Investment Team Voices Home Page

Investment Team Voices Home Page

Finding Innovation in the Chemicals Industry: Why We Say Yes to Croda

Jim Madden, CFA; Tony Tursich, CFA; Beth Williamson

ESG opportunities with robust returns on investment can be found in myriad industries, even among industries with discernable environmental and societal constraints. When approaching a high-risk industry from an ESG perspective, we take great care to ensure investments are not being made in companies with significant environmental, health, and safety risks or liabilities.

Consider the chemicals industry. Although chemicals are used to make virtually every manufactured product, they create negative impacts on human health and the environment. These negative impacts can be regarded as unpriced externalities that will ultimately affect shareholder capital. Furthermore, it is important to not be misled by the rankings of the largest chemical manufacturers by the ESG rating agencies. For example, at first glance, some household name chemical companies may seem like ESG leaders given their high third-party ratings, including AAA or A ratings from MSCI ESG.

Chemicals can negatively impact human health and the environment during various stages of their life cycles. Most chemicals use nonrenewable resources as raw material inputs (e.g., natural gas, coal and coke, minerals, fuel oil, and liquefied petroleum gas). These materials are typically hydrocarbons that, when combusted, can lead to the release of carbon dioxide (CO2), volatile organic compounds (VOCs), and nitrogen oxides (NOx) that contribute to the formation of tropospheric ozone or “smog.” The processing of raw materials can result in the release of hazardous pollutants to the environment. Additionally, hazardous waste is generated by as a byproduct of manufacturing.

Of elevated concern however are perfluoroalkyl and polyfluoroalkyl substances (PFASs). PFASs are a very large class of over 9000 persistent hazardous manufactured chemicals that includes PFOA, PFOS, and GenX chemicals. Since the 1940s, PFASs have been manufactured and used in a variety of industries in the United States and around the globe. PFASs are found in everyday items such as food packaging and nonstick, stain repellent, and waterproof products. PFASs also are widely used in industrial applications and for firefighting.

PFASs can enter the environment through production or waste streams and are so environmentally persistent that they have been termed “forever chemicals.” Exposure to several PFASs has been linked to a plethora of health effects in animal and human studies. There is toxicological evidence that some PFAS have adverse reproductive, developmental, and immunological effects in animals and humans.

It is important to note that only a handful of companies have produced the basic chemical building blocks for PFAS chemicals—but this short list includes companies with sterling third-party ESG bona fides. Evidence has been uncovered that although these companies knew about the potential human health risks since the 1960s, these firms have denied allegations and expanded production for decades. As recently as January 2021, spinoffs of one of these companies settled to share over $4 billion of PFAS-related liabilities.

This is just one example of why proprietary research—not third-party ratings—drive authentic and credible ESG portfolio construction. Of course, these ratings can be useful—either as a starting point or as a confirmation, but they cannot be the foundation of an investment decision. We reviewed one of these household name companies years ago. We were not willing to place it in our ESG strategies given our view of the company’s poor corporate governance, questionable business ethics, and significant environmental liabilities.

Instead, we seek to identify and invest in companies that recognize the value of biological raw material inputs as a human health and environmental risk mitigation tactic. Take, for example, the company Croda. The majority of Croda’s raw materials are sustainably sourced bio-based materials including palm derivatives, corn, castor, rapeseed, coconut and sunflower oils. Not only are Croda’s raw materials bio-based, but the company has also implemented some of the strongest supply chain management mechanisms, audits and certifications to ensure long-term sourcing partnerships and positive environmental impact.

Croda intends for its bio-based raw inputs to reach 75% by 2030. This is three times that of the European Chemical Industry target of 25%. Moreover, Croda recognizes its ability to be climate positive. Bio-based materials sequester carbon as they grow. As such Croda’s sourcing of bio-based inputs enables the company to minimize its impact on the environment by designing lower-footprint products. Croda’s customers, which include some of the world’s largest personal care, home care and life sciences companies, also recognize the carbon benefits of Croda’s sustainable ingredients as a means to achieving their own net-zero goals.

Croda: Authentic ESG attributes, supported by action and innovation

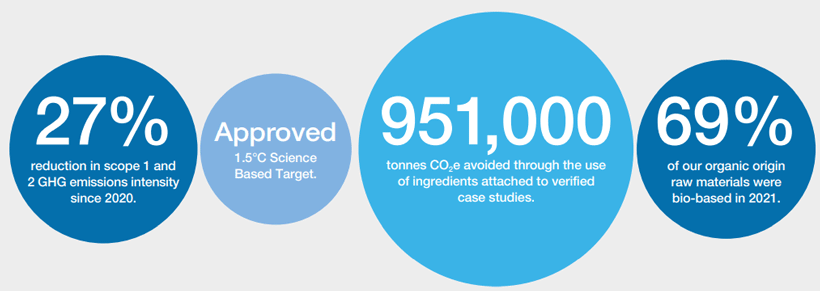

In its “Sustainability Report 2021,” Croda notes the following:

Source: Croda.

Croda can charge a premium on bio-based products and is focused on displacing petrochemical competitors in formulations with a broad “ECO Range” product line in renewable surfactants. Surfactants are useful for creating emulsions and are used in a variety of consumer goods. Surfactants can be formed via petroleum-derived compounds or biomass. Given that the input does not impact performance but does reduce ecological and health risks, Croda is seeing a significant increase in demand for these products and is earning a double-digit return on capital. Additionally, with rising ethylene prices, Croda is less exposed to hydrocarbon price volatility, given the company’s reliance on bio-ethylene,* which can lead to better planning and operational excellence.

Our team’s due diligence identifies major differences in Croda’s ESG profile versus those that are simply rated highly by third parties. And, as ESG investors, we believe Croda’s approach gives has a higher probability of future success. Moreover, we believe our attention to these sorts of business fundamentals gives our approach authenticity, credibility and a higher probability of success as well.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Global Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Fund's ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund's exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Environmental, Social and Governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

* Deutsche Bank CRDA@LN Croda Good H2 (despite growth investments). Solid outlo.pdf

MSCI ESG company ratings are assessed and rated on a 'AAA' to 'CCC' scale according to their exposure to industry specific, financially material ESG risks and the companies' ability to manage those risks relative to peers. Cash is excluded from the allocations shown.

As of June 30, 2022, the Fund’s Top 10 Holdings as a percent of net assets were as follows: Microsoft Corp., 3.6%; Apple, Inc., 3.1%; Alphabet, Inc.-Class A, 2.5%; CVS Health Corp., 1.8%; Thermo Fisher Scientific, Inc., 1.5%; Sony Group Corp., 1.4%; Taiwan Semiconductor Mfg (ADR), 1.4%; Merck & Company, inc., 1.2%; Verizon Communications, Inc., 1.2%; Target Corp. 1.2%.

Holdings and weightings are subject to change daily. Holdings are provided for informational purposes only and should not be deemed as a recommendation to buy or sell the securities mentioned.

18985 0722

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.