Rates can move without the Federal Reserve acting to raise interest rates. All that’s needed is a single event to occur—like a surprise presidential election result—for rates to spike quickly. The market prices in rate moves before the Fed moves.

A previous post on our Investment Team Voices blog featured an explanation from David O’Donohue, Vice President, Co-Portfolio Manager of Calamos Market Neutral Fund (CMNIX), on how the Calamos Alternative Team traded in advance of the election night turmoil.

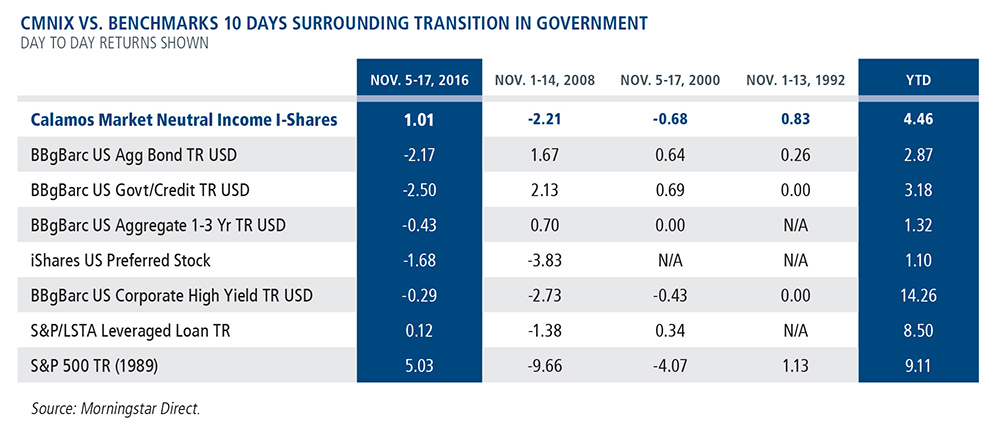

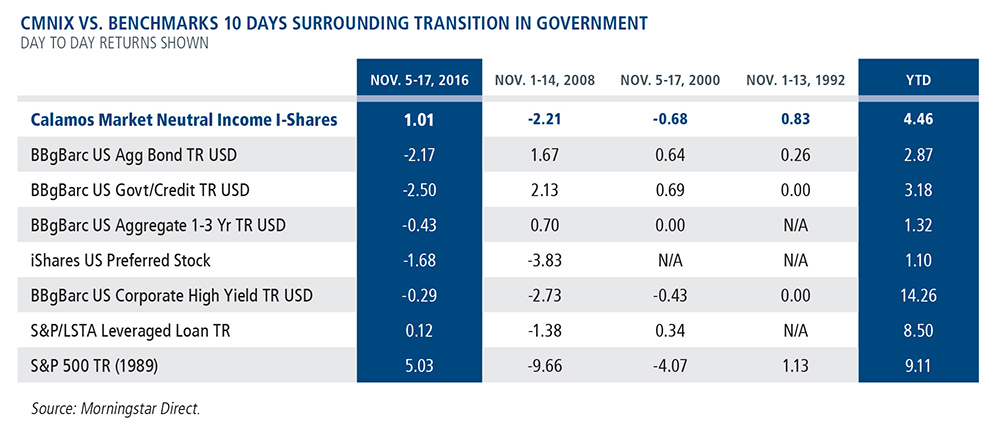

Below we show the results of that active management. In the left most data column, we isolate the performance of the fund and relevant benchmarks in the 10 business days surrounding the election—November 5 through November 17. It was a period when the 10-year Treasury rose 50 basis points.

We also show the performance of the fund and benchmarks during 10 days surrounding previous Election Days. Since Calamos Market Neutral Income Fund’s inception in 1990, there have been three years—1992, 2000 and 2008— when the political affiliation of the incoming president changed and the election could have represented a market event.

A few notes about the difference between the current period and the earlier periods: The 2016 election outcome was much more of a surprise, interest rates are at an all-time low and the economy appears to be headed toward a pro-growth rising rate environment. These differences complicate comparisons to previous periods.

CMNIX’s goal is to benefit from volatile periods and, as shown in this case, add alpha. Plan now, not after an event occurs.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 4.75% had it been included; the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.Calamos.com.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Alternative investments may not be suitable for all investors, and the risks of alternative investments vary based on the underlying strategies used. Many alternative investments are highly illiquid, meaning that you may not be able to sell your investment when you wish to.

Some of the risks associated with investing in alternatives may include hedging risk – hedging activities can reduce investment performance through added costs; derivative risk- derivatives may experience greater price volatility than the underlying securities; short sale risk - investments may incur a loss without limit as a result of a short sale if the market value of the security increases; interest rate risk – loss of value for income securities as interest rates rise; credit risk – risk of the borrower to miss payments; liquidity risk – low trading volume may lead to increased volatility in certain securities; non-US government obligation risk – non-US government obligations may be subject to increased credit risk; portfolio selection risk – investment managers may select securities that fare worse than the overall market. Alternative investments may not be suitable for all investors.

+ Morningstar ratings shown are for load-waived shares that do not include any front-end sales load. Not all investors have access to or may invest in the load-waived share class shown. Other share classes with front-end or back-end sales charges may have different ratings than the ratings shown. Additionally, some A-share mutual funds for which Morningstar calculates a load-waived A-share star rating may not waive their front-end sales load. There can be no assurance that the Fund(s) will achieve its investment objective.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

The principal risks of investing in the Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

The Barclays U.S. Aggregate Bond Index covers the U.S.- denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, Government-Related, Corporate, MBS (agency fixed-rate and hybrid ARM pass throughs), ABS, and CMBS sectors.

Standard Deviation measures the overall risk of a fund.

The S&P/LSTA U.S. Leveraged Loan 100 Index is designed to reflect the performance of the largest facilities in the leveraged loan market.

The iShares U.S. Preferred Stock ETF seeks to track the investment results of an index composed of U.S. preferred stocks.

S&P 500 Index is generally considered representative of the U.S. stock market.

Citigroup 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments.

Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody's, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Barclays EM country definition, are excluded.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

Convertible Hedging Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also may have an effect on the convertible security’s investment value.

CMNIX’s goal is to benefit from volatile periods and, as shown in this case, add alpha. Plan now, not after an event occurs.

CMNIX’s goal is to benefit from volatile periods and, as shown in this case, add alpha. Plan now, not after an event occurs.