Investment Team Voices Home Page

Investment Team Voices Home Page

CTSIX: Small Caps Poised for Momentum

Our Timpani team has over 25 years of experience investing in companies with fundamental momentum - companies with sustainably fast growth profiles and a knack for exceeding expectations. Like most investment approaches, ours has experienced relative performance up and down cycles.

We believe we’re in the early stages of a cyclical recovery that strongly favors our investment philosophy and process. Combined with a small cap asset class that is poised to play catch-up to larger caps, the Timpani Small Cap Growth fund (CTSIX) is currently positioned to continue its ascent into a thriving upswing, in our opinion.

Two key factors reveal a clear trend in upward momentum:

-

Small Caps Continue to Gain Momentum

Historically, small caps exhibit resilience and adapt swiftly to dynamic market conditions, positioning them as an appealing asset class with growth potential. Recently, small caps emerged from a 23-month bear market in October 2023, the second longest on record. Unlike large caps, we believe the small cap bull market is in early innings. Using the past as an example, the typical small cap bull market lasts 34 months and generates returns of 131%. We are only five months into this cycle and valuations versus large caps continue to look exceptionally low (10th percentile).

Small caps remain inexpensive compared to large caps and historically thrive during periods of Fed rate cuts, which are expected later this year. As momentum continues to build, we think small caps are poised for further growth.

-

CTSIX has Cyclical Tailwinds

Following historical patterns, a period of relative underperformance presents an opportunity for a comeback. The convergence of two factors – small caps’ favorable outlook as an asset class and the fund’s potential to bounce back from its cyclical trough sets the stage for an enhanced performance trajectory. The current surge in relative performance further reinforces its potential indicating a shift towards stronger performance in the near future.

The below chart shows cumulative monthly performance reset at the beginning of each year relative to the benchmark, Russell 2000 Growth.

CTSIX Excess Returns vs. Russell 2000 Growth

Performance is no guarantee of future results. Source: Morningstar Direct as of 3/31/2024

The track record shows cyclical robust performance, following periods of underperformance comparable to recent years. The highlighted green section demonstrates the strong relative performance over the first quarter of 2024. Furthermore, our approach has meant realizing losses over the last two years that can be used to offset realized gains taken in the future – an added benefit, especially if we see the upswing we expect.

What sets CTSIX apart in this scenario is the synergy between the broader market trends favoring small cap and the fund’s positioning to capitalize on its recent performance challenges. While these components move independently, their alignment presents a unique opportunity for investors. The established momentum underscores the potential for significant rewards for those who remain steadfast during periods of weakness.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

Portfolios are managed according to their respective strategies which may differ significantly in terms of security holdings, industry weightings and asset allocation from those of the benchmark(s). Portfolio performance, characteristics and volatility may differ from the benchmark(s) shown.

Index Definitions

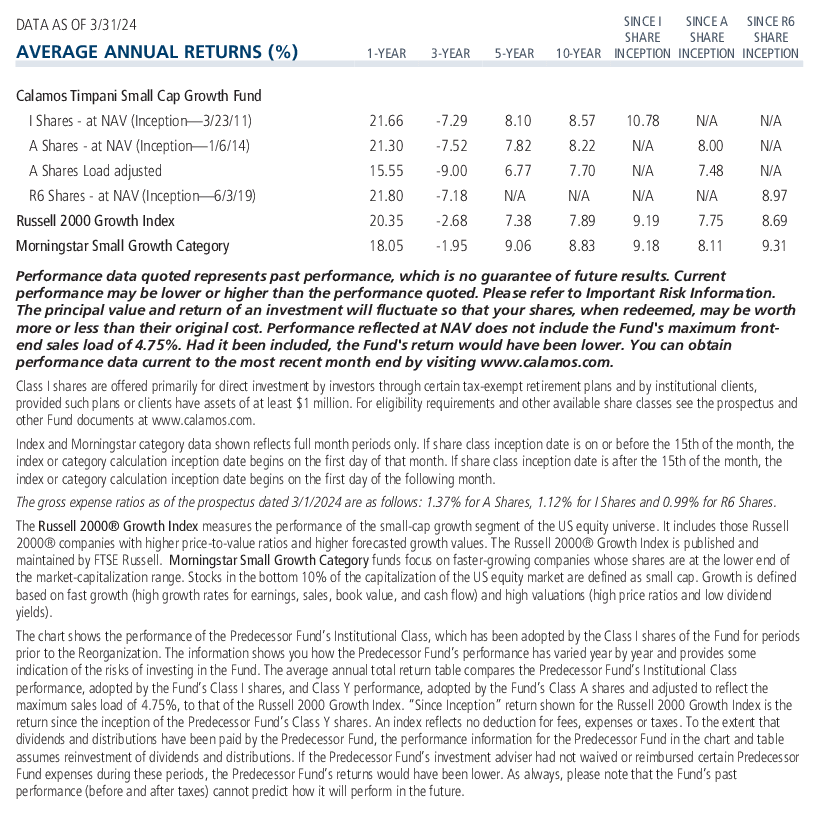

Morningstar Small Growth Category includes small-growth portfolios that focus on faster-growing companies whose shares are at the lower end of the market-capitalization range. The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the US equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. The Russell 2000 Growth Index is published and maintained by FTSE Russell. The Russell Top 200® Index measures the performance of the largest cap segment of the US equity universe. The Russell Midcap® Index measures the performance of the mid-cap segment of the US equity universe. The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The growth indices are constructed to provide a comprehensive and unbiased barometer of the growth market. The value indices are constructed to provide a comprehensive and unbiased barometer of the value market. CUSIP identifiers have been provided by CUSIP Global Services, managed on behalf of the American Bankers Association by S&P Global Market Intelligence LLC, and are not for use or dissemination in a manner that would serve as a substitute for any CUSIP service. The CUSIP Database, © 2011 American Bankers Association. “CUSIP” is a registered trademark of the American Bankers Association. The S&P 500 Index is generally considered representative of the US stock market. The S&P 500 Value Index measures the performance of stocks within the S&P 500 Index that have value-oriented characteristics, such as lower price-to-earnings ratios and price-to- book ratios. The S&P 500 Growth Index measures the performance of stocks within the S&P 500 Index that have growth-oriented characteristics, such as higher earnings growth rates and higher price-to-earnings ratios.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Important Risk Information

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

900134 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.