Is Your World Allocation Fund More Vulnerable This Year Than You Think?

If you’re positioning your clients for global growth, we like how you’re thinking. Having navigated multiple crosscurrents the past two years, global markets are poised for a broad recovery (read more in our outlook).

Calamos Global Opportunities Fund (CGCIX)

Morningstar Overall RatingTM Among 351 Global Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 3 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 351, 333 and 241 Global Allocation Funds, respectively, for the period ended 4/30/2024.

But, investment professionals, we have two quick questions for you:

- How reliant is your World Allocation fund on traditional fixed income?

- And, does that concern you?

In just the last year, global debt has grown to $226 trillion—a 30% year-over-year increase, according to the International Monetary Fund. Bond funds have seen positive flows for the last 10 years, in what’s been an ultra-low interest rate environment.

But here’s what concerns us, says Todd Speed, Calamos Investments Senior Vice President and Portfolio Specialist.

“The notion with bonds right now, or traditional high grade and sovereign fixed income, is in some ways sort of a lose-lose proposition. You can lose money quickly if interest rates spike this year, let’s say 100 basis points. And, you can lose money slowly, if inflation remains near these levels, or closer to a historic average, somewhere between 2-4% and not the kind of deflationary or low inflation world we’ve seen for a decade,” Speed says.

Heavy allocations to traditional income—Speed says funds in Morningstar’s World Allocation category may allocate as much as 50% to bonds—can make a core global allocation fund vulnerable in a rising rate environment.

