Investment Team Voices Home Page

Investment Team Voices Home Page

Fixed Income Update: Credit Market Fundamentals Call for Active Risk Management

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

- A recession is not likely in 2023—credit remains available to most borrowers, the banks are systematically stable, and the labor market is strong.

- The market’s expectation of additional Fed hikes in 2023 is reasonable.

- Fundamentals for investment-grade and high-yield credit may look strong on the surface but have become more mixed and defaults are increasing, which makes selectivity and a bond-by-bond approach essential.

Following the surprising failure of three banks in the first quarter, the market was unsure whether the Fed would be able to stick to its stated policy prescription of higher rates for longer. Bank stress has often led to tighter lending conditions that magnify the impact higher rates have on the economy. Fast forward 90 days and systemic stability seems to have returned. Lending standards appear to have tightened, but the worst-case scenario has been avoided and credit remains available to most borrowers. While questions remain around bank profitability, weak banks are not considered a sufficient deterrent to change the course of Fed policy.

Labor market strength was notable, as all three non-farm payroll releases during the quarter beat expectations. Although jobless claims have been increasing slowly, they have yet to reflect the level of job losses that many feel will be necessary to bring inflation down to the Fed’s long-held 2% goal. When viewed in totality, we believe these conditions indicate that a 2023 recession remains unlikely.

During the first quarter, the market anticipated multiple Fed rate cuts before year-end. That timeline has been pushed further out, and futures now indicate an additional rate hike (or two) are possible, with no cuts before May 2024 at the earliest. Our team views the updated timeline as reasonable, although we still believe the risk is to the upside on both terminal rates and the length of time that policy is held in restrictive territory.

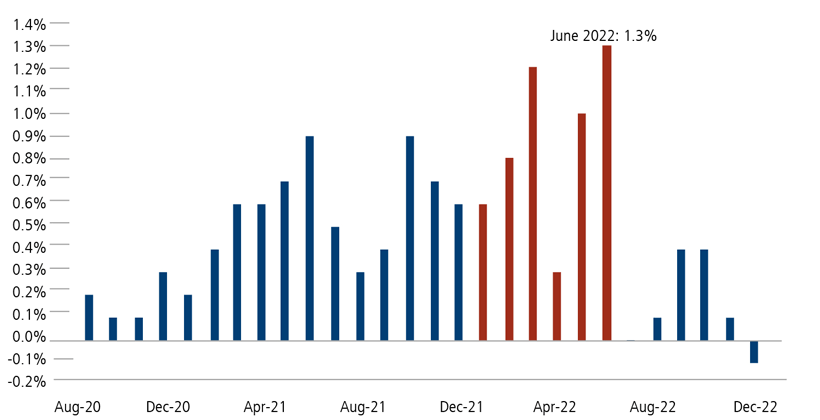

We do not foresee a reacceleration of inflation as the base case. However, we caution against claiming victory too early, as downward pressure on year-over-year (YoY) measures has benefited from large base effects from 2022 rolling off (Figure 1). In July, headline base effects give way to much lower hurdle rates from last year that could lead to higher YoY levels just as the Fed enters “the last mile” in its efforts to return price gains to 2%.

Figure 1. Higher year-over-year inflation levels are on the horizon as base effects wane

Source: Bianco Research, “Pivot Hopes Still Dominant,” January 12, 2023.

Fundamentals across corporate credit markets, both investment grade and high yield, have become more mixed. At first glance, headline numbers reflect considerable strength, but a closer look shows weakening performance from elevated levels. For instance, EBITDA measures in the high yield market show YoY growth of +7.5%. That appears to reflect significant strength, but if you remove the three strongest sectors of gaming/leisure, energy and transportation (which all benefited from strong accelerations off Covid lows), the YoY measure contracts ‑11.1%.

Management teams appear to be reacting to this deterioration, as we are seeing a simultaneous drop in both capital expenditures and cash return to shareholders while outstanding debt balances are unchanged. Market-wide leverage and interest-coverage measures (longstanding measures of overall credit strength) remain healthy. However, continued pressure on cash flows could lead to a reversal of recent trends, and we would expect wider spreads to emerge from such a development.

Defaults and distressed exchanges are increasing, trending back toward the long-term average of 3.5% on a trailing 12-month basis. Although balance sheets are starting from a position of relative strength, we expect continued pressure on top-line revenue growth and margins. If those materialize and persist, it is our view that the market is most likely to experience a more protracted default cycle than average, but one where defaults peak at lower levels.

Positioning Implications

The interest rate market has moved to what we believe is a more balanced representation of potential forward rate paths, and as such, the team took opportunities in the second quarter to extend portfolio durations. In Calamos Total Return Bond Fund and Calamos Short-Term Bond Fund, this leaves us neutral to slightly long. Duration is a less material driver of prices and returns in the high yield market, and Calamos High Income Opportunities Fund continues to be positioned short of benchmark durations.

In our estimation, credit spreads reflect too sanguine of an outlook. Although overall fundamental metrics are buoyant, unfolding trends are more concerning. As in the first quarter, when we warned against complacency, we are actively reducing exposure to credits we evaluate to be more exposed to a downturn in cyclical activity or a rapid deterioration of asset value and those with weak liquidity. We are maintaining allocations to select high yield issuers where we believe we are being well compensated for the risks taken as we follow our disciplined research process, which helps us identify value.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

EBITDA stands for earnings before interest, taxes, depreciation, and amortization; it reflects a firm’s short-term operational efficiency and is used to determine operating profitability.

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.