Breaking Up with TINA

“There is no alternative.” Adopted by former Prime Minister of the United Kingdom Margaret Thatcher as a baseline justification for capitalism, the term has been increasingly applied to investment markets. As central banks around the world kept interest rates at zero (or negative outside the US), investors progressively adopted the mentality that risk assets, primarily equities, were the only game in town. That is no longer true.

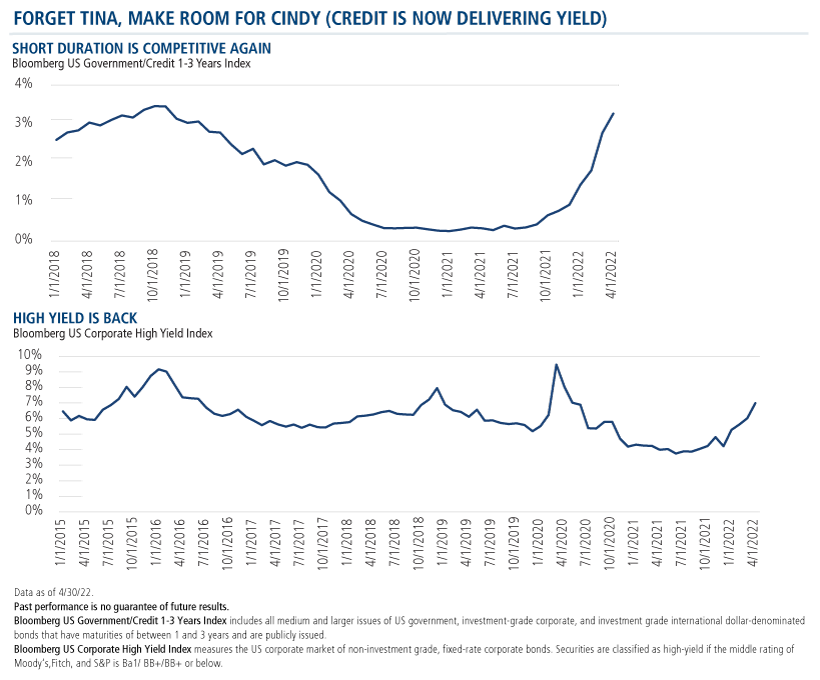

If you have been too busy watching the recent volatility of the market, you may have missed the news. This year is providing a harsh reality check for those who expected to earn high returns with minimal volatility. Meanwhile, moves in both interest rates and spreads mean that you can finally get 3% yields in short duration and nearly 8% in high yield assets. There is an alternative.

TINA Served Its Purpose

TINA was largely by design. Monetary policy is meant to alter market behavior as the Fed tries to steer the economy toward its dual mandates of price stability and full employment. For decades following World War II, the Fed used one primary tool, the overnight Federal Funds rate, to implement policy.

That changed under the Bernanke Fed during the Great Financial Crisis as additional easing was needed, and quantitative easing was born. By directly reducing the supply of publicly available Treasury bonds, the Fed forced investors seeking adequate returns to step further and further out on the risk curve. It was hoped that lower rates would create a “wealth effect” where higher stock and bond prices would lead to further economic growth.

Years later, during the Covid recession, Congress authorized the Fed to go even further and directly purchase a variety of corporate bonds in addition to more Treasuries. The market repriced its appetite for risk with improving metrics and ample liquidity, and income-seekers were forced to look for new asset classes to meet return requirements.

By June 2020, the S&P 500 had recovered to its pre-Covid levels while outyielding many fixed income asset classes. Volatility settled into a lower range. Equities were considered the only game in town for income and appreciation. This behavior was global in nature, and more extreme in Europe where interest rates were negative, and the central banks were directly buying equities. TINA may even be responsible, in part, for pushing investors to seek less traditional alternatives like cryptocurrencies, NFTs and meme stocks.

Fast-forward two years. The Fed and central banks around the world have an inflation problem. Tighter financial conditions are necessary, and lower stock prices are a component of that tightening. Weaker markets are not an unintended consequence of Fed policy, they are part of its specific goal (the previously created wealth effect is being reversed).

Re-engage with Fixed Income

The stock market correction has been painful, and it may not be over. Where does this leave investors? With more options. If it has been a while since you considered fixed income, now is the time to re-engage.

A combination of higher underlying Treasury yields and wider spreads result in yields across the spectrum of fixed income asset classes that are considerably higher than any time in the last two years. In some cases, yields are nearly as high as they’ve been at any time since before the financial crisis.

Calamos Fixed Income

Is it time to re-engage with Calamos fixed income? Your options include:

- Suitable for investors seeking current income accompanied by lower volatility over a one-year to two-year time frame, Calamos Short-Term Bond Fund (CSTIX) uses a multi-sector fixed income strategy.

- Calamos High Income Opportunities Fund (CIHYX) also uses a multi-sector strategy designed to provide a high level of current income and total return potential for more risk-tolerant investors.

- High yield bonds, bank loans and preferred securities are among the investable universe of the Calamos Total Return Bond Fund (CTRIX), whose purpose is to serve as the cornerstone of a fixed income allocation.

Consider the short duration universe. The Bloomberg US Government/Credit 1-3 Years Index ended April with a yield-to-worst of 2.86%. The index yield hovered at or slightly above that level for just a few months during the fourth quarter of 2018. Otherwise, you’d have to look back to mid-2008 for that type of return expectation without taking on additional credit or duration risk. The same is true for core fixed income assets as represented by the Bloomberg US Aggregate Bond Index.

Step further out the risk spectrum within fixed income and you’ll encounter even better results, albeit shorter in terms of the historical context. With the exception of the acute Covid market when credit spreads widened well beyond average recession levels, the Bloomberg US Corporate High Yield Index has not offered a yield like current compensation since the industrial recession of 2015-2016. With a yield of nearly 8%, the high yield market is ripe with opportunities.

As we evaluate the variety of current and forward-looking macroeconomic variables and challenges, we anticipate a wide dispersion of outcomes among fixed income asset classes and issuers. Avoiding pitfalls in fixed income is always important, even more so when recession risks are in play. We continue to apply our active approach and philosophy of being well compensated for the risks taken in search of the best opportunities for our shareholders.

Through the cacophony, one thing is clear. TINA is no longer valid, make room for CINDY (Credit Is Now Delivering Yield).

Investment professionals, for more information about Calamos Fixed Income capabilities, please reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high-yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk, foreign securities risk and liquidity risk.

The principal risks of investing in the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Bloomberg US Government/Credit 1-3 Years Index includes all medium and larger issues of US government, investment-grade corporate, and investment grade international dollar-denominated bonds that have maturities of between 1 and 3 years and are publicly issued.

Bloomberg US Corporate High Yield Index measures the US corporate market of non-investment grade, fixed-rate corporate bonds. Securities are classified as high-yield if the middle rating of Moody’s,Fitch, and S&P is Ba1/ BB+/BB+ or below.

Yield-to-Worst is the lowest potential yield that can be received on a bond without the issuer defaulting.

810148 522

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 24, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.