Recently, global index provider FTSE announced it has reclassified Morocco from “emerging market” to “frontier market” and Argentina from “frontier market” to “unclassified.”* These changes will impact the composition of FTSE’s emerging market and frontier market indexes in mid-2015.

Such constituent shuffling happens more often than many investors might realize. What’s more, I believe shifts between categories will occur with greater frequency as emerging markets follow divergent growth/contraction trajectories, due to different economic policies, political systems and geopolitics.

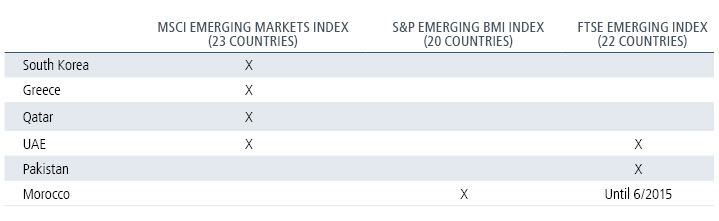

There is no single definition for “emerging market” and therefore for “emerging market investing.” Indexes use different criteria to classify countries. As a result, one index’s emerging market is another index’s developed market. South Korea is a case in point. While Standard & Poor’s and FTSE classify South Korea as a developed market, MSCI places South Korea in its emerging market index, where it represents more than 15% of the benchmark.

Similarly, FTSE and Standard and Poor’s consider Greece to be a developed market, but MSCI counts it among the emerging economies—for now, at least. Greece has hopped between MSCI’s categories, moving from emerging markets to developed markets in 2001 and then back to emerging in 2013.

Figure 1. Even Experts Don’t Agree on What Constitutes an Emerging Market

Source: MSCI Inc., S&P Dow Jones Indices LLC, FTSE Group as of June 30, 2014

In my view, the fluid nature of EM indexes illustrates the need for an active approach to EM investing. Passively managed strategies are subject to the vagaries of index reshuffling. What’s more, speculation about what’s in or out of a particular index could lead to volatility within emerging markets as passive strategies must sell or buy en masse to accommodate constituent changes.

We continue to believe fundamentals and top-down views provide the best criteria for deciding whether or not to invest in a company or market. When portfolio construction is dictated by the vagaries of a third-party index provider, I believe the potential for unnecessary downside risk increases significantly.

In a passive ETF strategy, investors end up with a static approach punctuated by abrupt and wholesale changes driven by index shifts rather than company fundamentals. In contrast, an active approach can adapt and capitalize on market opportunity.

As our international team has discussed in posts, our team emphasizes countries moving toward increased economic freedoms and companies with attractive growth fundamentals that are participating in long-term secular growth themes, such as the megatrend of global middle class expansion. As a result of our active management, our EM strategies may look quite different from an EM index—in our view, that’s good for investors.

*For more, see “FTSE Drops Argentina, Demotes Morocco: Mind Your ETF Index,” by Dimitra DeFotis, Barrons.com, September 25, 2014