Investment Team Voices Home Page

Investment Team Voices Home Page

Charting a Steadier Path as Bonds Deliver a Wild Ride

Eli Pars, CFA

Summary Points:

- CMNIX outpaced the bond market in 2023, as it has over longer periods.

- With little exposure to interest rate risk or opportunity, we believe our approach offers a compelling alternative for investors worried about interest rate volatility.

- Our team remains bullish on convertible arbitrage, supported by higher overnight interest rates and attractive prospects for convertible issuance.

- Our hedged equity allocation participated in the S&P 500’s upside in 2023 while limiting its downside risk, which we believe aligns with the risk appetite of our investors.

Learn more about the three pillars of CMNIX.

- Time-tested alternative

- Robust alternatives platform

- Diversification Overachiever

Getting There a Different Way

During the fourth quarter, bonds and stocks bounced back sharply in anticipation of a soft landing and Fed rate cuts in 2024. The Bloomberg US Aggregate Index gained 6.8% for the quarter, and the S&P 500 Index rose 11.7%. Calamos Market Neutral Income Fund (CMNIX) was also up for the quarter, rising 2.3%. However, for the first three quarters of the year, CMNIX was up 6.7% versus a loss of −1.2% for the US Aggregate Index. Looking at these two periods together, the fund gained 9.2%, well ahead of the index, which was only up 5.5%. Overall, the year demonstrated that CMNIX has little interest rate risk or opportunity. We simply reached our destination in a different way, one that we believe can appeal to investors seeking a steadier course in a volatile interest rate environment.

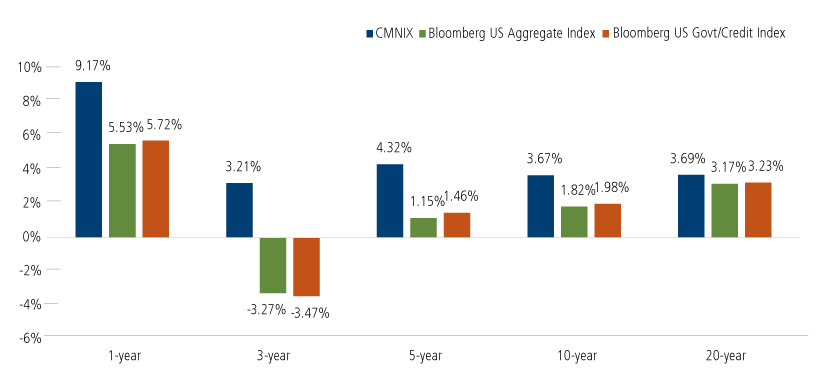

CMNIX: Long-Term Outperformance Versus Traditional Fixed Income

CMNIX is designed to enhance a traditional fixed income allocation. The fund combines two complementary strategies—arbitrage and hedged equity—to pursue absolute returns and income that is not dependent on the level of interest rates. This approach has proven effective over the long term but also through periods of extreme change in the markets (For more, see our post “Consistency Through Uncharted Waters.”)

CMNIX Versus Bonds: Leading the Way Over the Long Term

Source: Morningstar

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.75%. Had it been included, the Fund's return would have been lower. All performance shown assumes reinvestment of dividends and capital gains distributions. The fund’s gross expense ratio as of the prospectus dated 3/1/2023 is 0.88% for Class I shares.

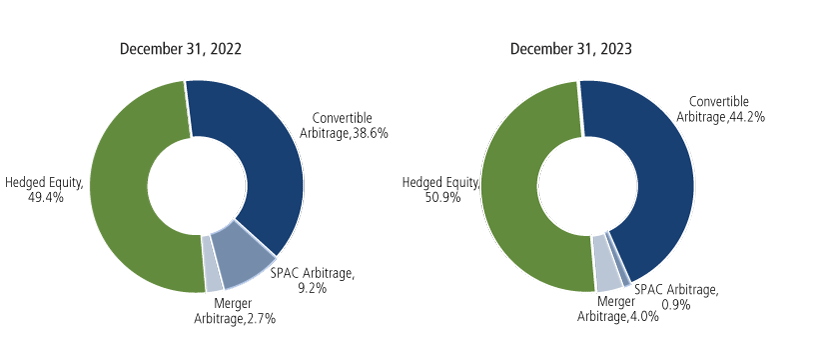

Arbitrage and Hedged Equity: Well-Balanced Opportunity

We monitor and manage the fund’s allocation between arbitrage and hedged equity and have maintained a roughly equal balance in recent months based on our view of strong relative opportunities in each. Over the course of the year, we have increased our allocation to convertible arbitrage and also boosted the fund’s allocation to merger arbitrage while paring the fund’s book in special purpose acquisition company (SPAC) arbitrage.