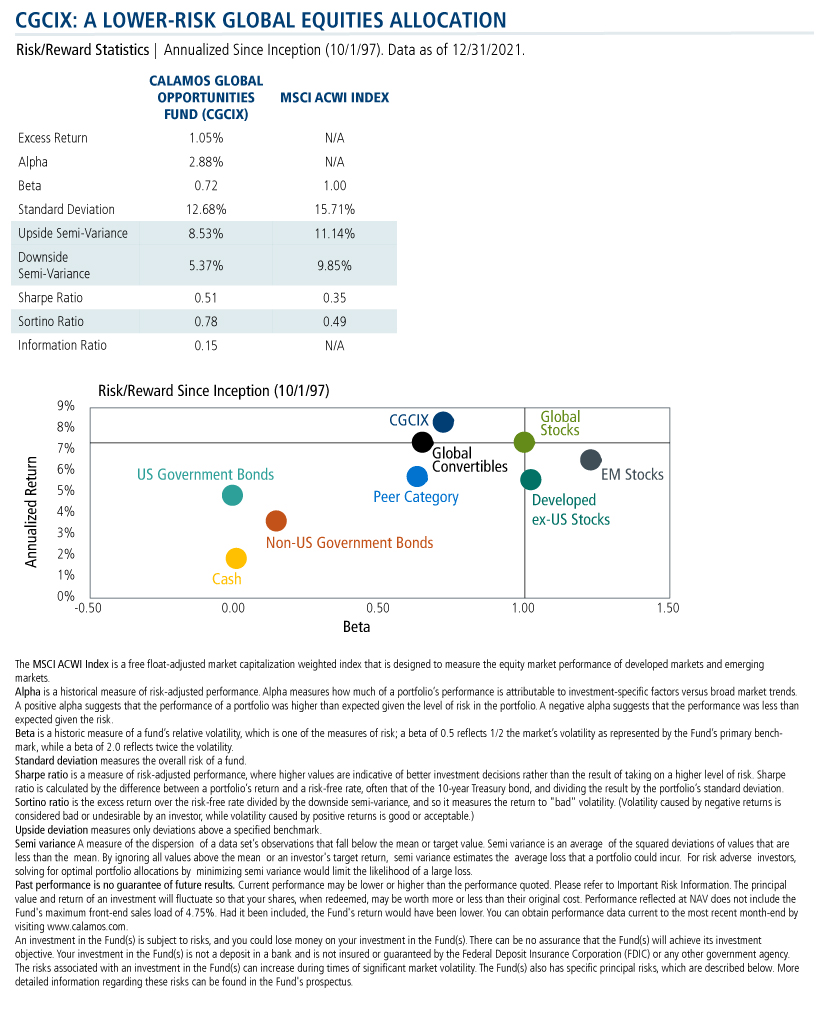

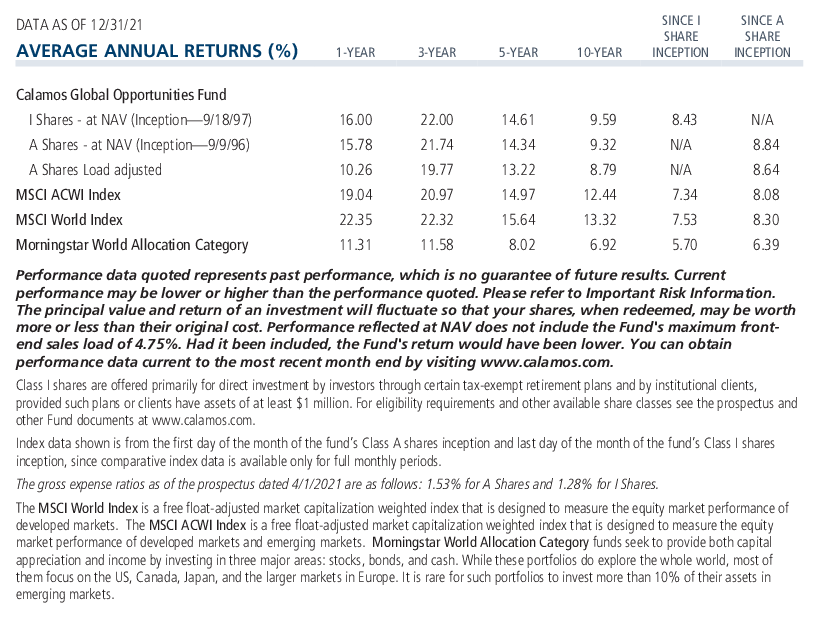

Here’s our counterproposal for a lower risk global equities allocation: Calamos Global Opportunities Fund. CGCIX favors convertibles over traditional fixed income to build a risk profile that has historically been more resilient to rising rates and inflation. An active blend of global equities and convertibles is what the team uses to pursue equity-like returns with lower risk.

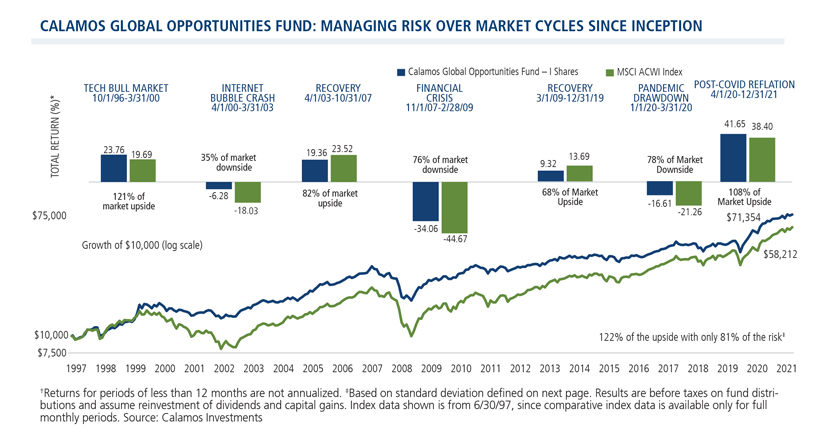

Since inception the fund has provided 122% of the upside with just 81% of the risk through December 31, 2021.

It’s exactly in times like these—mid-cycle when volatility typically picks up and the Fed begins to move on rates—that CGCIX has performed exceptionally well, thanks to the assist from convertibles.

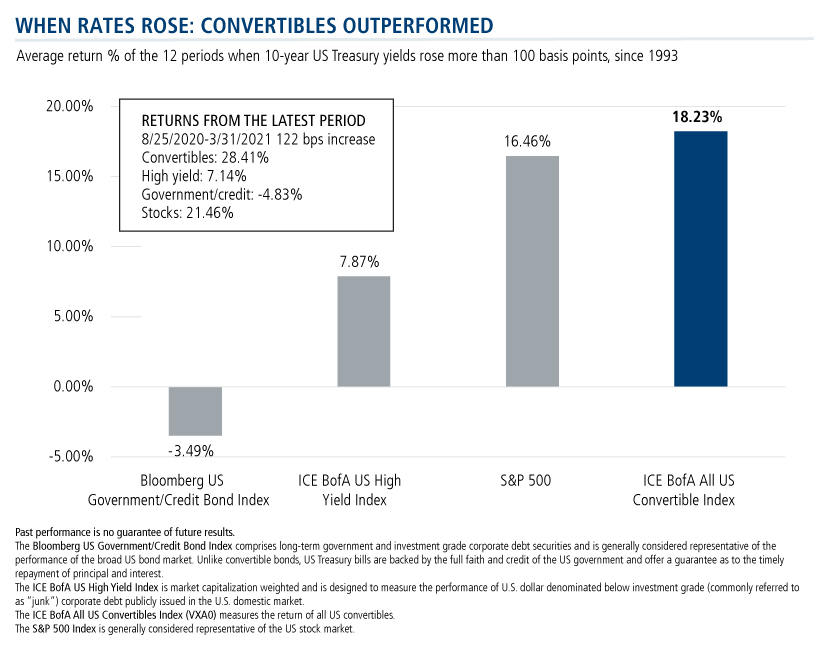

In 10 of 12 cycles over the last three decades when interest rates moved more than 100 basis points, convertible bonds “can often perform closer to equities, sometimes better than equities. But in almost all cases better than traditional high income and high yield,” says Speed.

“To us, it jumps off the page,” says Speed, referring to CGCIX virtually alone in the upper left quadrant on a risk-reward plot. “Relative to global stocks, emerging stocks, ex-US stocks, and relative to bonds, the fund gave you some of the best of both worlds.”

Given the evolving monetary policy backdrop and expectations for rising rates, vigilance on valuation risk-reward and selectivity is a critical piece of due diligence. Investment professionals, there’s much more to say about CGCIX and how it’s positioned for a blend of cyclical and secular growth opportunities during the recovery. Contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets and emerging markets.

Morningstar World Allocation Category funds seek to provide both capital appreciation and income by investing in three major areas: stocks, bonds, and cash. While these portfolios do explore the whole world, most of them focus on the US, Canada, Japan, and the larger markets in Europe. It is rare for such portfolios to invest more than 10% of their assets in emerging markets.

Morningstar RatingsTM are based on risk-adjusted returns and are through 12/31/21 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2022 Morningstar, Inc.

808634 122

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 21, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.