LinkedIn? We Can Help With This Time-saving Way to Serve Clients, Build Business

For better or worse (some say it’s for the better—keep reading), the investment professional’s job has changed as a result of social distancing required by COVID-19. Interactions with clients are largely virtual, and prospecting requires some new thinking.

Making the Transition from In-person Events to Online Engagement

If you’re accustomed to earning new business from in-person events, you know how to work a room, how to share something about yourself and how to show your interest in others.

Effective social media participation uses all of those skills—with one major difference. On social networks you’re in an environment where others are doing their best to impress, too. And that means you need to bring it.

Having a token social presence is not going to get you the kind of reception you’re accustomed to getting from in-person events. To be effective on LinkedIn, in particular, you may need to learn a few new tricks about reaching out, attracting attention, earning followers, and serving clients while at the same time creating favorable impressions with prospects looking to try what you have to say before they buy. This is something we can help with.

Given what’s changed, if this were 10 years ago, the near-term business outlook might be grim. Last year, growth-focused investment professionals told Broadridge Financial Solutions that they found in-person events to be their most effective channel. Pre-pandemic that’s where business was expected to come from.

But that was then, and this is now. Our experience now with investment professionals, along with research conducted recently, confirms that social media participation in 2020 has been a difference-maker in both communicating with clients and winning business.

- 2/3 of financial advisor respondents believe that they are using social media in a way that improves their business.

Source: Greenwich

- 3 out 4 of U.S. advisors who used social media for business initiated new relationships or on-boarded new clients.

Source: Putnam Investments Social Advisor Study, 2020

- 9 out of 10 advisors said social media has changed the nature of their relationships with clients during the pandemic—that’s almost double what was reported in 2019.

Source: Putnam Investments Social Advisor Study, 2020 and 2019

And what about you? For those of you who haven’t prioritized your social media presence to date or suspect you could be more effective, we offer the data below to nudge you in our direction. We can help.

Work with us and you may realize your potential as a social media superstar. Or, maybe you’ll just be you—and that alone will be more than enough to deepen your relationships with clients and broaden the reach of what you have to say.

Where The Clients’ Faces Are

It’s long been true that the battle for new clients, and to retain generations of clients, has moved online. Websites were named in last year's Broadridge survey as the second most effective marketing channel.

But the experience of this year finally closes the case on the role that social media plays. Simply put, your clients and prospects spend more time on social platforms than you can ever expect them to spend on your own site.

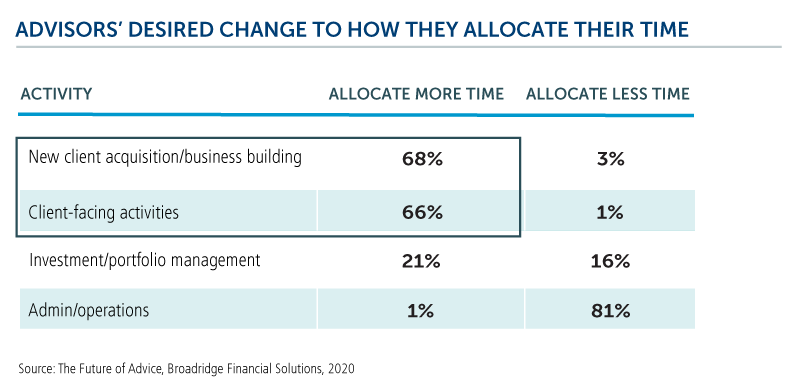

If you’re anything like the respondents to this Broadridge survey, you know you need to be more “client-facing.”

