Not Every Alternative Fund Is Pricey

October 25, 2017

First published: September 6, 2017

Price isn’t ordinarily where we’d start when presenting our alternative fund Calamos Market Neutral Income Fund (CMNIX) to financial advisors.

More likely, we’d start with an explanation of how the portfolio management team blends complementary strategies—convertible arbitrage and covered call writing—to produce an efficient portfolio that has demonstrated a positive risk-adjusted profile over a full market cycle. (See No Matter What: CMNIX).

We’d probably mention the fund’s historical lower or negative correlations to fixed income categories. Most certainly, we’d call attention to the fund’s history of attractive, consistent returns with lower risk.

There’s much to commend CMNIX. But it’s an alternative fund, and alternative funds as a group can be painted with the same broad brush—"too expensive" or "too new/untested" or "disappointing."

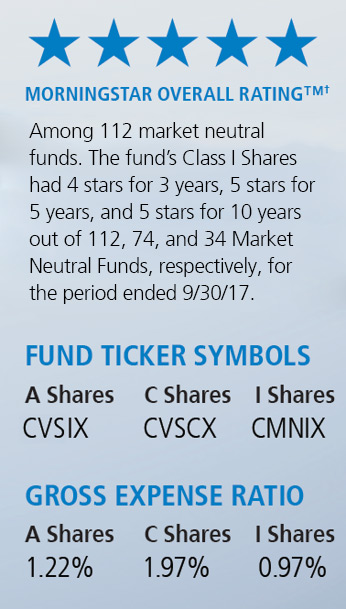

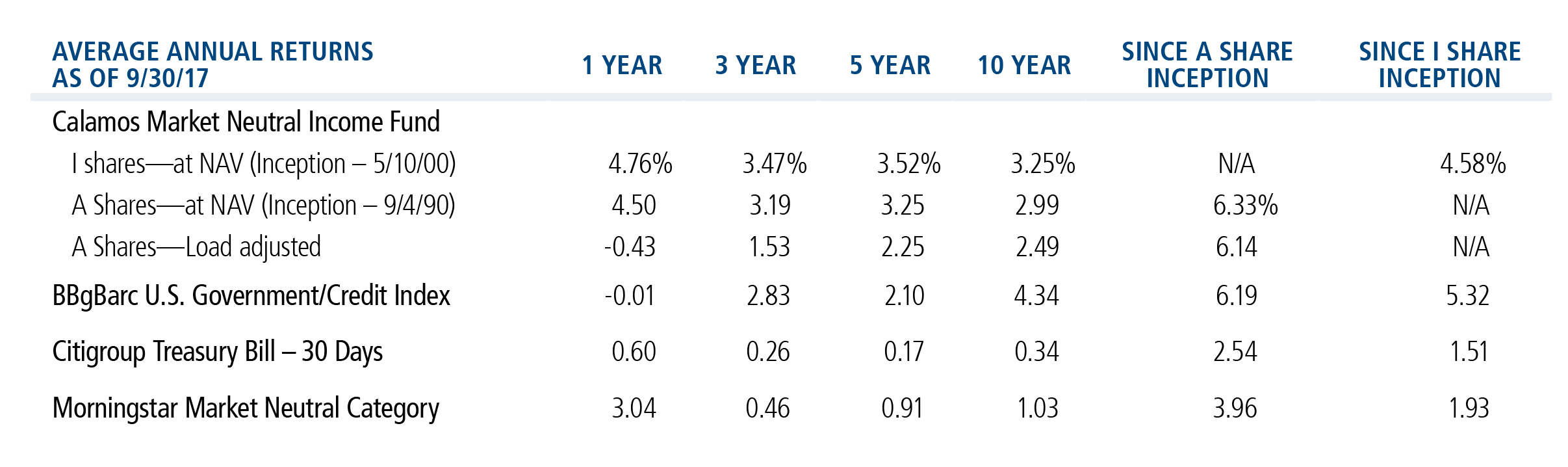

So, for this post, let’s start here. Calamos Market Neutral Income Fund, established in 1990, has one of the lowest expense ratios in its Morningstar category or across all alternatives tracked by Morningstar (data as of 9/30/17). Below you’ll find its performance results.

Don’t let price keep you from learning more about what CMNIX can do for clients’ portfolios.

Advisors, for more information about CMNIX, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

As of 9/30/17

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

Morningstar Bank Loan Category represents funds that invest primarily in floating-rate bank loans instead of bonds. In exchange for their credit risk, they offer high interest payments that typically float above a common short-term benchmark.

The S&P 500 Index is considered generally representative of the U.S. equity market.

The Citigroup 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments. Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

The Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

800459 09/17R