When I speak with clients about convertibles, one topic that often crops up is how credit quality considerations play into portfolio construction. Some believe that a portfolio built exclusively from investment grade convertibles is inherently safer than a portfolio that also includes below investment grade and non-rated securities. Our view is that in the current environment, the opposite may be true. Here’s why we believe that having the flexibility to invest across credit qualities makes sense:

- An investment grade portfolio may be subject to a shrinking opportunity set, as investment grade convertibles currently make up a small and decreasing segment of the overall universe. As of July 15, 2014, the 300 securities of the BofA Merrill Lynch Global 300 Index had a total market value of more than $170 billion dollars (USD). However, the index includes just 44 investment grade issues out of the 300, with a total market value of $37.6 billion.

There’s a similar issue in the U.S. market. The BofA Merrill Lynch All U.S. Convertibles Index included 484 issues as of July 15, with a total market value of $209 billion. The investment grade subset, the BofA Merrill Lynch VXA1 Index, included just 61 names, valued at $47.7 billion. - Non-investment grade securities have dominated recent issuance. Recently, global convertible issuance has been very promising, a trend which we expect will continue, supported by global economic recovery. Recent issues have exhibited attractive characteristics and terms, as well as good breadth by sector, geography and market cap. However, this issuance has been largely dominated by non-investment grade issuers, as investment grade issuers have continued to find inexpensive financing in traditional debt.

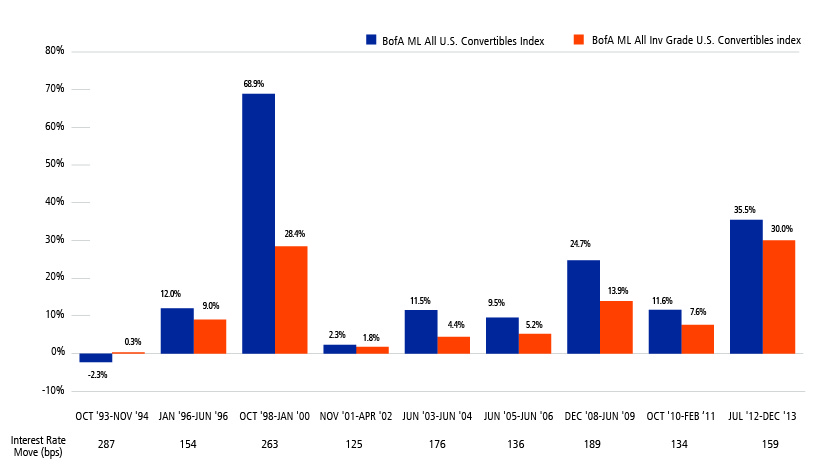

Within the global market, 148 issues have been brought to market through the first half of 2014, with a value of $52.3 billion. Only $4.3 billion of this issuance has been rated investment grade, in six issues. Similarly, within the U.S. market, 61 new issues were brought to market during the first half of the year, with a value of $23.5 billion. Just four issues ($3.0 billion) of these were rated investment grade. - Investment grade convertibles have typically underperformed the broad convertible universe when interest rates rise. During the past 20 years, there have been nine periods when the 10-year Treasury yield rose more than 100 basis points. During eight of these periods, the BofA Merrill Lynch All Investment Grade U.S. Convertibles Index lagged the BofA Merrill Lynch All U.S. Convertibles Index. While rates are still low, investors should be positioned proactively for an eventual rate increase.

In Rising Rate Environments, Investment Grade Convertibles Typically Lagged the Convertible Universe

Performance data quoted represents past performance, which is no guarantee of future results. Source: Morningstar Direct and Bloomberg. Rising rate environment periods from troughs to peak from October 1993 to December 2013. Data as of 6/30/14.

- An investment grade portfolio may also be subject to a higher level of equity sensitivity, and therefore, downside equity capture—precisely the risk that most convertible investors seek to avoid. In the current environment, we believe a portfolio composed exclusively of investment grade issues would be subject to a level of equity risk that is higher than most convertible investors would anticipate or intend. While this equity sensitivity may in fact mitigate some of the interest rate risk we discussed above, we believe the profile of much of the investment grade market is not what investors have come to expect.

- Quality restrictions can increase valuation risk at points of the market cycle. Our team continues to identify a range of attractively valued securities in the convertible market. Even so, there are pockets of the market where we believe convertibles are generally fully valued—including a number of investment grade issues. We do expect that equity markets will continue to rise, but believe the global rotation that ran from mid-March to June illustrates that the highest priced securities may be vulnerable to the increased downward pressure when market sentiment wavers. Historically, overpriced bonds often underperform when the market moves in either direction.

At Calamos, we believe that the unique advantages of convertibles are best harnessed through actively managed strategies that seek an asymmetrical risk/return profile—that is, one with more equity upside than downside. A flexible approach that can include convertibles across the quality spectrum provides us with the best way to achieve this goal over full and multiple market cycles.