Watch: Answers to Frequently Asked Questions about Our Covered Call Strategy

July 23, 2018

Covered call writing is a strategy that’s part of both Calamos Market Neutral Income Fund (CMNIX) and Calamos Hedged Equity Income Fund (CIHEX). Recently, Senior Vice Presidents Jason Hill and Dave O’Donohue—Co-Portfolio Managers of both funds along with Eli Pars, Senior Co-Portfolio Manager and Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies—answered some questions frequently asked by financial advisors.

The Difference Between CMNIX and CIHEX

With management applying the same philosophy and often using similar equity names, CMNIX and CIHEX portfolios and strategies can be similar, O’Donohue acknowledges in the video below.

“But at the end of the day,” he says, “they’re two different strategies with two different return expectations, two different risk profiles, and two different investor bases, and we need to manage them accordingly.”

Our ‘North Star’ Trade

The team uses a model trade as a “compass” to guide its pursuit of alpha with covered call writing. Below Hill elaborates on the North Star trade, which is essentially a long-leaning, SPX option collar position.

Pursuing 2 Strategies to Generate Alpha

There are two pieces of the team’s strategy: an option hedge and an S&P replication basket. Below Hill explains that historically the most alpha has been added through the option side. The team has more than 60 years of options experience, he notes.

An equity book of 250 to 270 S&P 500 stocks is used to try to add alpha at the margin. “But,” he adds, “our main goal here is to keep tracking error low and beta in correlation to the S&P 500 high.”

Active Management to Construct a Better Hedge

The team’s active hedging is what sets it apart from other strategies, O’Donohue explains below.

“There are going to be periods when buying puts is really attractive. There are going to be periods when selling calls is really attractive and, quite frankly, there are going to be periods when both are challenging,” he says.

Not needing to work with predetermined hedges affords the team the flexibility to take advantage of whatever opportunities a specific market presents. (Also see Using Covered Calls to Protect Against Fast-Moving Markets.)

Calamos ranks fifth on the list of alternative fund managers by assets under management in the Morningstar Alternatives Category as of 6/30/18.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

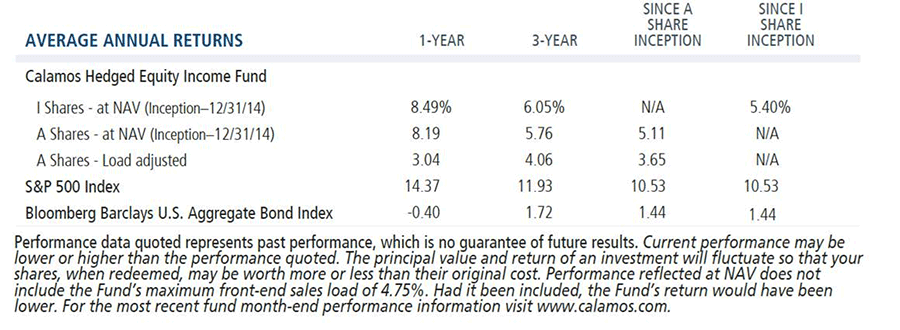

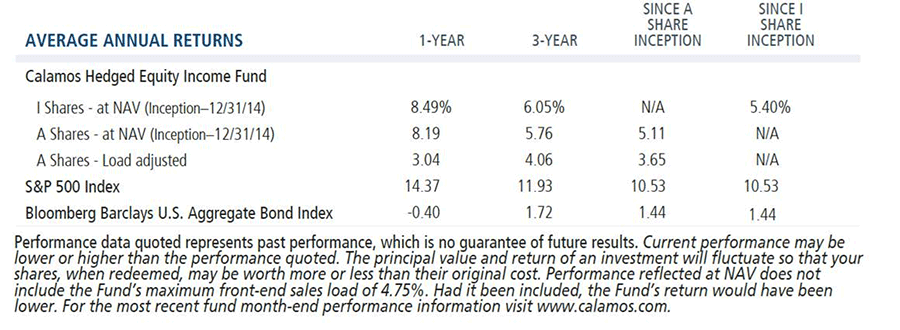

Data as of 6/30/18

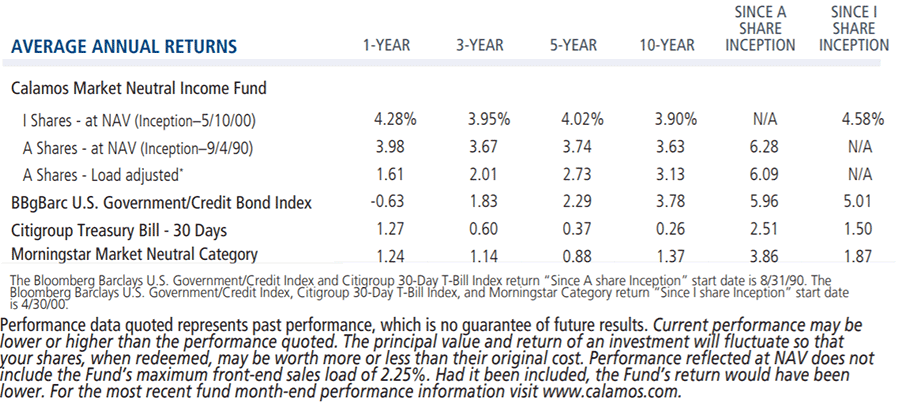

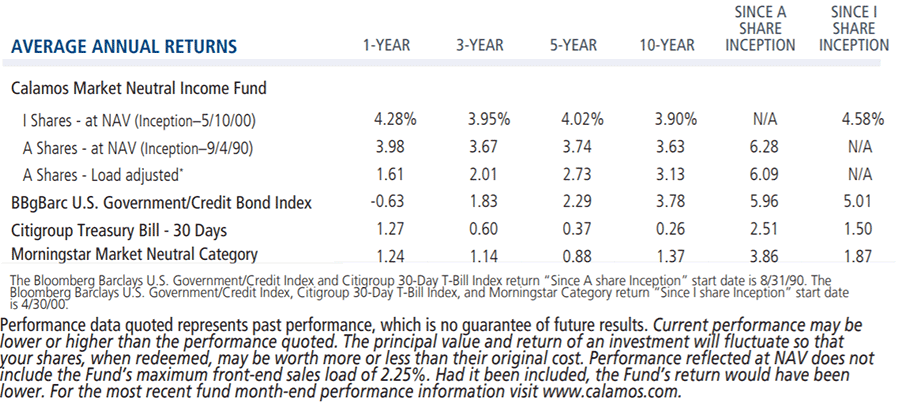

Data as of 6/30/18

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Alternative investments are not suitable for all investors.

The principal risks of investing in the Calamos Hedged Equity Income Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Options Risk: The Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the option market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment adviser to predict pertinent market movements, which cannot be assured.

Covered Call Writing involves selling (or “writing”) a call option against an equity the writer holds. When managers sell a call option, they earn a premium from the option sale. If the shares trade below the strike price, the option will expire worthless and they keep the premium from the option and retain the security. If the share price exceeds the strike price, the buyer will likely exercise the option and the seller must sell the shares at the strike price. To hedge additional risk, managers could also purchase put options to protect against significant equity market declines.

S&P 500 Index is generally considered representative of the U.S. stock market.

801218 0718