Given their strong 2017 year to date (see post), convertibles are commanding heightened attention from financial advisors and investors. The following are some observations Calamos Convertible Fund Co-Portfolio Manager Joseph Wysocki recently shared about convertibles’ issuance and outlook. All data is as of June 30, 2017.

- Convertible bond issuance is solid, totaling $23 billion year-to-date domestically. Globally, issuance is on pace for $80 billion for the year, ahead of 2016.

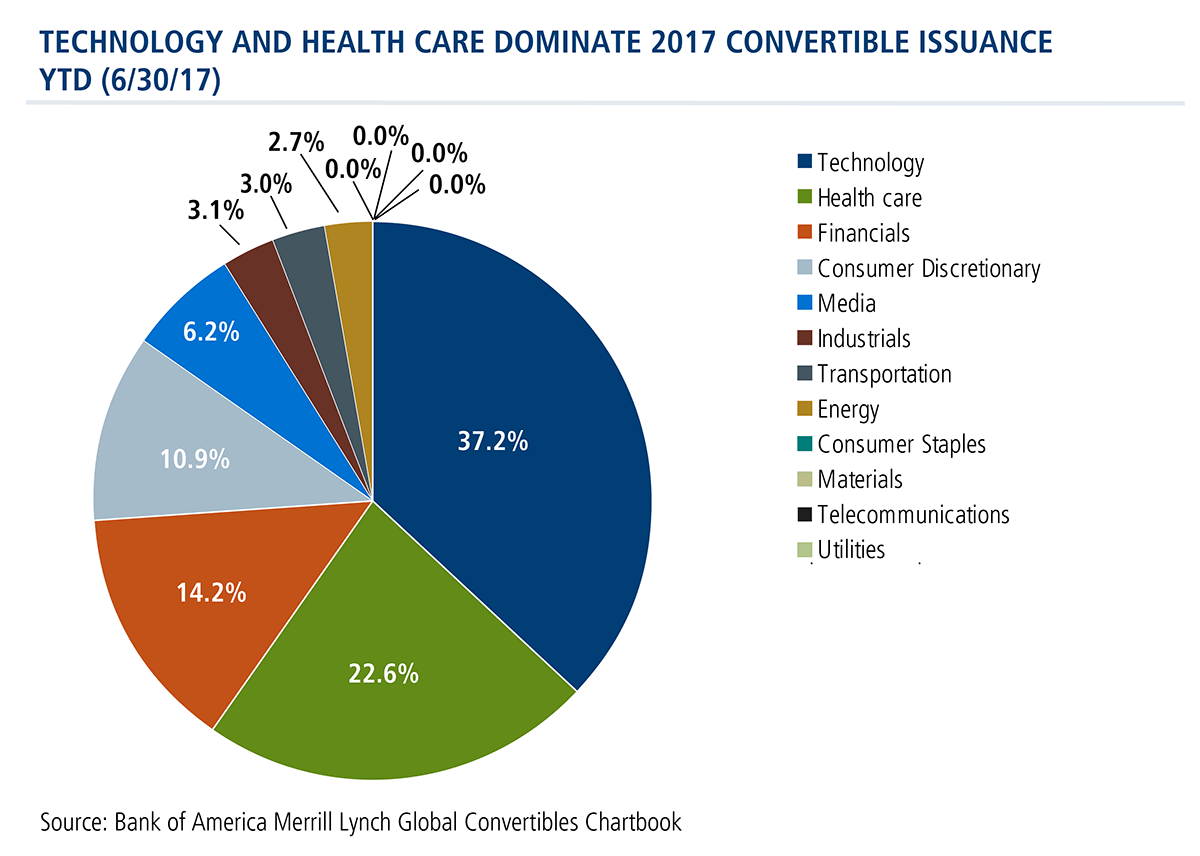

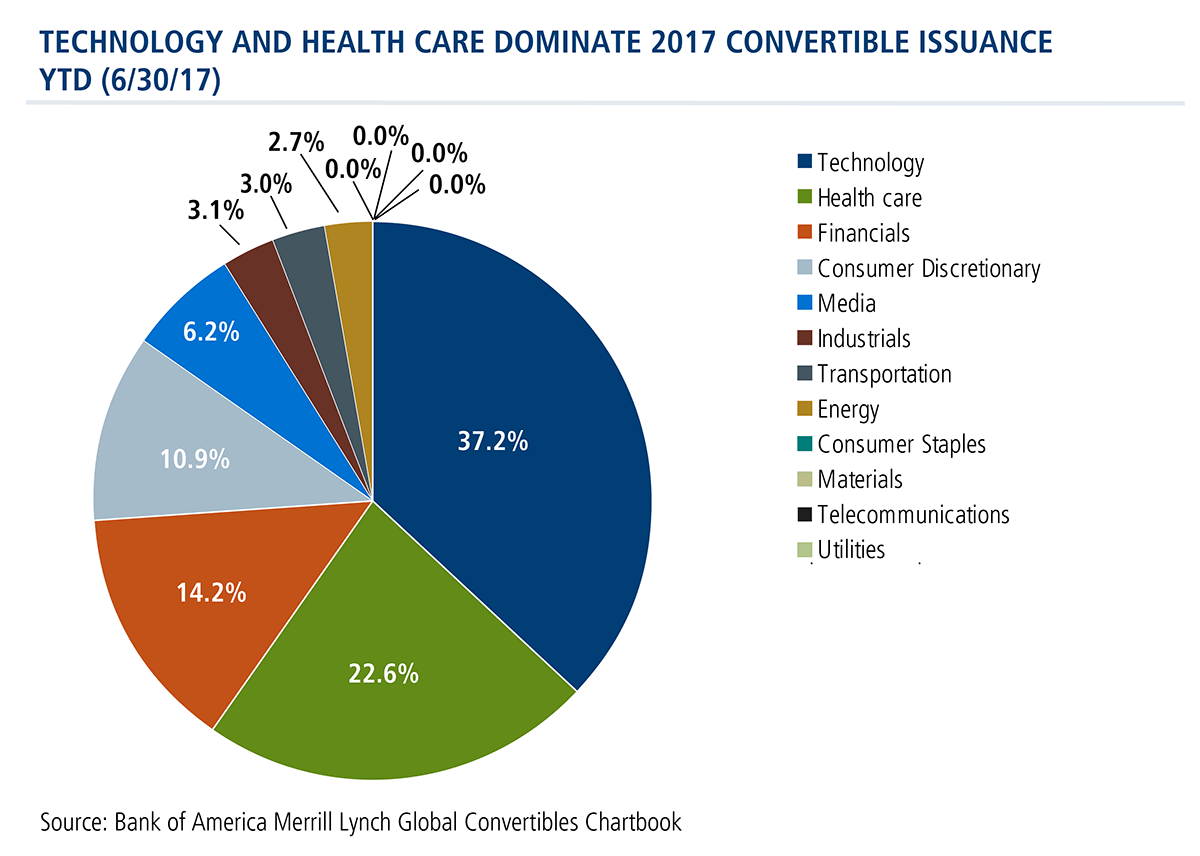

- Issuance primarily has been from technology and health care issuers.

- One sign of the market “keeping it fresh,” Wysocki says, is the entrance of new issuers. In the second quarter, 61% of the issuers were new to the market.

