Understanding the Options-based Funds Category: Infographic

First published: April 2, 2019

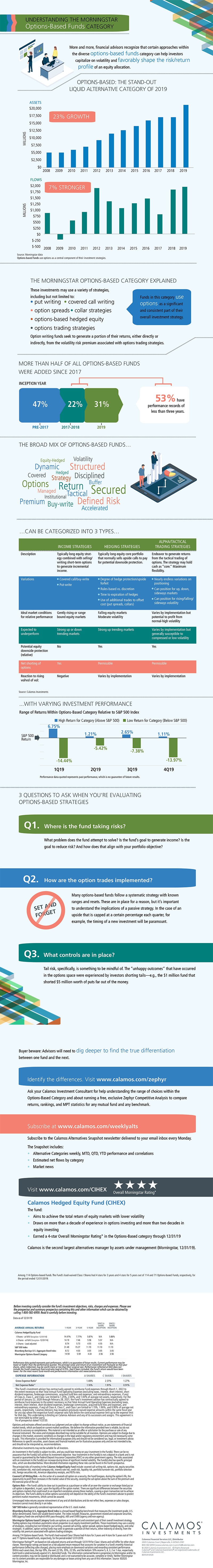

Financial advisors are increasingly recognizing the value of options-based funds as a means of reshaping the risk/return profile of a client’s equity allocation. With 23% growth in assets and 7% growth in flows, Morningstar’s Options-based category was the stand-out liquid alternative category in 2019, a year when flows to most alts categories were negative (see Liquid Alternatives: 2019 Year in Review).

Funds in the category pursue a broad set of approaches and have significantly different risk profiles. Such diversity leads to variable returns. In the fourth quarter of 2019, for example, the returns achieved by options-based funds ranged from a gain of 1.1% to a loss of -13.97%.

The infographic below summarizes the category’s defining traits, approach to hedging and trading strategies, and three questions for advisors to ask when evaluating options-based strategies. For more information on the category, download the infographic.

The Calamos Hedged Equity Fund (CIHEX) is a ????? fund within the Options-based category.* Designed for falling equity or volatile equity markets (see CIHEX Beats Back 3 Equity Market Drawdowns to Finish 2018 Positive), CIHEX has the full spectrum of levers to deliver on its “baseline” objectives and the tactical freedom to add additional return from options selection and structuring.

To learn more about Calamos Hedged Equity Fund, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Calamos is the second largest alternatives manager by assets under management (Morningstar data, 12/31/19).

Click here to view CIHEX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Alternative investments may not be suitable for all investors.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

S&P 500 Index is generally considered representative of the U.S. stock market.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Unmanaged index returns assume reinvestment of any and all distributions and do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

*Overall Morningstar rating among 94 Options-based Funds: The fund’s load-waived Class I shares had 5 stars for 3 years out of 94 Options-based Funds for the period ended 12/31/18.

Morningstar ratings shown are for Class I shares and do not include any front-end sales load. Not all investors have access to or may invest in the share class shown. Other share classes with front-end or back-end sales charges may have different ratings than the ratings shown.

Morningstar Ratings™ are based on risk-adjusted returns and are through 12/31/18 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2019 Morningstar, Inc.

Morningstar Options-based Category funds use options as a significant and consistent part of their overall investment strategy. Trading options may introduce asymmetric return properties to an equity investment portfolio. These investments may use a variety of strategies, including but not limited to: put writing, covered call writing, option spread, options-based hedged equity, and collar strategies. In addition, option writing funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

© 2019 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

801498 0319

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end performance information, please CLICK HERE. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 23, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.