Any Gas Left in the Tank? Investors Wonder What to Expect After EM’s Strong 1st Half

July 19, 2017

“When returns in emerging markets are so strong in the first half of the year, how likely are they to continue through the second half?”

That’s the question about emerging markets that our Calamos Global and International Portfolio Specialist Todd Speed, CFA, has been fielding lately.

The MSCI Emerging Markets Index gained 18.60% from January to June, twice the Standard & Poor’s 500 9.34% return. For those who wonder whether there can be any more to the EM equities rally, Speed provides this analysis.

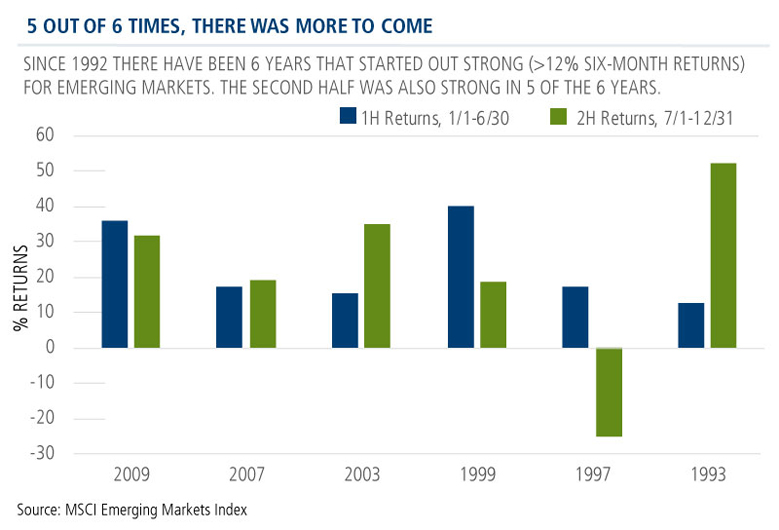

Since 1992 there have been six years that started out with similar strength (>12% returns over the first six months and an average of 23.12%). In five of the six years the second-half returns delivered robust gains as well, with an average return of 21.87%. The notable exception was 1997 as the Asian Financial Crisis ultimately engulfed multiple regions.

Speed cites a few reasons for optimism about July through December 2017. “Emerging market gains are supported by better fundamentals than we’ve seen in years including a sustained pickup in the economy across many emerging economies, stronger currencies versus the U.S. dollar, and leading earnings growth,” he says.

Advisors, for more information about our outlook or about Calamos Emerging Market Equity Fund, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

The principal risks of investing in the Calamos Emerging Market Equity Fund include: equity securities risk, growth stock risk, foreign securities risk, emerging markets risk, convertible securities risk and portfolio selection risk.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index is calculated without dividends, with net or with gross dividends reinvested, in both U.S. dollars and local currencies.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

800367 0717 R