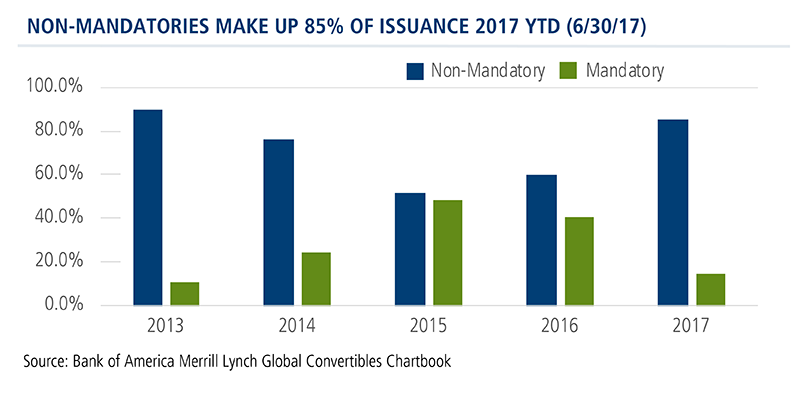

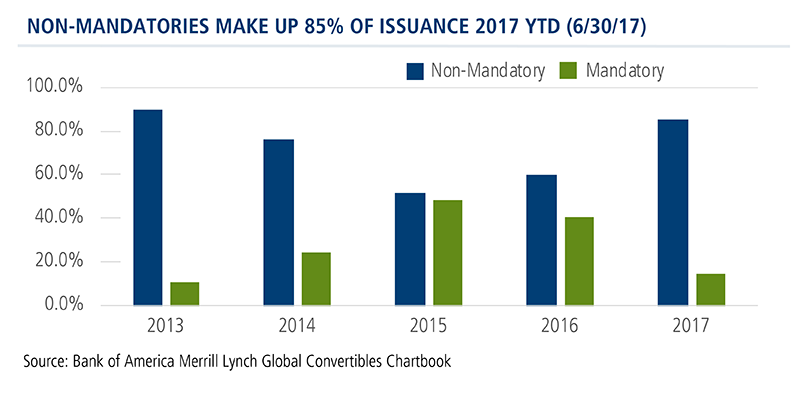

- The majority (85%) of issuance year to date is convertible bonds vs. prior years’ higher mix of mandatories.

- The market remains balanced: 40% total return, 35% yield alternative and 25% equity sensitive. (For more on this, see “Don’t Make This Mistake with Convertible Bond Funds.”) Source: BofA Merrill Lynch, All U.S. Convertibles Index (VXA0). Data as of June 30, 2017. A convertible bond has “fixed income characteristics” when it is valued at about the same level as a similar non-convertible bond and is not as sensitive to the underlying equity. A convertible bond has “hybrid characteristics” when it has fixed income characteristics as previously explained but is becoming increasingly sensitive to changes in the underlying equity price. “Equity characteristics” represents a convertible bond that is highly sensitive to movements in the underlying equity. Percentages shown represent the proportion of convertible bonds in the Bof A Merrrill Lynch, All U.S. Convertibles Index (VXAO) that fall into each classification.

The convert market is healthy and well positioned in this rising rate environment, Wysocki says. And, he stresses the opportunities that active management can identify across the full market, including the potential for diversification.

