Reclaiming the Investor Psyche: A Roadmap

Michael Grant

Investment success requires taking on risk in exchange for return. Since John P. Calamos, Sr., founded Calamos Investments in 1977, our aim, as active managers, has been not to avoid risk, but to engage it in a sensible and measured manner.

But the years since the Global Financial Crisis (GFC) have skewed how investors think about risk. In the interest of stability, governments and central bankers alike have pursued policies that have remapped investors’ understanding of economic growth, corporate profitability and insolvency risk —and how all of these impact equity returns.

Today we continue a three-part series featuring the perspective of Michael Grant, Calamos Co-CIO, Head of Global Long/Short Strategies and Senior Portfolio Manager of Calamos Phineus Long/Short Fund (CPLIX), on what’s changed, why and what it means for financial advisors’ clients’ pursuit of investment returns in the coming years. In this post, Grant pushes back on the “consensus reflex to fade U.S. equities and go overseas.”

A Global Long/Short View: Why Europe Is In Trouble

Also see: The U.S.: An Island of Economic Dynamism and Non-monetary Reflation

The excitement attached to European equity in 2017 is unlikely to return anytime soon, according to Michael Grant. In fact, he says, there’s a rising risk of the “Japanisation” of Europe’s equity future.

Structural outperformance of European equity awaits a different investment cycle, one more favorable to the value style of investing. For now, Europe cannot inspire confidence, he says, cautioning investors to “avoid enthusiasm.”

Europe lags well behind the U.S. trajectory, he notes, adding there is “no constituency for non-monetary reflation or deregulation of the American kind and, thus, some risk that Europe fails to exit its monetary experiment.” Grant views the legacy of deflation in the eurozone as a “disastrous” divergence of conditions across its member economies that is arduous to reverse.

Europe’s largest established companies have underinvested in the future, he says, and represent what he calls “legacy capitalism”—overdependence on protected domestic markets that are stifled by an unfriendly regulatory, overtaxed culture that discourages innovation.

Its established companies are like “over-regulated utilities”—saved from insolvency, but where is the growth, asks Grant. “Where are the Facebooks and Googles of Europe? What’s left is more of an open-air museum than a vibrant economy.”

The European predicament, according to Grant, "reflects an enviroment in which capital has been subsidized, insolvency is suppressed and regulation has expanded to justify a Brussels technocracy. Across the political spectrum, there is a German-led preference for stability at the expense of risk-taking and capital expansion.”

What follows is what Grant has to say, specifically, about Brexit and the UK, Germany and the Economic Union, and France.

Brexit and the UK

Much of the commentary concerning the British withdrawal from the European Union has been overexcited conjecture, according to Grant.

“We used to hear how Brexit would be the impetus for the revitalization of the Euro project. What we see is ideological rigidity and institutional inertia,” he says. “Europe’s leaders are trapped in the mental version of a foxhole.”

For Grant, the barometer of the Brexit risk premium is the behavior of the GBP, which has stabilized versus the euro. However, Grant says there is little evidence that global investors have begun to revise their negative view of UK equities. “The prevailing suspicion across continental Europe is that the UK is committing some kind of economic suicide,” he says.

The Brexit saga highlights the leadership deficit that frustrates any conversation about the future of Europe. Grant describes it as “a testament of institutional inflexibility and how political considerations hamper the rise of economically advantaged outcomes.”

In Grant’s view, the structural weaknesses of the euro system remain. There is neither convergence nor rebalancing along the direction that China is pursuing, he says, where the limitations of export-led growth are fully acknowledged.

At the same time, Grant dismisses the view that Brexit and the election of U.S. President Donald Trump marked the beginning of the disintegration of the European Union. This kind of reckoning ignores the political capital invested in the European project by its leaders, and by Germany above all.

Today’s contradictions imply small incremental fixes rather than the emergence of a more dramatic vision. “If the EU ceased to exist it would have to be renewed in some form,” says Grant, as close cooperation between European states is essential.

“The tragedy has been the drift away from cooperation amongst sovereign countries, towards a sort of United States of Europe, which overlooks the fundamental differences of national self-image and stages of economic development,” he says.

Germany and the European Union

Grant is critical “of the rules-based, monocultural” order that the EU has built under German leadership. “It is undynamic and oversheltered: plainly vulnerable in a Trump world,” he says. It overvalues stability at all cost.

According to Grant, free trade in goods is sacrosanct in Germany, where Trump’s calls for “free and fair trade” are rejoined with moral indignation. Since the creation of the euro, the share of exports in German GDP has nearly doubled from about 26% to 47%—an “amazing” imbalance for an economy of its size.

Not surprisingly, Germany’s trade surpluses have become a source of irritation worldwide. According to Grant, Germany’s business sector is especially threatened by Trump, for his demands are more credible and insistent even though his message is the same of prior U.S. administrations.

Together with France, the Angela Merkel government is open to policy initiatives to restore the momentum of European integration. According to Grant, the catalyst has been the UK’s exit from the EU and a Trump administration that is questioning aspects of the post-war settlement under which Germany has prospered.

“Despite talk of Trump’s new American isolationism, it is Europe that has displayed parochialism from a geopolitical and policy perspective for many years,” says Grant. He describes Europe’s claim to moral superiority in the trade dispute as “grotesque.”

European unity will predictably emerge when there is the perception of an external threat, Grant says. Trump fulfills this role of the external enemy, adding that Trump is especially loathed in Germany. But again, he says, the current U.S. president is sending a message to Germany that is not new.

France

The eurozone is handicapped not only by its structural weaknesses and political instability that plague neighboring countries. A core weakness, according to Grant, has been the chronic underperformance of the French economy.

