If January is any indication, 2018 could be a year to remember for convertible securities issuance. Of course, February started with significant increased volatility, providing a fresh reminder of both the value proposition for convertibles and for active management.

Let’s review January’s four promising signs.

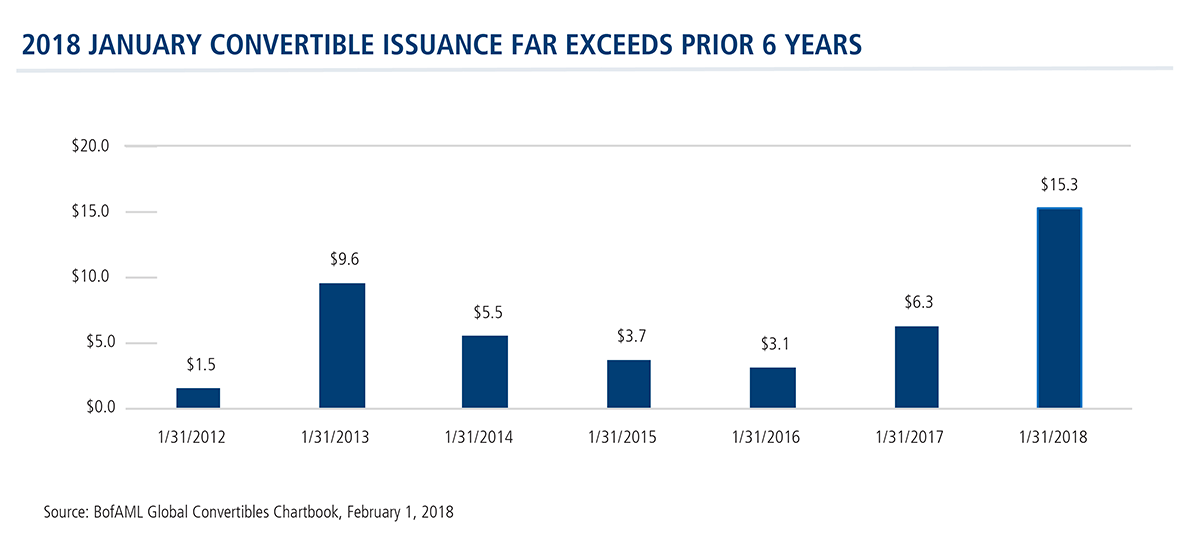

1. Convertible Issuance Is Up

More than $15 billion in convertible securities have priced in the first month of the year. That’s far more than in the prior six Januarys.

