Sorting Out the ‘New New Normal': Freund on Growth, Inflation, Rates and The Positive Climate for Risk Assets

“We’re in a very different sort of place than we were in 2019,” prior to the global COVID-19 outbreak, Calamos Co-CIO, Head of Fixed Income Strategies and Senior Co-Portfolio Manager Matt Freund, CFA, said on a Calamos Webcast Tuesday. While there’s no doubting the tremendous GDP growth as the economy moves from reopening to open—what he termed the “New New Normal”—Freund sought to sort through some conflicting economic signals. (Listen to the full presentation on the quarterly review and outlook for Calamos Long/Short Equity & Dynamic Income Trust [CPZ] webcast here).

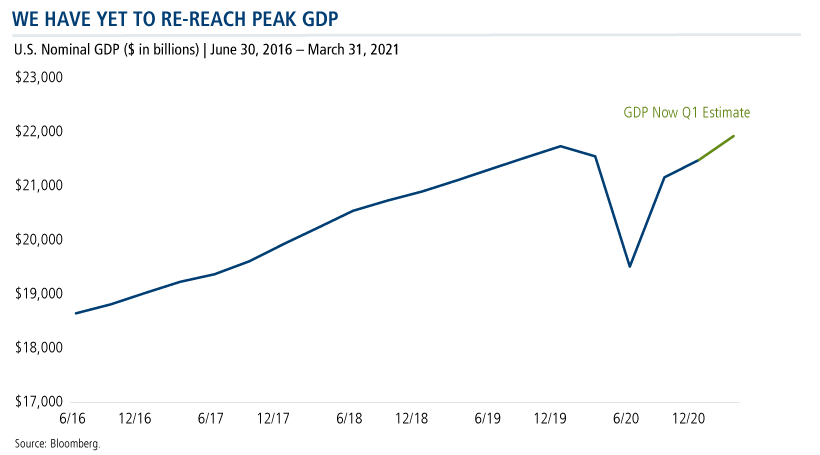

For one, he said, “I think we’re confusing activity that is rebounding, because we really spent most of last year choking off economic growth, with a long-term improvement in growth trends.” But he asked, “Will 2022 or 2023 be significantly better than 2019?” For as much time as his team spends thinking about the answer, they just aren’t certain. “In a lot of ways, we’ve created bigger problems than we had in 2019,” Freund said.

“Truthfully,” he said, “we’re just getting back to the high that we experienced in 2019 and, more importantly, [GDP] is still far below trend. There is significant unused capacity and there is significant unproductive labor.”

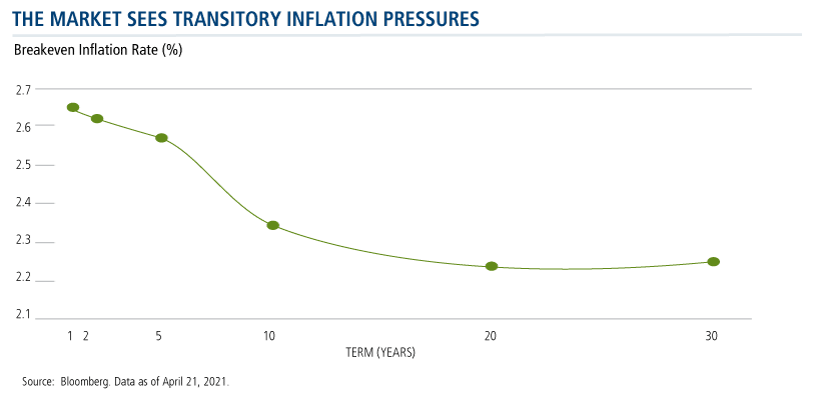

It’s a given that inflation will trend significantly higher for the next couple of quarters, according to Freund. But he said, “the long-term trend is less clear. But it’s not deflationary. Let me be clear on that, we are not expecting deflation.”

However, Freund expressed skepticism beyond that. “I think that some of the commentary out there that inflation is going to be gapping higher and accelerating longer term from here, that the dollar has to collapse, I don’t know that that’s true beyond the next couple of quarters,” he said.

The market is convinced that inflation will significantly exceed the Fed’s target 2% for the next year or so and then quickly moderate closer to the 2.20%-2.40% range, well within Fed tolerances. Such a spike is being described as an effect of the economy reopening. While Freund agrees with the characterization, he is not ready to say whether inflation is “transitory,” as many believe.

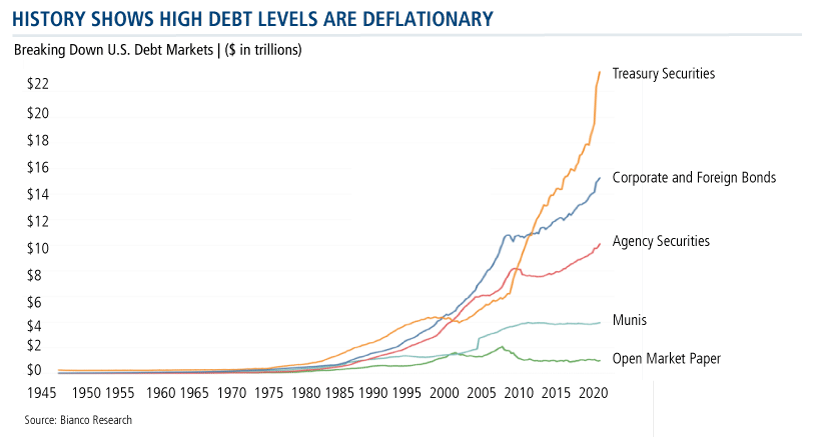

What’s counterintuitive is the high level of debt across debt markets, with the exception of municipal bonds.

“High debt levels generally are associated with periods of low inflation, certainly not the inflationary problem that people are worried about, we think, prematurely,” according to Freund.

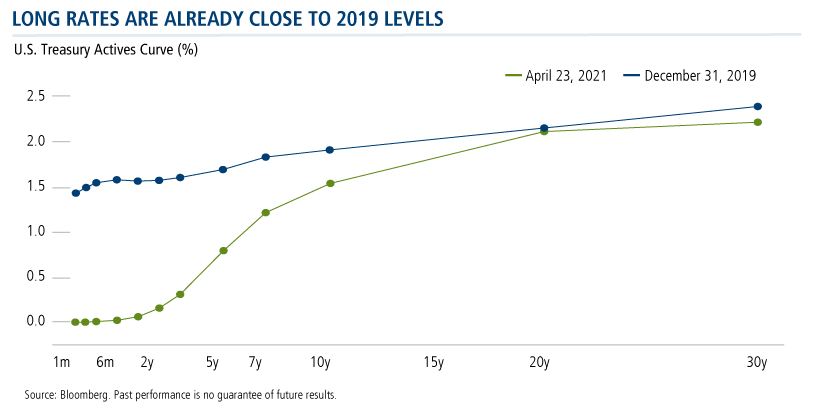

Freund then compared the yield curve in December 2019 with last week. While long rates are very close to where interest rates were in 2019, the key difference is the front end of the yield curve.

“You have three choices,” Freund said. “You can be early, you can be late or precisely on time. If you take the last one out as fortuitous, the Fed has told us without any doubt that they are going to be late and they will not be raising rates ahead of inflation being a problem.”

The picture Freund was painting, then, was an economy whose growth supported rates increasing “gently” to the 2% range but with high levels of indebtedness and inflation that’s seen as transitory.

“Again, rhetorically, you have to ask yourself what problems from 2019 have gone away and what new problems have been created?”

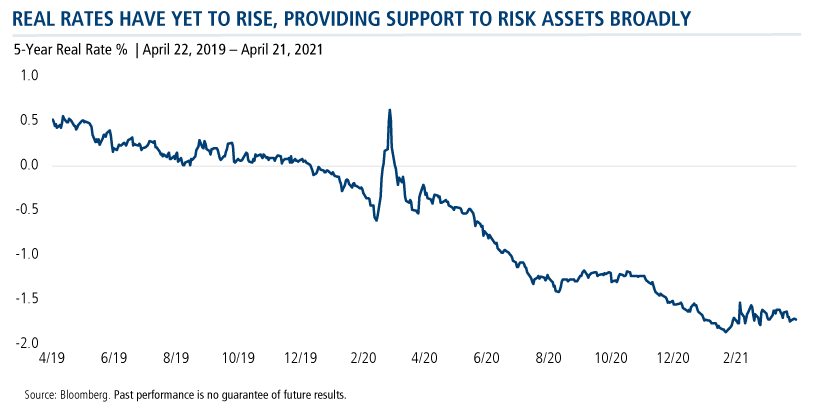

Freund closed his comments with the chart below showing nominal rates less inflation. “You can see that they are still decisively negative. That is incredibly supportive for risk assets.”

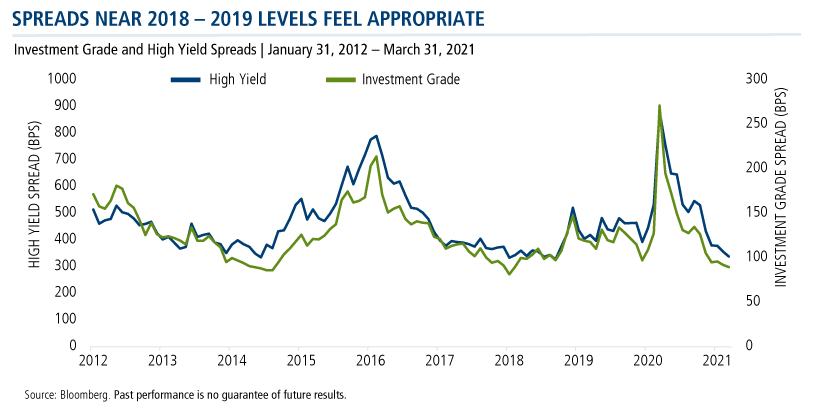

The next chart showed the premium available to investors over treasuries for both high yield and investment grade bonds.

“You can see [the Calamos team] had a great opportunity to put money to work in 2020, and we did that. We managed to lock in an opportunity set that looked just downright fabulous with today’s opportunity sets. We think that reflects the strong growth that we talked about, investors warming up to the idea that the Fed is providing liquidity and it’s going to be late [to raise rates], and that real rates are negative and incredibly supportive of risk markets.”

Investment professionals, for more information, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

802383 0421

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on April 29, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.