The French economy is one of the principal beneficiaries of Europe’s economic return-to-normal, and Germany needs a partnership with France in order to restore political cohesion within the eurozone. “Growth without inflation” is an accurate description at the moment, according to Grant. Investors were surprised by the economic recovery in 2017 because growth has been so unfamiliar for so long.

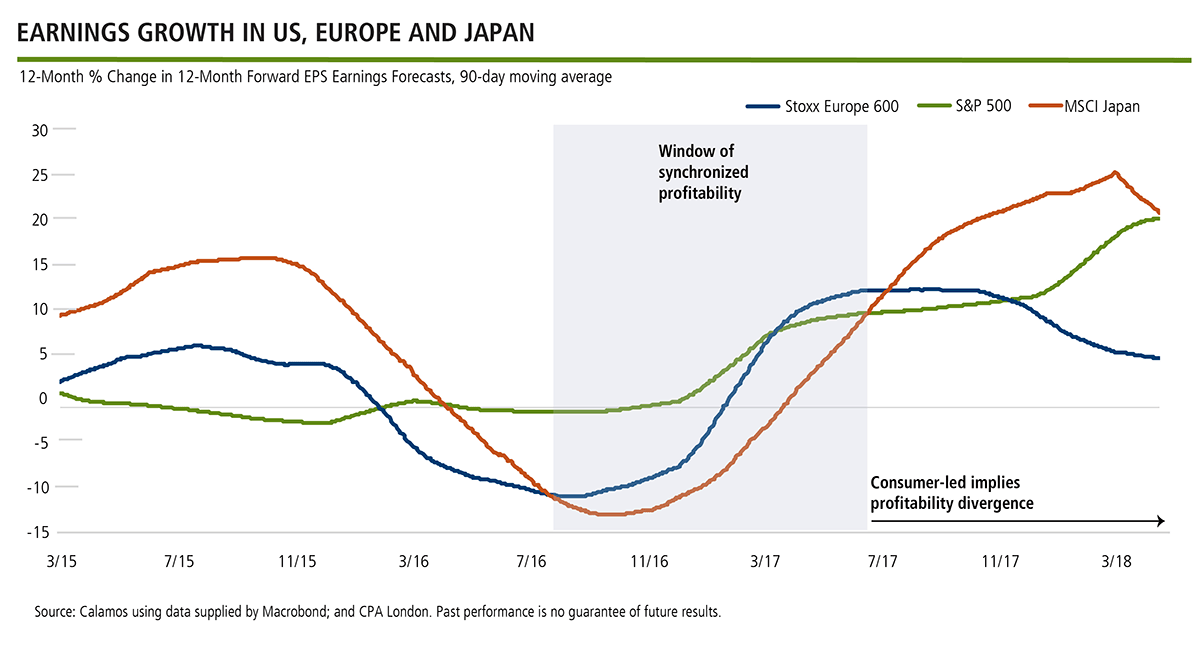

But Grant doubts that the region’s equity markets can sustain international outperformance. More generally, a degree of reflation—which implies higher levels of inflation—is required to unlock the value in the region’s equity assets.

Grant describes the presidential election of Emmanuel Macron as “symbolic of the technocratic elite that will not confront the fundamental burden: an oversized French state.” He asks, “How credible are reforms when they start with the replacement of French for English as the official language of Brussels?”

Grant sees few signs that a Merkel-led Germany is prepared for the concessions that might remedy the structural imbalances within the euro system. Still, economic and political developments are converging to restore a degree of confidence in a European order under Franco-German leadership.

“In Europe economic confidence can never be separated from politics,” Grant adds. “In this sense, the culture wars across the West destabilize Europe. However, it also offers a way out of the region’s stagnation. The question is when and at what cost?” The social pressures and popular discontent that have given rise to Trump are equally apparent in Europe, he says.

The distortions of monetary super-stimulus are especially visible in Europe, where the central bank has been a major purchaser of corporate bonds, according to Grant. With the exit of the UK as political ballast against the French instinct toward protectionism and intervention, he worries that Europe will be unable to exit its monetary experiment for years or longer.

Most investors assume that political risk in Europe is exemplified by the challenges to the status quo, which now include almost every election in the region. Instead, Grant says, investors should focus on the consequences of the conservative, ineffectual nature of the economic orthodoxy that prevails today.

The status quo is noxious for investors, Grant believes. If Europe’s political mainstream is incapable of responding to the discontent caused by people migration and the deflationary bent of the euro system, then investors should not fear political change. After all, “the moribund status quo is likely worse.”

The Eventual Opportunity: UK Equities

The eventual opportunity across the Atlantic may be UK equities, which have become the most under-owned asset within the global equity universe. In contrast to consensus, Grant expects Brexit to unfold as a positive demand shock for the UK economy.

“Leadership always matters,” he says “but reflation optionality for Sterling-based assets widens considerably after Brexit.”

Three decades ago, the political tide of the former U.S. President Ronald Reagan and former UK Prime Minister Margaret Thatcher revolutions emerged first in the Anglo-Saxon economies, much as Brexit and Trump have today. This is not chance, says Grant, “but reflect the deep roots of liberal democracy in these societies. Their political elites bend earliest to social tensions and popular discontent.”

“The protest against today’s economic orthodoxy is just the beginning, just as it was under Thatcher and Reagan, and investors should consider the long-term implications,” he says.

Also see: Part 3: Winds of Change: Will Anti-Globalization Lead to a World Less Favorable for Capital?

Advisors, for more information, talk to a Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.