April marks the one-year anniversary of one of Calamos’ most popular funds in 2017, Calamos Phineus Long/Short Fund. While the fund has been a ’40 Act fund for just one year (the result of a successful April 2016 hedge fund conversion), it was established in May 2002 and continues to be managed with the same investment approach and by the same lead Senior Co-Portfolio Manager Michael Grant.

In fact, thanks to the Phineus fund and Market Neutral Morningstar category leader (by assets under management)

Calamos Market Neutral Income Fund, Calamos now ranks as the 9

th alternative fund manager by AUM. It climbed from its #10 position at 12/31/16 (see

related post). Calamos alternative asset growth was second only to AQR Funds in the first quarter of 2017.

“In my many meetings and conversations with advisors over the last year, they have made one point clear: consistency of performance outcomes is essential,” says Grant. “We agree, of course, and have enjoyed learning about how advisor are adopting the fund’s unconstrained approach as an equity alternative in a core equity allocation.”

The Vulnerability of 60/40

Advisor conversations inevitably touch on the vulnerability of the 60/40 portfolio, according to Grant.

Many advisors have been structurally bearish and “wrongly positioned in equities”—a miscalculation overcome by the extraordinary performance of their fixed income allocations, Grant says. Because he believes that “there is a rising likelihood that the risk in the 60/40 model will be driven as much or more by fixed income,” Grant encourages advisors to pay particular attention to their equity allocations. Failure to do runs the risk of disappointing clients, Grant says.

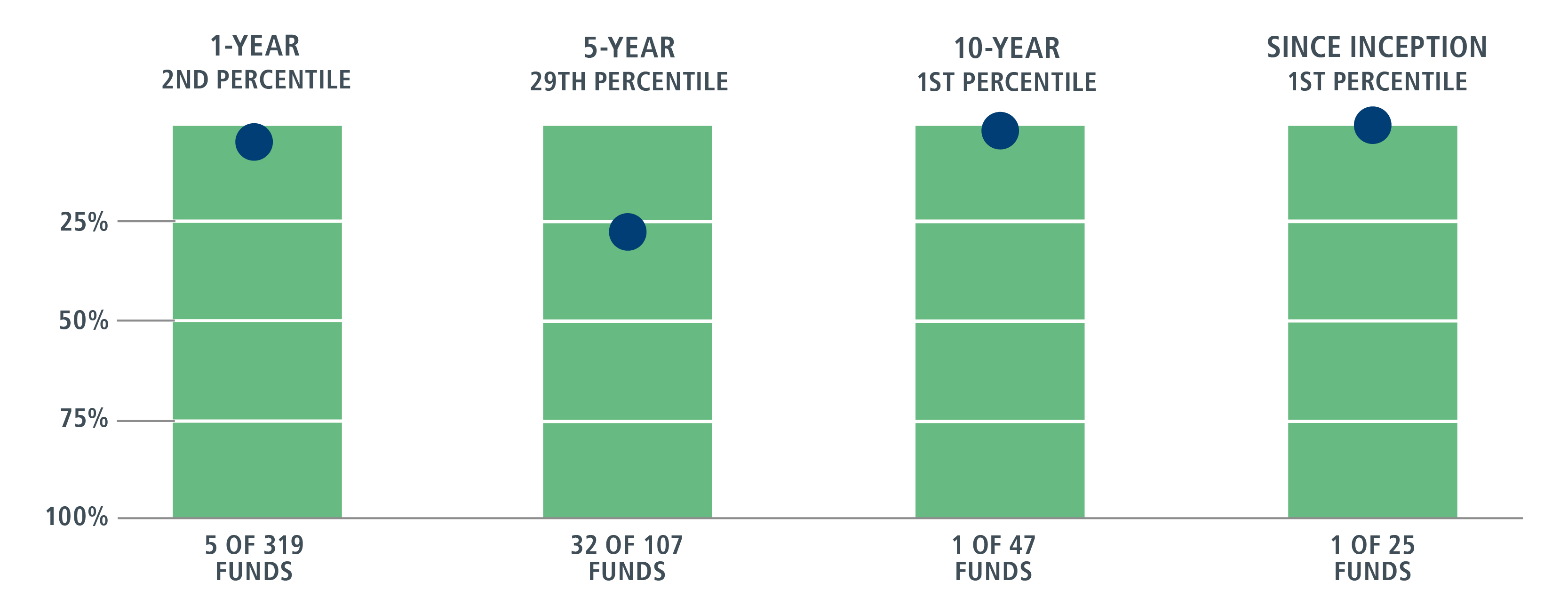

Within the Morningstar Long/Short category*, Calamos Phineus Long/Short Fund is ranked #1 since inception.

