Can Your Bond Fund Do This?

First published: August 1, 2019

The last 11 years were an extraordinary period for investors, as equity and fixed income markets rewarded believers who stayed the course after the Great Financial Crisis. In the aftermath of the crisis, new ideas were introduced to mitigate the risk of traditional stock and bond investing. But as the decade wore on, the 60/40 portfolio prevailed over the promise of many liquid alternatives.

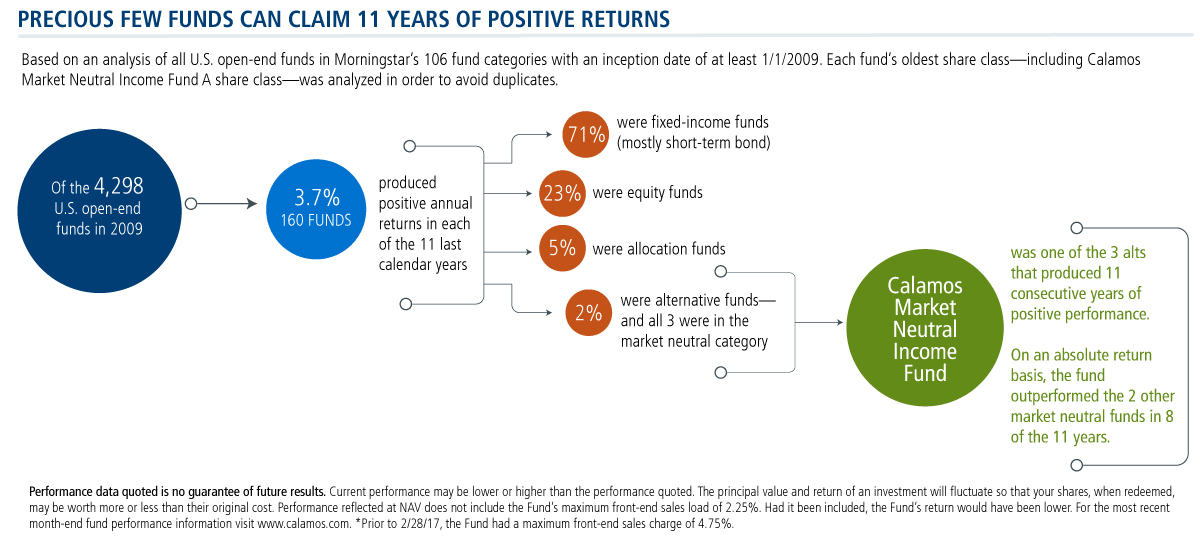

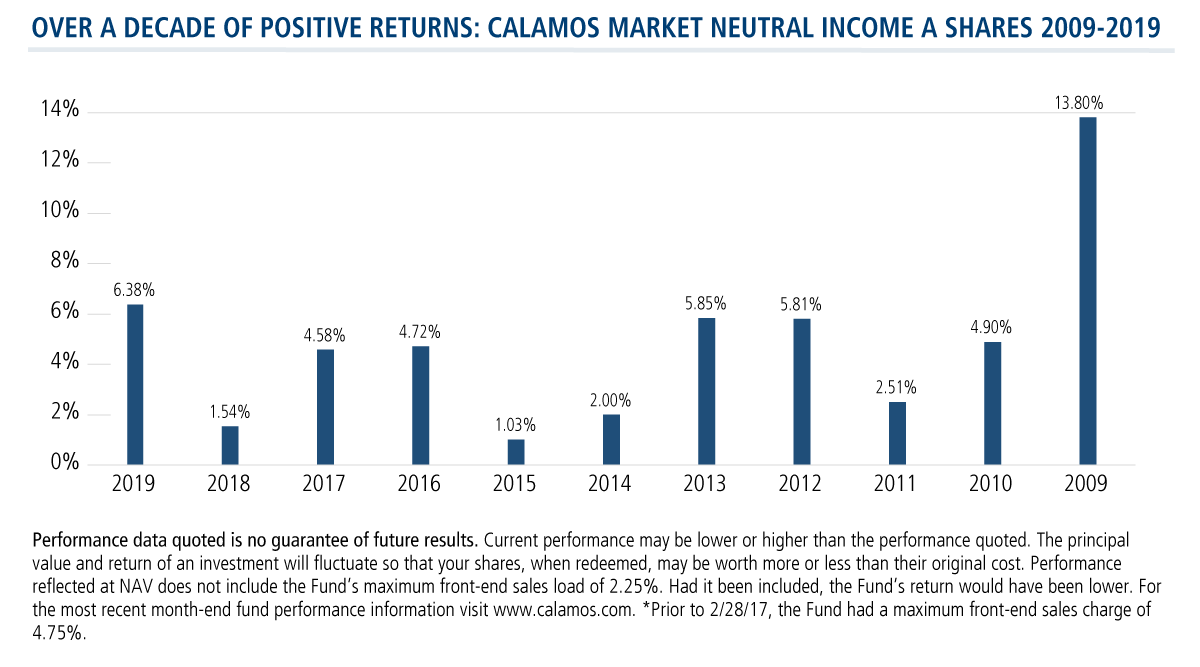

Even in such a positive investing environment, only an elite set of U.S. open-end funds made money every year of the last decade. Of the 4,298 U.S. open-end funds with performance going back to 2009, just 160 produced positive annual returns in each of the last 11 calendar years. Of those 160 funds, just three were alternative funds.

