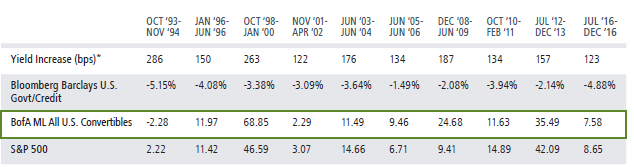

With investors increasingly concerned about rising interest rates, we thought it would be a good opportunity to revisit one of our favorite convertible security charts. Regular readers may recognize the chart below, which compares the performance of U.S. convertibles with stocks and bonds during periods when the yield of the 10-year Treasury rose 100 basis points. We’ve updated it to include the most recent period of rising rates through 2016. Convertible securities again outperformed the broad bond market, thanks to their increased equity sensitivity and moderate duration (typically, the duration of the convertible market index is lower than that of the broad bond markets).

Returns in Rising Interest Rate Environments

Past performance is no guarantee of future results. *10-year Treasury yield. Rising rate environment periods from troughs to peak from October 1993 to December 2016. Performance shown is cumulative. Source: Morningstar.

We believe the remainder of 2017 is setting up to be a good year for convertible securities, which provide the opportunity for equity market upside participation with potential downside protection. As we have discussed in our recent outlook, we expect an increase in market volatility due to U.S. policy uncertainty, as well as central bank policies, populist sentiment and established geopolitical tensions. Still, economic data is improving overall, both in the U.S. and globally, which can provide a sustained tailwind for equities, and by extension, convertibles. Global issuance has also gotten off to a good start, with $6.2 billion coming to market in January, led by the U.S. at $3.3 billion. We believe economic growth should provide a healthy backdrop for issuance from here. Also, some of the proposed policies of the new U.S. administration could bolster issuance if enacted. For example, if interest deductibility is eliminated as part of tax code changes, companies would likely prefer issuing convertibles versus straight debt, due to the lower coupons typically offered by convertibles. Additionally, infrastructure spending could increase demand for capital.