Regular readers of our blog know we turned bullish on Japanese equities this past fall, as we believed the Bank of Japan was ready to embark on a second round of quantitative easing and equity valuations were attractive. And perhaps most importantly, we saw a potential inflection point in corporate governance as the tone and actions of company managements were becoming more investor friendly. Since that November 4, 2014 post through March 13, the Nikkei 225 Index has rallied more than 7%, outperforming the S&P 500 Index (+2.9%) and the Euro Stoxx 50 Index (+1.4%).

While this advance has already been impressive, we believe Japanese equities may still only be in the early stages of a longer-term rally. As we wrote in November, Prime Minister Shinzo Abe’s government has highlighted the Nikkei 400 Index as a key part of its structural reforms. Unlike indexes that focus on market capitalization or sector, this index includes Japanese equities issued by companies that efficiently utilize capital and have investor-focused management. A strict financial screening criteria and quantitative and qualitative scoring are used to determine the index’s 400 constituents. Many Japanese companies aspire to be included in this index, which we believe has contributed to recent increases in stock buyback activity and capital expenditure announcements.

Among the recent examples that have anecdotally affirmed our optimism about Japanese equities, a large Japanese robotics company historically known for its lack of transparency made headlines when its chief executive officer indicated publicly that the company would set up a shareholder relations department, and was also considering both increases its to dividend payout ratio and a stock buyback program. This may not sound like an earth-shattering announcement, given that even many small-cap companies in the U.S. have dedicated investor relations departments. But for those of us who follow the Japanese equity market, dividend increases and stock buyback programs have not been a focus for many Japanese companies, specifically this company; and discussing these topics via the media was surprising. Moreover, this same company also recently announced plans to increase its manufacturing capacity via two new factories in Japan, requiring a capital investment of nearly $1 billion. This is yet another positive signal that Japanese corporations are becoming more comfortable with investing in growth and building these facilities within Japan.

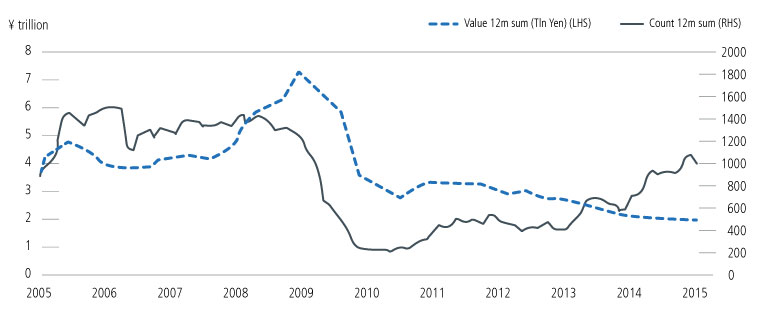

Structural Reforms in Japan: A Catalyst for Stock Buybacks

Source: J.P. Morgan, “Japan Equity Strategy,” February 3, 2015, using data from Bloomberg and J.P. Morgan.

Within our economic profit valuation framework, many Japanese companies that historically exhibited very low returns on invested capital (ROIC) and allocated capital to under-producing assets are now beginning to exhibit ramp-ups in ROIC as they refine their capital allocation strategies. The combination of capital growth, improving returns, and a low cost of capital is accelerating intrinsic value creation for many of these Japanese companies, in turn supporting the strong returns we have seen in the equity markets.

Our investment process seeks to identify these inflection points from both the top down and the bottom up. Japan provides a recent example of how we believe this process can create significant value for investors