Included among the three alts is Calamos Market Neutral Income Fund, whose 1990 inception makes it one of the oldest and best performing liquid alts.

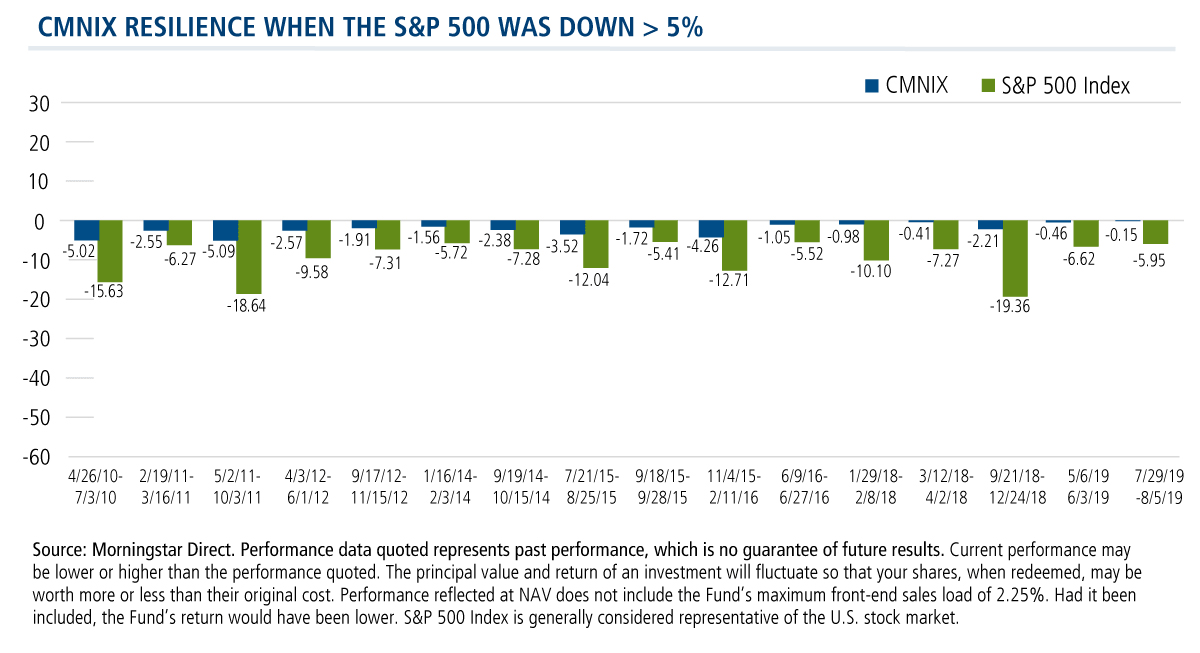

Key to the fund’s performance in the last decade has been its ability to limit drawdowns during market tests. Below we show the I Shares’ resilience during S&P 500 declines of greater than 5%.

CMNIX combines:

- Convertible arbitrage, seeking alpha and uncorrelated returns

- Hedged equity, providing income from options writing and upside participation

Financial advisors value CMNIX’s demonstrated consistency and resiliency, but especially now as an alternative to traditional bond strategies. If you took on more risk than a short duration bond fund, then your fund (whether bond, equity or alternative) most likely did not provide 11 years of positive performance. And, those were more favorable markets than what we are likely heading into.

Advisors, your Calamos Investment Consultant will be happy to answer any additional questions you may have about CMNIX. Reach him or her at 888-571-2567 or caminfo@calamos.com.

Click here to view CMNIX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

S&P 500 Index is generally considered representative of the U.S. stock market.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Convertible Arbitrage Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

Hedged Equity Risk: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Alpha is a measurement of performance on a risk adjusted basis. A positive alpha shows that performance of a portfolio was higher than expected given the risk. A negative alpha shows that the performance was less than expected given the risk.

Convertible arbitrage involves purchasing a mispriced convertible bond (long position) and simultaneously short-selling a calculated number of shares of the stock. As the manager waits for the prices to converge, the portfolio is insulated from price movements of the underlying stock. Using this technique, a manager seeks to enhance income and to hedge (or reduce) equity market risk.

Hedged equity involves selling (or “writing”) a call option against an equity the writer holds. When managers sell a call option, they earn a premium from the option sale. If the shares trade below the strike price, the option will expire worthless and they keep the premium from the option and retain the security. If the share price exceeds the strike price, the buyer will likely exercise the option and the seller must sell the shares at the strike price. To hedge the risk, managers could also purchase put options to protect against significant equity market declines.

801679 0220

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on February 25, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.