CMNIX Allocation

Arbitrage Strategies: a Closer Look

Convertible arbitrage. Our arbitrage strategies continued to perform well in the fourth quarter and for the full year. As we have discussed in our past commentaries, the returns of these strategies are traditionally linked to overnight money, with higher rates providing a boost. For example, convertible arbitrage is linked to overnight rates in a couple of ways. The most direct link is the rebate we get on our short positions, which is typically at the fed funds rate, less a fee for borrowing the stock (generally around 50 basis points). Slower to come through, but just as important, is the rise in coupons that we’ve seen as new issues come to the convertible market and old, lower-coupon bonds mature or are refinanced.

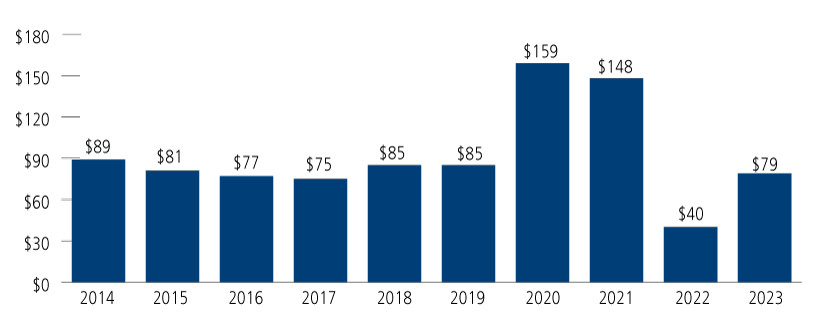

We believe new issues will be a potential bright spot for the convertible market over the next year or two. For 2023, global convertible issuance totaled $79 billion, close to the long-term trend and a significant bounce back from the soft market of 2022 when just $40 billion of issuance came to market. With large maturity walls approaching in the investment-grade bond, high-yield debt and convertible markets, there should be plenty of opportunities for convertible bankers to keep busy.

Global Convertible Issuance: Regaining Momentum in 2023

Source: BofA Global Research.

The investment-grade opportunity in the convertible market is particularly intriguing. In exchange for the conversion feature, convertibles typically offer lower coupons than comparable nonconvertible debt, which can be an appealing option for issuers to keep borrowing costs low. However, in the zero-interest rate world of years past, there was little incentive for investment-grade issuers to come to the convertible market. If a company can issue straight debt with coupons of 2% to 3%, why bother with a convertible? But now that those companies are looking to refinance and are seeing straight debt quotes from their bankers north of 5%, we believe that we will see some of them come to the convertible market to lower that coupon back closer to 2% to 3%. For CMNIX, this will likely mean an increased opportunity set, potentially with higher coupons and better credits.

Merger arbitrage. We’ve also found opportunities to increase our merger arbitrage book. We like merger arbitrage because it’s another way to pursue absolute returns with little correlation to the equity and fixed income markets. We expect to see more opportunities on the horizon once interest rates stabilize. For more on our views of merger arbitrage, see Co-Portfolio Manager Jason Hill’s commentary, “Stabilizing Interest Rates Can Set the Stage for a Merger Surge.”

Hedged Equity Strategy

Despite running the strategy with minimal exposure to the S&P 500 Index’s downside, we still captured what we believe is a reasonable portion of the S&P 500’s upside. One driver of this favorable asymmetrical capture was the positive standstill yield our current hedge generates, due in part to the higher short-term interest rate environment. As we have discussed, the recent rise in the Fed funds rate flows through to the option market in higher call and lower put prices. (Co-Portfolio Manager Dave O’Donohue’s video blog “Higher Rates are an Opportunity for Hedged Equity Strategies” provides a good overview on the impact of higher rates on option pricing.) Although we always adapt to what we believe is most attractive in the options market, we will likely retain the higher hedge delta in 2024, as long as it is still available in the option market.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered a measure of the US equity market. The Bloomberg US Aggregate Index measures the performance of investment grade bonds. The Bloomberg US Government/Credit Bond Index includes Treasuries and agencies that represent the government portion of the index, and includes publicly issued US corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Foreign security risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

024001b 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.