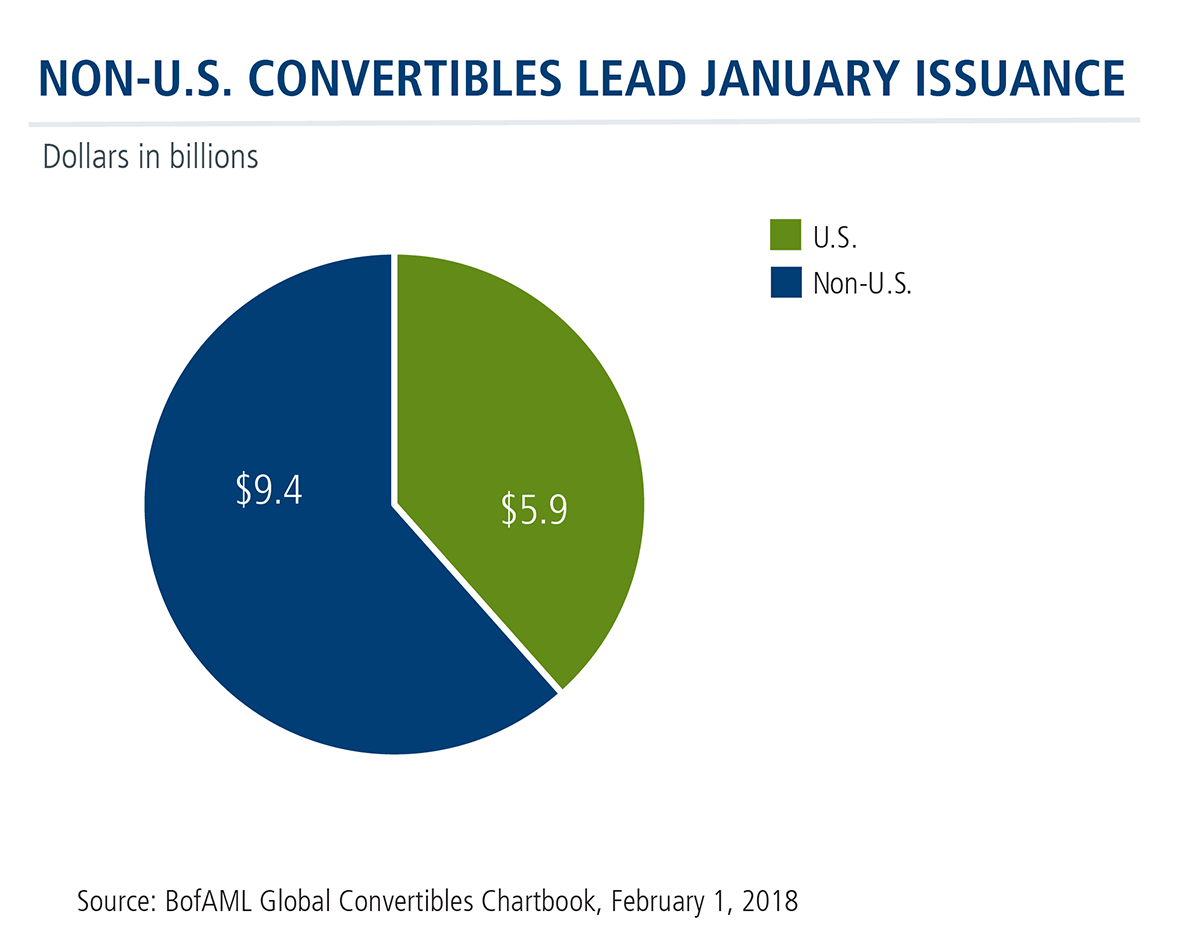

New U.S. convertibles total $5.9 billion while $9.4 billion are from outside the U.S. (The global convertibles market in general offers twice the opportunity of the U.S., and the opportunities are varied. For more information, see Convertibles: Why Limit Yourself to Less Than Half the Market? And learn more about Calamos Global Convertible Fund (CXGCX), the only U.S.-based global convertible fund.)

“Issuance is positive in that it helps broaden the convertible opportunity set,” says Calamos Senior Vice President, Portfolio Specialist R. Scott Henderson, CFA, CIMA, CMFC. But, he adds, “At the same time, a new convertible issue may not always present an attractive investment opportunity. Every new convertible issue needs to be evaluated on its investment merits.”

New issues including from new issuers (see below) require the kind of scrutiny that only an active manager can provide, over time.

“Active management is absolutely essential for capitalizing on the unique structural benefits of convertibles; the attributes of convertible securities can change over time,” as Calamos Founder, Chairman and Global CIO John P. Calamos wrote in a recent blog post. John pioneered the use of convertible securities more than 40 years ago.

Convertibles are a dynamic asset class, with changes occurring with individual issues and in the convertible universe as a whole. (Read more in our convertible guide and asset allocation whitepaper.)

2. Half of Issuers Are First-timers

More than half (58%) of 2018 new convertible paper has come from first-time issuers. See the next two points.

3. Convertible Debt Advantaged by Tax Law

As a means of raising capital, convertible securities now may be favored by corporations seeking to limit their interest expenses. The new tax law limits corporate interest expense deductions to 30% of adjusted taxable income.

Calamos believes that the recent enacted changes should prompt issuance given that companies up against their interest expense cap will find it more advantageous to issue convertibles with a lower coupon than that of cash payment bonds.

According to BAML’s Global Convertibles 2018 Year Ahead report published in November 2017, about 36% of current eligible convertible issuers (roughly 21% of the outstanding convertible market value) have an interest expense that exceeds the threshold. By comparison, the high yield market has just under 40% exposure and investment-grade issuers have about 5% because they have better interest coverage.

4. Heightened M&A Activity Could Drive Supply from Different Sources

Companies are expected to be flush with cash thanks to lower corporate tax rates and repatriation resulting from the tax law changes. Deal-related new supply of converts could result as corporations divert excess capital to mergers and acquisitions. Of special note: Merger-linked issuance often comes from issuers outside the top three convert sectors in the U.S. (technology, financials and health care), providing added diversification.

Overall Issuance Outlook

Calamos has a constructive view of the overall economy, risk assets and the convertible market in particular.

Equity valuations appear stretched and volatility returned to the market last week. But the impact of the recent tax legislation—both the immediate as well as secondary effects of capital allocation decisions—may provide further upside, according to our Investment Team.

We expect healthy new convertible issuance driven by companies seeking new growth capital, companies refinancing maturing debt, as well as from traditional high yield issuers at or above their interest deductibility caps who will see structural benefits. And there are some upcoming maturities that may be refinanced.

New issuance will be beneficial in providing new balanced structures to the market and will provide additional opportunities to improve the overall portfolio risk/reward profile, according to the Calamos outlook.

Advisors, could you use additional information about global convertible securities and how they’re used? For more information, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.