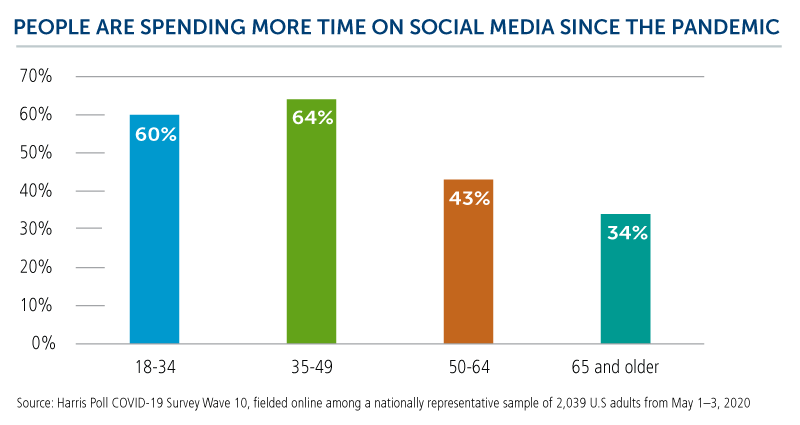

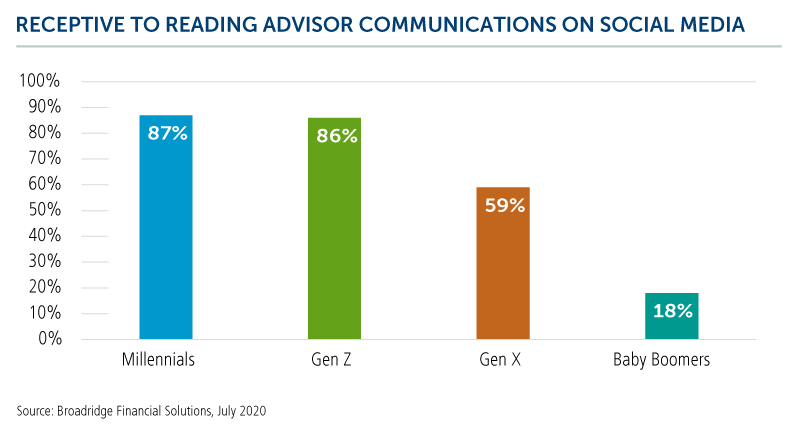

For the last several months, social media platforms are where the faces of clients of all ages are. Increasingly, they expect to see you there, too.

Leverage Your Time

“But I don’t have time to do all this.” Back in the day that was a common pushback from investment professionals who considered social media optional. This year’s experience has turned that objection on its end. Social media offers a way to leverage your effort.

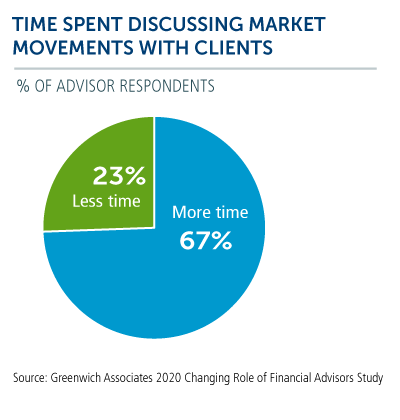

Survey after survey shows that you’re spending more time than ever communicating with clients about market movements—likely often repeating yourself.

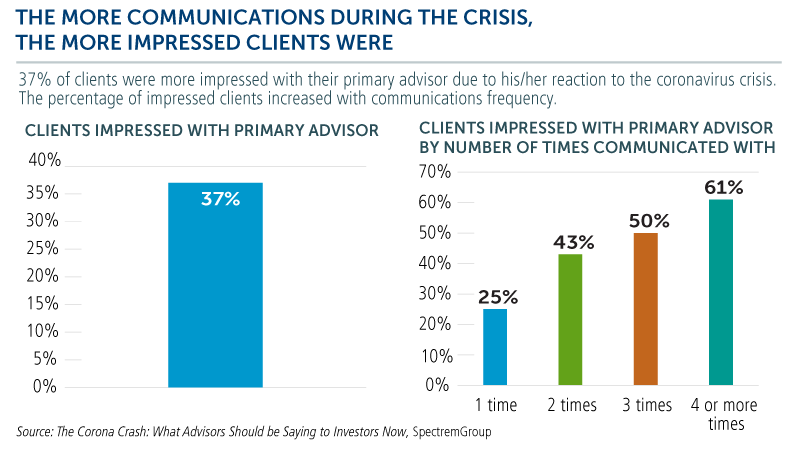

Clients have been surveyed, too, about communicating during the pandemic, and their message is unambiguous. The more they hear from you, the happier they are—and the more impressed they are with the value you provide.

Think of the time you spend on individual phone calls and emails. Now consider how you might scale those messages with social media posts. Your market updates, for example, keep your clients informed and have the potential to be shared by them with their networks. Even the social media post that triggers a follow-up call or email will get you further faster.

Just as lines have blurred this year between work and home so have the barriers dropped on social networks. New research shows that Baby Boomers are the last holdout to have reservations about reading your posts or your following them on social media, including Facebook, Twitter, Instagram and others.

