Investment Team Voices Home Page

Investment Team Voices Home Page

Emerging Market Technology: A Port in the Storm

Alex Wolf, CFA

Heightened U.S-China tensions continue to reshape global supply chains—creating tailwinds for many international technology companies, including a number of holdings in our global and international strategies.

In January, we wrote about the benefits of investing globally in technology to access key trends, such as China’s investment in 5G. (See our post, “Investing in Technology Innovators: The Benefits of a Global Approach” for more.) We noted that non-U.S. technology companies were enjoying a distinct competitive advantage as China sought to localize supply chains within Asia. Since then, the U.S. government has taken strict action on Chinese firms deemed to be a security threat, essentially cutting them out of key parts of supply chains. There is every reason to expect that this move will prompt China to further accelerate the insourcing of its supply chains.

This disruption creates many opportunities across the global technology landscape. Beneficiaries include local Chinese businesses, such as China SaaS players. (For more, see our post, “China’s Cloud Software Industry: Long Runway Supports Secular Growth Potential.”) Companies in Korea and Taiwan are also likely to get a boost as they help fill the gap in global supply chains. Both these countries offer very advanced technologies across the semiconductor, mobile phone, and networking sectors. Those companies able to prove themselves as having differentiated and best-in-class offerings will benefit from these supply chain disruptions as they play a leading role in driving technology advancement during a new era of heightened U.S.-China tensions.

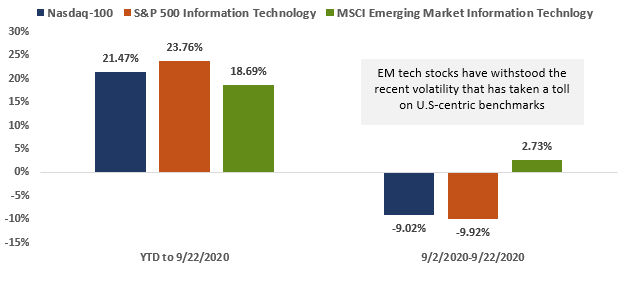

Current market conditions illustrate the benefits of building technology exposure that extends beyond the large-cap U.S. companies that often dominate U.S. investors’ attention and the headlines. As most investors are aware, U.S. tech stocks have been very strong performers, with the Nasdaq-100 Index up 21% and S&P 500 Information Technology Index up 24% year to date through September 22. Perhaps less known though, is that emerging market technology stocks have kept up with these U.S. centric tech benchmarks, as measured by the MSCI Emerging Market Information Technology Index, up 19% year-to-date. Notably, the emerging market benchmark has proven more resilient over recent weeks. Supported by positive absolute performance from Korean and Taiwanese tech companies (due in large measure to the factors outlined above), the MSCI Emerging Market Information Technology Index has remained in positive territory, versus declines of more than 9% in the Nasdaq-100 and S&P 500 IT Index.

Total Return %

Past performance is no guarantee of future results. Source: Bloomberg.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific companies, securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to buy or sell. Investing in non-U.S. markets entails greater investment risk, and these risks are greater for emerging markets. The above commentary for informational and educational purposes only and shouldn’t be considered investment advice.

The Nasdaq-100 Index is a large-cap growth indexes that includes non-financial companies with heavy technology sector representation. The S&P 500 Information Technology Index includes companies included in the S&P 500 (a measure of U.S. large-cap stock performance) that are classified as members of the GICS® information technology sector. The MSCI Emerging Markets Information Technology Index is designed to capture the large and mid-cap segments across 26 emerging market countries. All securities in the index are classified as members of the GICS Information Technology sector. Indexes are unmanaged, do not include fees and expenses and are not available for direct investment.

18834 0920 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.