Followers of our posts and commentaries know that we have long held a positive view on China, specifically as it relates to the growth of the country’s middle class. In recent years, many investors have become increasingly focused on the decelerating growth and significant leverage in the Chinese economy. While not losing sight of these factors, we are also focusing on the transitions that are underway in China’s economy—from investment to consumption and from public sector to private sector. These shifts have created powerful tailwinds for many consumer, information technology, and health care companies, both those domiciled in China as well as multinational corporations selling into China’s growth story.

We have always monitored China’s policy actions and reform initiatives through the lens of whether these activities support the medium-term goal of a more consumption-based economy with a greater contribution from the private sector. Overall, we believe China is making good progress in this regard, and we have remained more constructive on China than a number of other investment managers. We believe our stance has been affirmed by China’s strong market performance over recent years, including within the investment technology and health care sectors we favor.

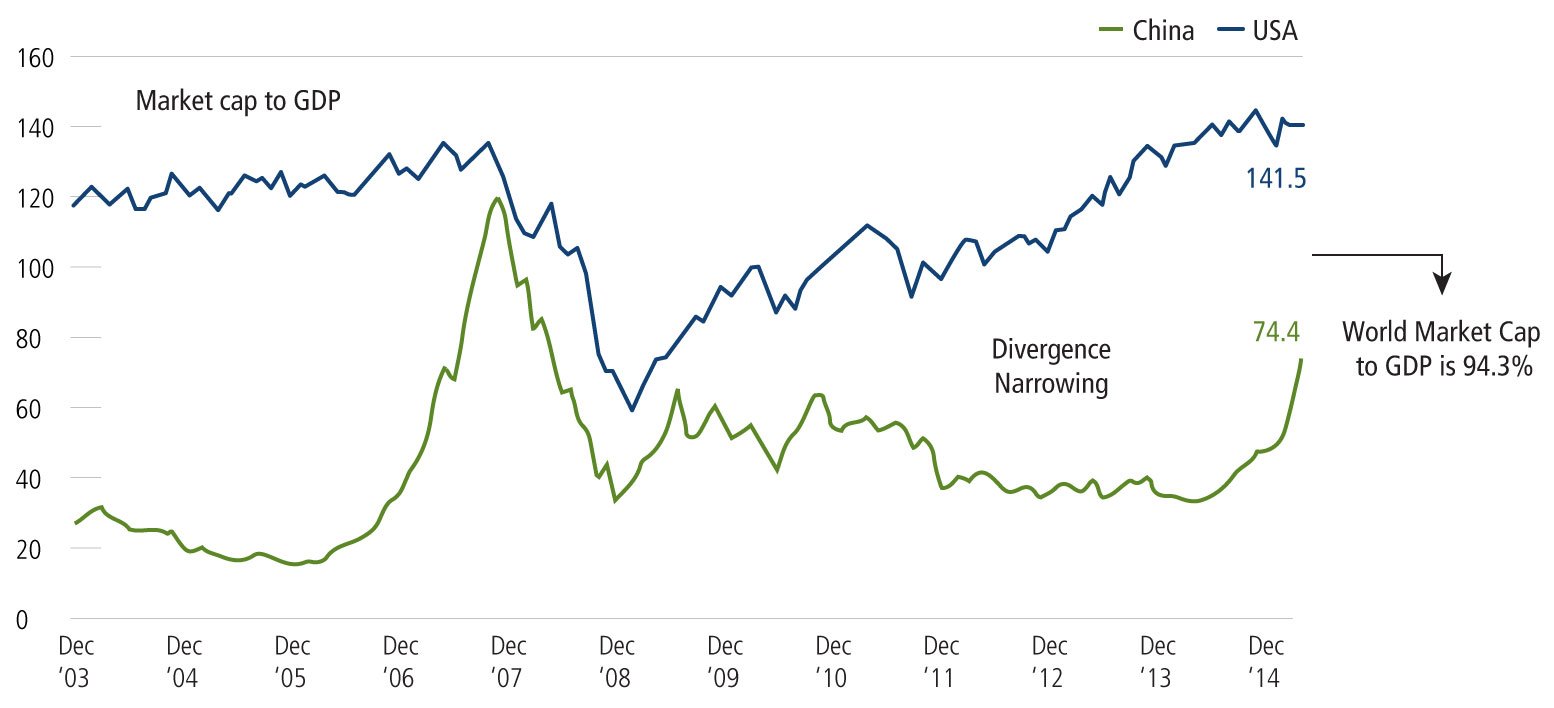

Since the middle of last year, we have expanded our view of investable opportunities in China. While we believe China remains committed to the medium-term goal of growing consumption and the private sector, the country is equally if not more focused on its longer-term goals of solidifying its position as the dominant power in Asia and establishing itself as equal to the U.S. on the global stage. China’s push to have the renminbi to IMF’s special drawing rights, its opening of local markets, its founding of the Asian Infrastructure Investment Bank, and the “One Road, One Belt” infrastructure program all support its bid for greater influence in Asia and globally, including the internationalization of the renminbi. As one measure of China’s progress, we see China is converging ever closer with U.S., when measured by market cap to GDP (Figure 1).

Figure 1. U.S. versus China: Market Cap to GDP trend

Source: CLSA

As China pursues its longer-term goals, we see tailwinds for many more industries within the country. This has led us to increase our weighting to China, including through investments in several state-owned-enterprises (SOEs) and infrastructure-related companies that we may have found less compelling in the past.

Convertible Structures Afford Risk-Managed Exposure

Of course, we recognize that these companies are not without their own risks. They may be more influenced by policy and regulation changes; historically, many have been less focused on efficiencies than businesses in the private sector; and in some instances, they may also entail more balance-sheet risk than their private sector counterparts. However, we see significant opportunities, particularly for investors who are willing to do their homework. We believe some of the risks we previously saw in SOEs and investment related companies are mitigated by the course government policy is likely to take over the next six months.

For those of our strategies that have the flexibility to utilize convertible securities, we have additional tools for tapping into the expanding opportunities we see in China, consistent with a risk-managed posture. Within emerging markets, Chinese and Hong Kong companies have been active issuers of convertible securities. Convertible securities have been key in bolstering our overall exposure to China, including in SOEs and companies tied more closely to investment rather than consumption.

As interest rates have declined in China, the bond floors of our convertible positions have moved up, improving downside protection, while the increased volatility we have seen in the market recently increased the values of the embedded call options. The breadth of the convertible market has allowed us to participate in the strong rally we have seen within cyclical sectors, with our delta to the underlying equities increasing as the rally in China’s equity market has progressed.

We typically pare convertible positions when their deltas become equity like, rolling into more balanced structures on an ongoing basis. This active management has permitted us to keep up with the equity markets during strong rallies, while providing better downside protection during recent pullbacks we’ve seen and expect to continue throughout the remainder of the year.