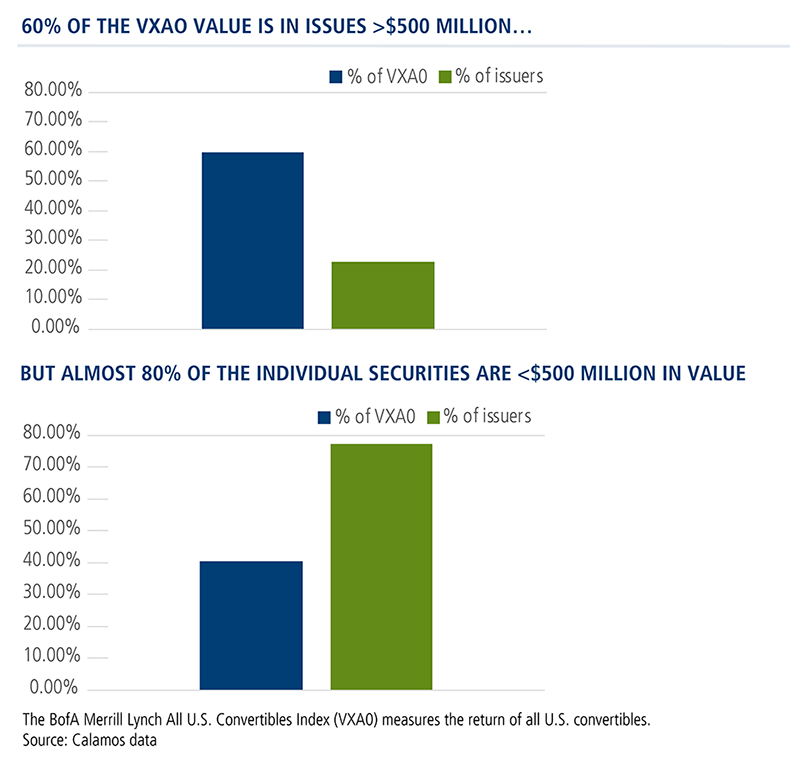

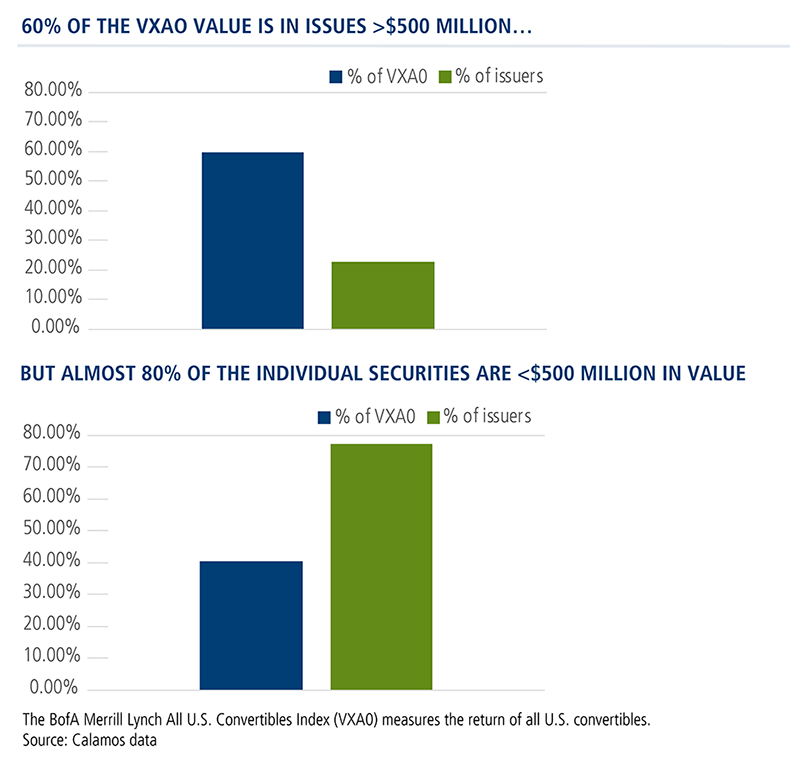

"While 60% of the BofA ML All U.S. Convertibles Index (VXA0) value is in issues that are greater than $500 million in market value, almost 80% of the individual securities are less than $500 million in value. That can present a lot of opportunities for active managers to invest in—which may not make their way into a passive approach focused only on the largest issues,” Wysocki says.

For a review and outlook of the Calamos Convertible Fund, please download this just published commentary (download PDF).

Financial advisors, for more information on Calamos Convertible Fund or any of the Calamos funds that use convertible securities, please see the Related Funds section or talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Additional Resources

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned, and while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Data as of 6/30/17.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%.* Had it been included, the Fund’s return would have been lower. For the most recent fund performance information visit www.calamos.com.

Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. The Fund also offers Class B and C Shares, the performance of which may vary.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and nonqualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

BofA Merrill Lynch All U.S. Convertibles Index (VXA0) is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Morningstar Convertibles Category funds are designed to offer some of the capital appreciation potential of stock portfolios while also supplying some of the safety and yield of bond portfolios. To do so, they focus on convertible bonds and convertible preferred stocks. Convertible bonds allow investors to convert the bonds into shares of stock, usually at a preset price. These securities thus act a bit like stocks and a bit like bonds.

The Value Line Convertible Index is an equally weighted index of the largest convertibles.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

*Prior to 2/28/17, the Fund had a maximum front-end sales charge of 4.75%.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

800317 -7/17