CMNIX: All Weather Through the Decades

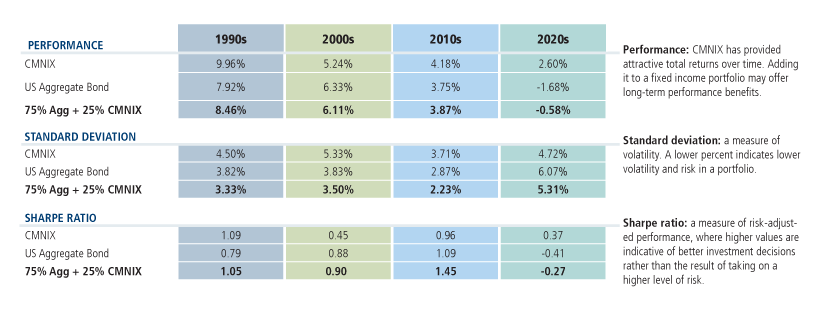

Diversifying a bond allocation* by investing 25% in Calamos Market Neutral Fund (CMNIX) resulted in a better risk/reward profile

- For more than three decades, CMNIX has navigated multiple market cycles and provided consistent diversification to fixed income investment portfolios.

- Allocating 25% of your bond allocation* to CMNIX would have provided significant risk/reward benefits.

- Outperforming both the S&P 500 Index and the Bloomberg US Aggregate Bond Index in a tumultuous 2022, the CMNIX investment team stands ready to capitalize on higher interest rates.

CMNIX has provided compelling diversification to a fixed income allocation, as represented by the Bloomberg US Aggregate Bond Index. Over every decade since its inception, adding CMNIX as 25% of a high-quality bond allocation* resulted in (1) better or similar total returns, (2) lower volatility as measured by standard deviation, and (3) better risk-adjusted returns than investing in bonds alone, as measured by the Sharpe ratios.

Performance data quoted represents past performance, which is no guarantee of future results. Source: St. Louis Fed and Morningstar. 1990s data starts with the first full month of CMNIX’s performance, 10/1/1990. 2020s data includes 2020–2023, ending 1/31/2023.

The CMNIX investment team stands ready to capitalize on higher rates. CMNIX does not have the duration risk associated with traditional fixed income investments, and the CMNIX team believes the fund is well positioned to navigate a higher interest rate environment. The table below takes a closer look at the impact of higher rates on CMNIX. To find out more reasons to be excited about the total return prospects for CMNIX in 2023, listen to Co-CIO Eli Pars in a recent webcast Q&A here.

| CMNIX Source of Return | Impact of Higher Interest Rates |

|---|---|

| Convertible yield coupon | As rates rise, new convertible issues may offer a greater yield advantage than stocks. |

| Short interest rebate | Higher short-term interest rates mean that the fund collects higher income from holding collateral for short positions. |

| Gains from hedging and appreciation of convertibles | Modifying our hedging strategy remains attractive, while convertible pricing may also improve after last year’s market-wide sell-off. |

| Option premium capture | Option premiums typically increase with rising rates, which can be a tailwind when the portfolio is net short options. |

For additional information about the potential long-term benefits of including Calamos Market Neutral Income Fund in an asset allocation, please contact your Calamos Investment Consultants at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

*Represented by the Bloomberg US Aggregate Bond Index.

The blend of CMNIX and the Bloomberg US Aggregate Bond Index has been set to rebalance annually. An annual rebalancing strategy can add value when investments have a performance stream that tends to zig and zag, leading to stronger total returns or lower volatility. Performance reflected is using Morningstar’s extended performance methodology. Morningstar adjusts historical total returns of a fund’s older share class(es) to reflect the higher expenses share class. Performance reflects the Calamos Market Neutral Income Fund A shares class incepted 9/5/1990, before the Calamos Market Neutral Income Fund I shares class 5/10/2000 inception date.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

The principal risks of investing in the Calamos Market Neutral Income Fund include equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates, the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible-hedging risk, covered call writing risk, options risk, short-sale risk, interest-rate risk, credit risk, high-yield risk, liquidity risk, portfolio-selection risk, and portfolio turnover risk.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries. The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). The S&P 500 Index is generally considered representative of the US stock market. The Sharpe ratio is a calculation that reflects the reward per each unit of risk in a portfolio. The higher the ratio, the better the portfolio’s risk-adjusted return is. Annualized standard deviation is a statistical measure of the historic volatility of a mutual fund or portfolio.