Data as of 3/31/17. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 4.75%. Had it been included, the Fund's return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

*The percentile and category rankings illustrated are created by Calamos Financial Services, LLC. The percentile rank measures the Fund's total return among the Morningstar U.S. Fund Long/Short category as of 4/6/16. This is the fund's total-return percentile rank relative to all funds that have the same category for the same time period.

The fund invests using alternative strategies that entail a high degree of risk.

Morningstar Ratings are based on I share total return and are through 3/31/17 and will differ for other share classes.

The performance shown for periods prior to 4/6/16 is the performance of a predecessor investment vehicle (the "Predecessor Fund"). The Predecessor Fund was reorganized into the Fund on 4/6/16, the date upon which the Fund commenced operations. On 10/1/15 the parent company of Calamos Advisors, Purchased Phineus Partners LP, the prior investment adviser to the Predecessor Fund ("Phineus") and Calamos Advisors served as the Predecessor Fund using investment policies, objectives, guidelines and restrictions that were in all material respects equivalent to those of the Fund. Phineus and Calamos Advisors managed the Predecessor Fund in this manner either directly or indirectly by investing all of the Predecessor Fund's assets in a master fund structure. The Predecessor Fund performance information has been adjusted to reflect Class A and I shares expenses. However, the Predecessor Fund was not a registered mutual fund and thus was not subject to the same investment and tax restrictions as the Fund. If it had been, the Predecessor Fund's performance may have been lower.

The Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock picking or market-timing (alpha).

The S&P 500 Index is a market weighted index and is widely regarded as the standard for measuring U.S. stock market performance. MSCI World Index is a market capitalization weighted index xomposed of companies representative of the market structure of 21 developed market countries in North America, Europe, and the Asia/Pacific region.

Indexes are unmanaged, do not reflect fees, expenses or sale charges, and are not available for direct investment.

The fund resonates with advisors whose clients seek capital appreciation but are averse to volatility, says Tim Brand, Calamos Senior Vice President and Head of U.S. Intermediary Distribution, “Phineus has distinguished itself by engaging risk at the right time and with an average net exposure of 27% as of 3/31/2017.”

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 4.75%. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

The performance shown for periods prior to 4/5/16 is the performance of a predecessor investment vehicle (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Fund on 4/5/16, the date upon which the Fund commenced operations. On 10/1/15 the parent company of Calamos Advisors, purchased Phineus Partners LP, the prior investment adviser to the Predecessor Fund (“Phineus”), and Calamos Advisors served as the Predecessor Fund’s investment adviser between 10/1/15 until it was reorganized into the Fund. Phineus and Calamos Advisors managed the Predecessor Fund using investment policies, objectives, guidelines and restrictions that were in all material respects equivalent to those of the Fund. Phineus and Calamos Advisors managed the Predecessor Fund in this manner either directly or indirectly by investing all of the Predecessor Fund’s assets in a master fund structure. The Predecessor Fund performance information has been adjusted to reflect Class A and I shares expenses. However, the Predecessor Fund was not a registered mutual fund and thus was not subject to the same investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance may have been lower.

Alternative investments may not be suitable for all investors, and the risks of alternative investments vary based on the underlying strategies used. Many alternative investments are highly illiquid, meaning that you may not be able to sell your investment when you wish to.Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Unmanaged index returns assume reinvestment of any and all distributions and do not reflect any fees, expenses, or sales charges. Investors cannot invest directly in an index.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk.

The principal risks of investing in the Market Neutral Income Fund include equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock picking or market-timing (alpha).

The HFRI Equity Hedge Index: Equity Hedge: Investment Managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. EH managers would typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities, both long and short.

S&P 500 Index is generally considered representative of the U.S. stock market.

MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of 21 developed market countries in North America, Europe, and the Asia/Pacific region. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Net exposure. The difference between a portfolio’s long and short exposure, expressed as a percentage. If a portfolio holds a larger percentage in long positions than in short positions, the portfolio is “net long.” Conversely, a portfolio is “net short” when it has a larger percentage in short positions than in long positions.

Gross exposure. The sum of long exposure and short exposure, gross exposure measures how much of the portfolio’s assets are invested and the amount of leverage in the portfolio.