As interest rates normalize, investors are revisiting their asset allocations—and especially their fixed income positions. When it comes to fixed income, many investors may not appreciate the breadth in the asset class and the potential opportunities this diversity provides. As we often say on our team, it’s a market of bonds, not a bond market. With active management, a bond allocation can take advantage of many different types of opportunities and market inefficiencies. In this post, I’ll take a closer look at one of the less frequently discussed segments of the market: short-duration high yield securities.

The Potential Benefits of Playing at the Edges of the Style Box

Many fixed income investors like to think about the traditional style box when it comes to investing, with interest-rate sensitivity (duration) on one axis and credit quality on the other. This can be a useful tool in characterizing both mutual funds and individual bonds alike. Many managers like to fit strategies neatly within a particular style box to be labelled as a so-called “pure play” strategy. At Calamos, we take an opposing view. We believe selectively expanding our opportunity set beyond the benchmark universe enhances our ability to exploit market inefficiencies and to manage risk and return.

Take the example of short maturity, below investment grade bonds. High yield investors are most often looking to maintain a high level of yield or maximize current income. There is a tendency to buy five to 10 year bonds and hold them as they age. As maturity approaches, the yields on many below investment grade bonds move incrementally lower as the market factors the time period during which the investment is at risk. This makes them less attractive for high yield funds, and they are often sold in favor of longer maturity, higher yielding replacements. However, rating agencies do not distinguish between long and short maturity bonds from the same issuer. As a result, the short maturity bonds still carry below investment grade ratings and do not meet the criteria for investment in many investment grade or core strategies. Bonds like this might attract less interest from investors as there is no clear “middle of the fairway” home for them anymore.

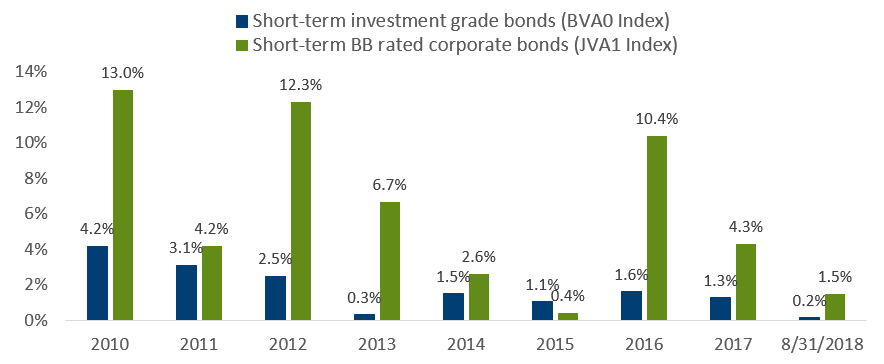

Our team believes that misunderstood securities like these can add value to a portfolio. As shown in the graph below, since 2010, short-term BB rated corporate bonds have outperformed short-term investment grade bonds in all but one year. The cumulative return for the short-term high yield segment was 69.8% versus 16.7% for traditional short duration.

Short-duration high yield: An overlooked corner of the market has delivered compelling returns

Annual total return (%)

Past performance is no guarantee of future results. The ICE BofA Merrill Lynch 1-5 Year US Corporate & Government Index represents investment grade bonds; the ICE BofA Merrill Lynch 1-5 Year BB Cash Pay Yield Index represents short-term BB rated corporate bonds. Source: Bloomberg.

Regardless of duration, when it comes to the high-yield asset class, active risk management and fundamental research are extremely important. High-yield investments carry more credit risk than government bonds and higher rated corporate debt, and they are often more idiosyncratic. Because of this, our team devotes extensive resources to ensure we are well compensated for the risks taken. We believe the depth of our team’s experience gives us a valuable edge in identifying high yield securities with risk profiles that are more comparable to investment grade issues, due to a variety of factors, maturity included. For us, the short-duration high yield market is an excellent hunting ground for the inefficiencies that produce alpha opportunities.