821021 0323

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

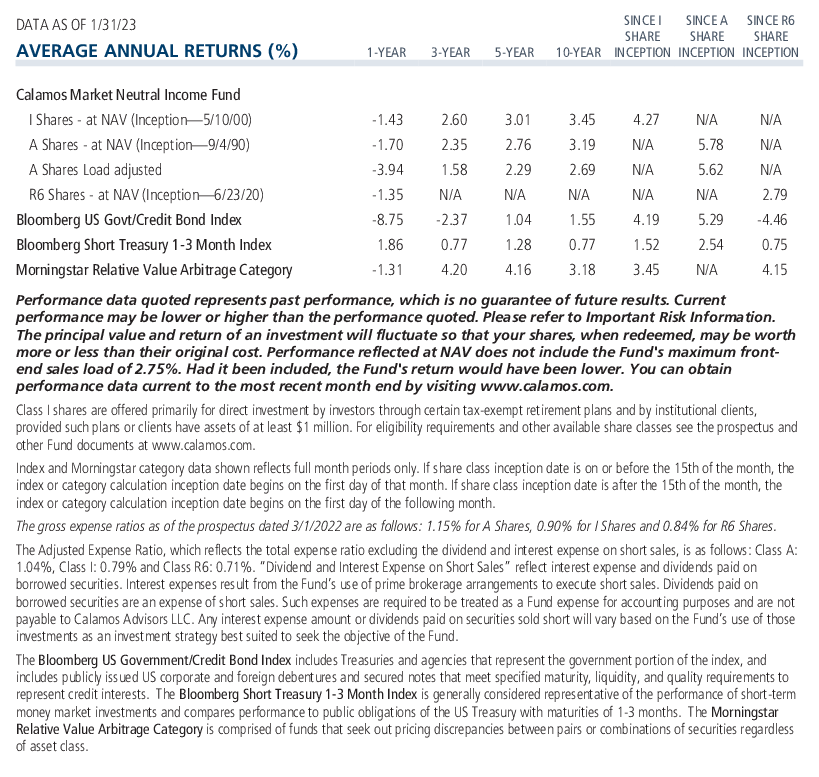

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

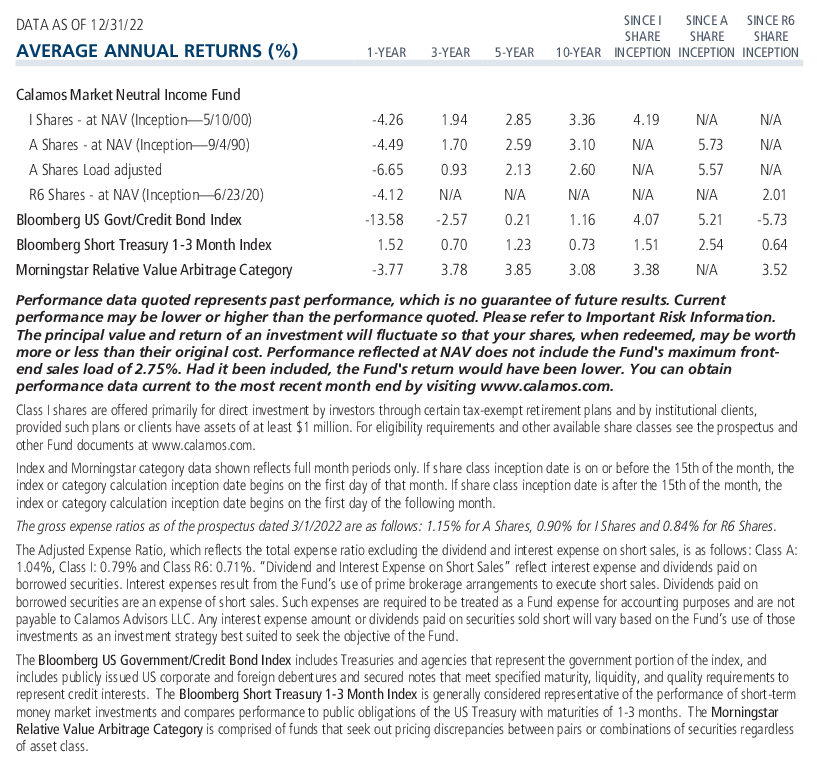

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 01, 2024Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.