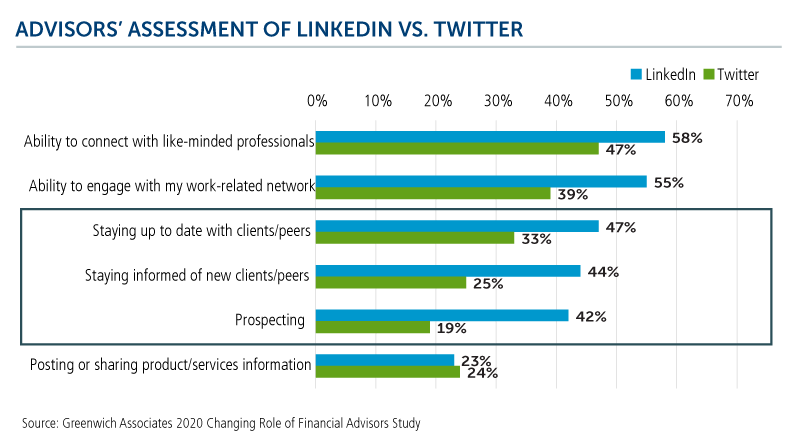

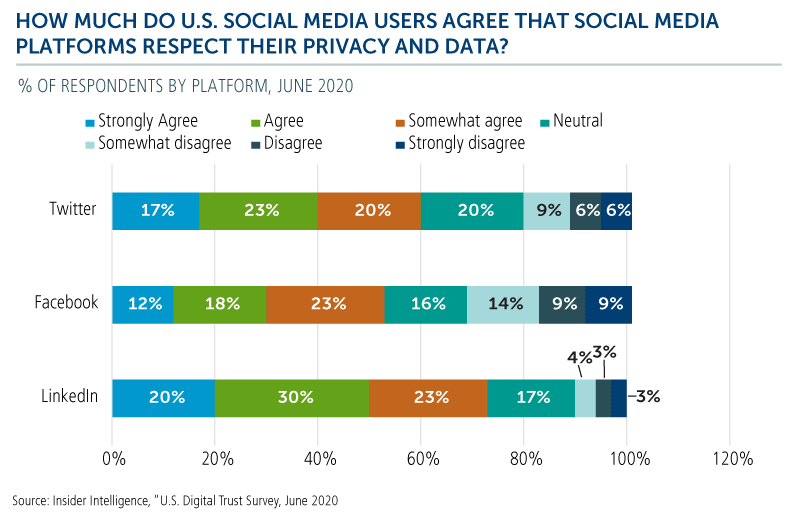

Of course, the best social platform for business purposes is LinkedIn. It's by far investment professionals’ preferred social network, according to research conducted over the years.

What’s more, LinkedIn is the best fit for your brand.

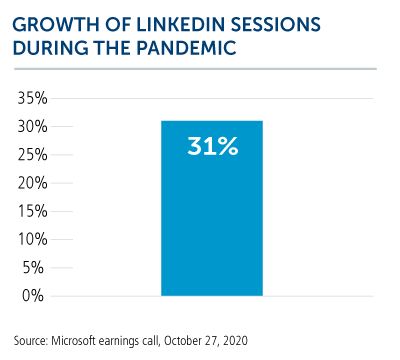

On LinkedIn, too, user sessions have grown during the pandemic, and Microsoft recently reported that engagement was at record levels.

Get Our Help

We want to help you like we helped one client, an investment professional who’s doubled his AUM and needed to close his practice to new clients for the rest of the year.

Ask your Calamos Investment Consultant for that story when you dial 888-571-2567 or email caminfo@calamos.com.

LinkedIn training and consulting is what Calamos Investment Consultants specialize in, as you can read more about in this post.

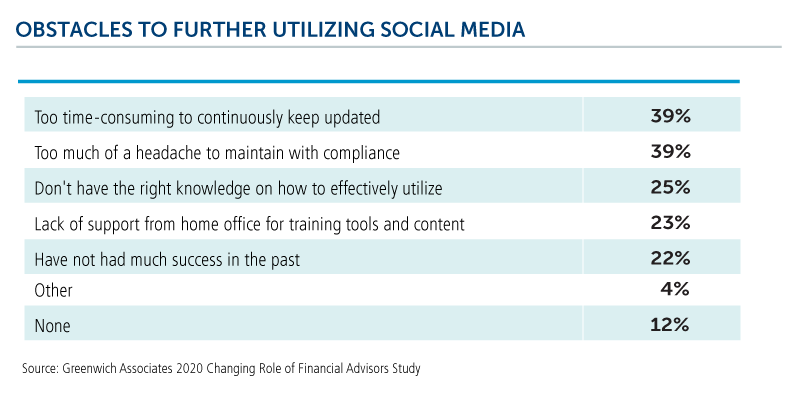

The research tells us that you may have any number of reasons for not acting until now. Last year, 41% of advisor respondents to an American Century Investments' study said they were reluctant to use social media for business for fearing of making a mistake. Understandable, we've heard that, too. And see the obstacles below, as identified by this year's Greenwich research.

Whatever's kept you from missing out on the benefits of social media and LinkedIn, in particular, let's work through them now together to jumpstart 2021.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. The opinions and views of third parties do not represent the opinions or views of Calamos Investments LLC. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

802227 1120

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on November 17, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.