes, which may make the funds a compelling choice in the search for income. Figure 2 looks back to each fund’s inception to highlight the long-term potential of our approach, which includes distribution policies that pursue steady monthly income.

Our recent whitepaper provides an overview of the funds’ multi-asset strategies and how they have addressed the long-term needs of income-oriented investors. And for a closer look at the funds, visit the Calamos closed-end fund profiles.

All Calamos closed-end funds: Investments by the Fund in lower-rated securities involve substantial risk of loss and present greater risks than investments in higher rated securities, including less liquidity and increased price sensitivity to changing interest rates and to a deteriorating economic environment.

Fixed income securities are subject to interest-rate risk; as interest rates go up, the value of debt securities in the Fund’s portfolio generally will decline.

There are certain risks associated with an investment in a convertible bond such as default risk—that the company issuing a convertible security may be unable to repay principal and interest, and interest rate risk—that the convertible may decrease in value if interest rates increase.

CCD: The Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the option market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment adviser to predict pertinent market movements, which cannot be assured. Investment Adviser Purchase Risk. As contemplated in the Fund’s prospectus, Calamos Advisors LLC (the “Adviser”) has entered into a 10b5-1 Plan under which a registered broker-dealer (not a member of the underwriting syndicate involved in the offering of the Fund), as agent for the Adviser, will purchase in the open market up to $20 million of our common shares in the aggregate, on such terms and at times, and subject to a variety of market and discount conditions and a daily purchase limit, to be described in a subsequent press release. See “Management of the Fund — Related-Party Transactions” in the Fund’s prospectus. Whether purchases will be made under the 10b5-1 Plan and how much will be purchased at any time is uncertain, dependent on prevailing market prices and trading volumes, all of which we cannot predict. Although intended to provide liquidity, these activities may have the effect of maintaining the market price of our common shares or suppressing a decline in the market price of the common shares, and, as a result, the price of our common shares may be higher than the price that otherwise might exist in the open market. Conversely, any eventual sale of purchased common shares by the Adviser and its affiliates may act as a catalyst for a decline in the Fund’s market price, and therefore the market price of our common shares may be lower than the price that might otherwise exist in the open market. Limited Term Risk. Unless the Termination Date is amended by shareholders in accordance with the Declaration of Trust, the Fund will be terminated on the 15th anniversary of its effective date, currently expected to be March 26, 2030. If the Fund’s Board of Trustees believes that under then current market conditions it is in the best interests of the Fund to do so, the Fund may extend the Termination Date for one year, which is anticipated to be March 26, 2031, without a shareholder vote, upon the affirmative vote of three-quarters of the Trustees then in office. Beginning one year before the Termination Date (the “wind-down period”), the Fund may begin liquidating all or a portion of the Fund’s portfolio. During the wind-down period the Fund may deviate from its investment strategy. As a result, during the wind-down period the Fund’s distributions may decrease, and such distributions may include a return of capital.

CHW: The Fund may invest up to 100% of its assets in foreign securities and invest in an array of security types and market cap sizes, each of which has a unique risk profile. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities. These include fluctuations in currency exchange rates, increased price volatility, and difficulty obtaining information. The Fund may invest in derivative securities, including options and swap agreements. The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. There is no assurance that any derivative strategy used by the Fund will succeed. One of the risks associated with purchasing an option is that the Fund pays a premium whether or not the option is exercised.

CPZ: Equity Securities Risk. Equity investments are subject to greater fluctuations in market value than other asset classes as a result of such factors as the issuer’s business performance, investor perceptions, stock market trends and general economic conditions. Equity securities are subordinated to bonds and other debt instruments in a company’s capital structure in terms of priority to corporate income and liquidation payments. The Fund may invest in preferred stocks and convertible securities of any rating, including below investment grade. Short Selling Risk. The Fund will engage in short sales for investment and risk management purposes, including when the Adviser believes an investment will underperform due to a greater sensitivity to earnings growth of the issuer, default risk or interest rates. In times of unusual or adverse market, economic, regulatory or political conditions, the Fund may not be able, fully or partially, to implement its short selling strategy. Periods of unusual or adverse market, economic, regulatory or political conditions may exist for extended periods of time. Short sales are transactions in which the Fund sells a security or other instrument that it does not own but can borrow in the market. Short selling allows the Fund to profit from a decline in market price to the extent such decline exceeds the transaction costs and the costs of borrowing the securities and to obtain a low cost means of financing long investments that the Adviser believes are attractive. If a security sold short increases in price, the Fund may have to cover its short position at a higher price than the short sale price, resulting in a loss. The Fund will have substantial short positions and must borrow those securities to make delivery to the buyer under the short sale transaction. The Fund may not be able to borrow a security that it needs to deliver or it may not be able to close out a short position at an acceptable price and may have to sell related long positions earlier than it had expected. Thus, the Fund may not be able to successfully implement its short sale strategy due to limited availability of desired securities or for other reasons. Limited Term Risk. Unless the limited term provision of the Fund’s Declaration of Trust is amended by shareholders in accordance with the Declaration of Trust, or unless the Fund completes the Eligible Tender Offer and converts to perpetual existence, the Fund will dissolve on the Dissolution Date. The Fund is not a so called “target date” or “life cycle” fund whose asset allocation becomes more conservative over time as its target date, often associated with retirement, approaches. In addition, the Fund is not a “target term” fund whose investment objective is to return its original NAV on the Dissolution Date. The Fund’s investment objective and policies are not designed to seek to return to investors that purchase Shares in this offering their initial investment of $20.00 per Share on the Dissolution Date or in the Eligible Tender Offer, and such investors and investors that purchase Shares after the completion of this offering may receive more or less than their original investment upon dissolution or in the Eligible Tender Offer Terms.

Leverage creates risks which may adversely affect return, including the likelihood of greater volatility of net asset value and market price of common shares; and fluctuations in the variable rates of the leverage financing. The ratio is the percent of borrowing to total assets.

Level Rate Distribution Policy and Managed Distribution Policy are each an investment company’s commitment to common shareholders to provide a predictable, but not assured, level of cash flow.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

18827 0820R

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.