CMNIX: Finding Opportunities in any Interest Rate Environment – Hear the Replay from Co-CIO Eli Pars’ Webcast

Will the Fed stay put or cut aggressively? In a historically contentious election cycle, will markets be orderly or chaotic? In a February 27 webcast, Co-CIO Eli Pars presented five major positive factors Calamos Market Neutral Income Fund (CMNIX) is harnessing in this year of uncertainties.

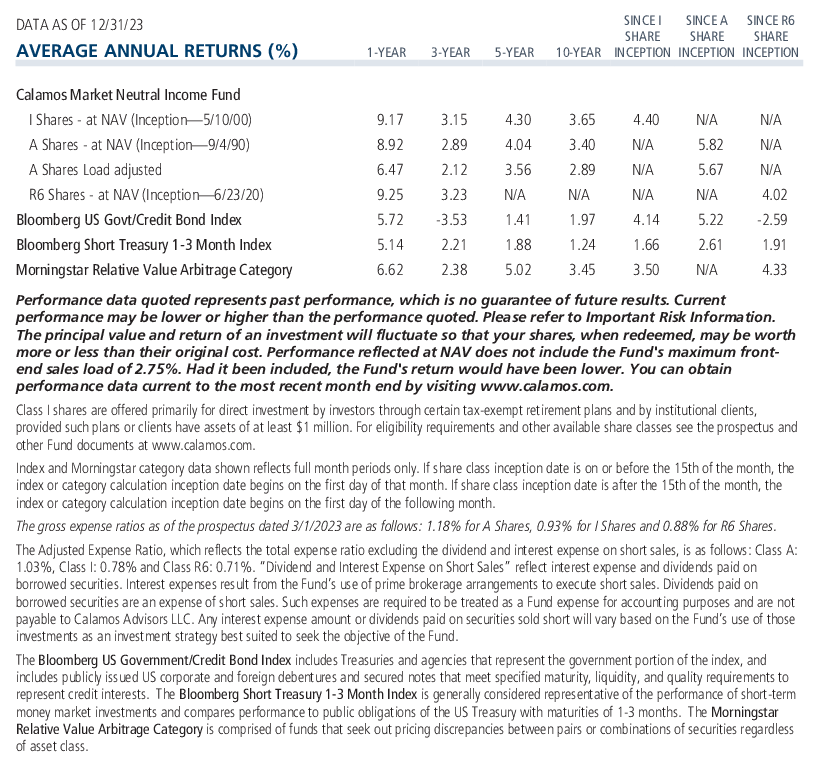

- CMNIX has little exposure to interest-rate risks or opportunities, offers a compelling alternative for investors worried about interest-rate moves and bond-related volatility, and has outperformed the bond market* since its inception in 1990.

- Convertible issuance has ramped up, including a pickup in investment-grade issuers seeking to refinance with lower coupon payments versus the higher rates of straight bonds. This new convertible issuance translates to more choices for the fund’s convertible arbitrage strategy.

- Our team remains bullish on convertible arbitrage, supported by higher overnight interest-rate payouts and a meaningful pickup in the size of the coupons we’re receiving.

- The fund’s hedged equity strategy also benefits from the rise in overnight rates, allowing our team to enhance defensive positioning.

- Broad market volatility provides opportunities for our approach.

To find out how CMNIX’s active strategy can serve as a resilient fixed-income allocation, listen to the full replay and Q&A with Eli Pars, CFA, here.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

*The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency). For the period 9/1/90 through 12/31/23, the index returned 5.13%. Unmanaged index returns, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Market Neutral Income Fund include equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower missing payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

900097 0324

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.