Using Long/Short to Embrace Risk: Learn More at December 1 Webcast

November 21, 2016

“You are paid to take risk. A lot of investors lose sight of that: They overdiversify, they stop taking risk and they wonder why there's no return,” says Calamos Senior Vice President Michael Grant.

Financial advisors are invited to learn more about long/short investing and how Grant embraces risk as Senior Co-Portfolio Manager of Calamos Phineus Long/Short Fund at a December 1 webcast presented by Advisor Perspectives and sponsored by Calamos.

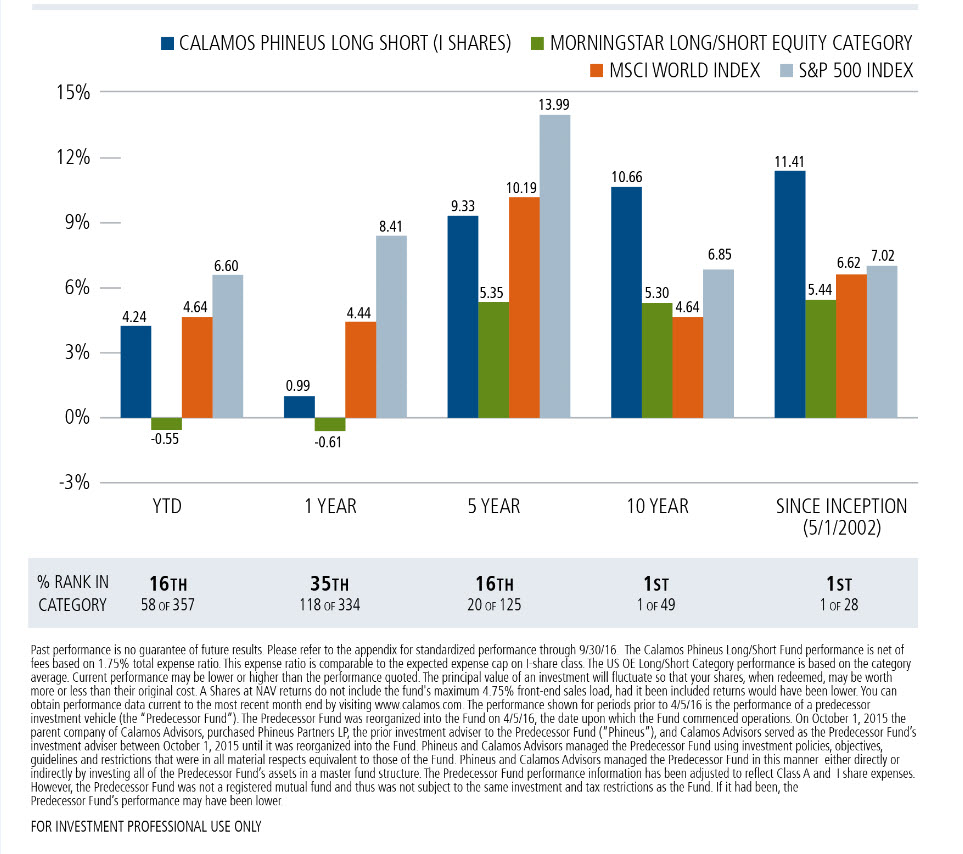

Recognized by Advisor Perspectives as a top VeneratedVoice™, Michael will share his market insights and positioning perspectives while explaining the flexibility of his long/short approach. His 14 years of experience as a long/short manager has resulted in Calamos Phineus Long/Short Fund (CPLIX) historical outperformance versus the MSCI World & S&P 500 Index since inception.

A Compelling Long-Term Track Record

Four Reasons Advisors Should Attend

The webcast will cover:

- The characteristics of different long/short strategies, including flexibility of mandate, portfolio construction and expenses

- Where long/short fits within a client’s asset allocation

- The case for long/short in the current environment

- What clients should look for when evaluating long/short managers

Join us to learn more about the benefits that this often misunderstood category can offer your clients’ portfolios.

The CFP Board has accepted this program for 1 hour of CE credit towards the CFP® certification. In addition, IMCA has accepted this program for 1 hour of CE credit toward the CIMA®, CIMC® and CPWA® certifications. If you provide the required information during the webinar registration process and stay for the entire session, we can report your attendance to these organizations.

To register for the event, you will need to login or join APViewpoint at www.apviewpoint.com. Once you've joined, login and click on the REGISTER FOR EVENTS link at the top of the page to be taken to a special APViewpoint Events registration page. APViewpoint is a free, secure online community where advisors can gain insights that improve investor outcomes and learn from more than 13,000 of their peers and more than 60 industry thought leaders.

Additional Resources

For a preview of Michael’s views, see his post-election blog post “Thoughts on the Market In Light of Election Results.”

For additional insights, commentary and videos, visit: https://www.calamos.com/alternatives

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 4.75% had it been included; the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.Calamos.com.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

Alternative investments may not be suitable for all investors, and the risks of alternative investments vary based on the underlying strategies used. Many alternative investments are highly illiquid, meaning that you may not be able to sell your investment when you wish to.

Unmanaged index returns assume reinvestment of any and all distributions and do not reflect any fees, expenses, or sales charges. Investors cannot invest directly in an index. The MSCI World Index consists of the following 23 developed market country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The HFRI Equity Hedge Index – Equity Hedge: Investment Managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. EH managers would typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities, both long and short.

The S&P 500 Index is a market weighted index and is widely regarded as the standard for measuring U.S. stock market performance.

MSCI World Index Is a market capitalization weighted index composed of companies representative of the market structure of 21 developed market countries in North America, Europe, and the Asia/Pacific region. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Morningstar Long/Short Equity Category: Long-short portfolios hold sizable stakes in both long and short positions in equities and related derivatives. Some funds that fall into this category will shift their exposure to long and short positions depending on their macro outlook or the opportunities they uncover through bottom-up research. Some funds may simply hedge long stock positions through exchange-traded funds or derivatives. At least 75% of the assets are in equity securities or derivatives.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk.

The principal risks of investing in the Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE