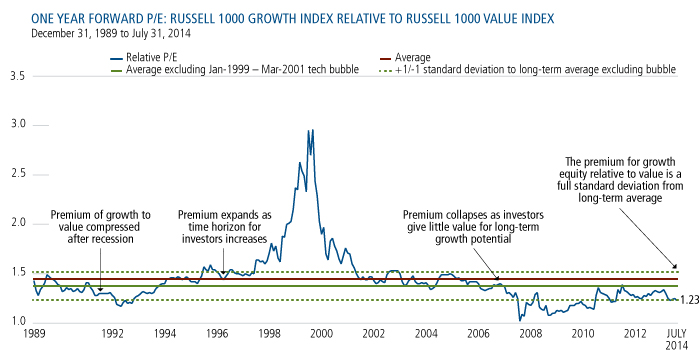

After five years of a strong bull market, I believe there’s still room for stocks to advance. Growth stocks look especially attractive. At 1.23, the premium for growth over value remains lower than the historical average of 1.44. Even when we omit the tech bubble from the long-term average, the 1.23 premium for growth is lower than that 1.37 average.

FIGURE 1. THE VALUE IN GROWTH

Source: FactSet (1989-6/2012) and CapIQ (7/2012-present). Past performance is no guarantee of future results.

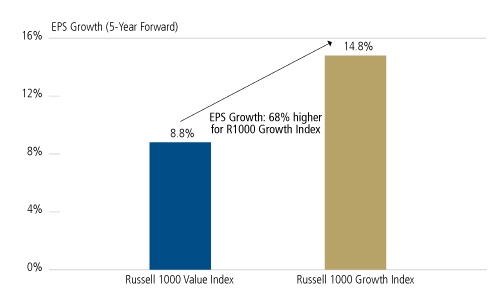

While growth stocks’ prices are low relative to value, their earnings prospects are significantly better. The 5-year forward EPS growth rate for the Russell 1000 Growth Index is 14.76%, versus 8.77% for the Russell 1000 Value Index (Figure 2). As investors move from the "bad news is good news" mindset to "good news is good news," we believe that growth stands to benefit.

FIGURE 2. BRIGHTER EARNINGS PROSPECTS FOR GROWTH

Past performance is no guarantee of future results.Data as of July 31, 2014.

As we’ve discussed in our previous commentaries, we believe that the market has entered a growth regime, and that this current economic expansion cycle will likely be longer than typical—providing a favorable backdrop for growth stocks. Accommodative monetary policy seems set to continue: Last week, the European Central Bank surprised the markets with a rate cut and Friday’s anemic job numbers suggest that the Fed is unlikely to accelerate the pace for a rate increase. But when a rate increase does eventually occur, P/Es are likely to go up as well. History has shown that P/Es go up when interest rates are moving up from abnormally low levels.

No doubt, there will be volatility from economic reports and geopolitics, with Ukraine and the Middle East looming largest today. Active management and a long-term perspective will make the difference in taking advantage of the short-term choppiness that is likely to occur.