This article first appeared in the December 2017 issue of Investor Insights, our fund shareholder publication.

Many people recognize the importance of including a global component in their asset allocation but have questions about the best approach. To learn more, we spoke with John P. Calamos, Sr., the Founder and Global Chief Investment Officer of Calamos Investments, and Nick Niziolek, CFA, Co-Chief Investment Officer and Head of Global and International Strategies.

Q. John, how does Calamos approach the global markets?

John P. Calamos, Sr.: We’ve been investing in non-U.S. companies since the late 1980s, so our process reflects decades of perspective.

Our global and international funds are managed by a seasoned team that carefully researches companies, industries, economies and long-term societal trends. As part of this research, our team members travel around the world, where they meet with company management teams and gain firsthand knowledge of businesses, as well as broader social and regional trends. We monitor risks in many ways and actively adjust portfolios to capitalize on emerging opportunities.

Our approach differs from passive mutual funds that simply try to replicate a global stock index. Passive funds can’t respond to changes in the markets the same way actively managed funds do, and investors may end up with more downside than they expect.

Q. Nick, the U.S. economy has been growing steadily, and the U.S. stock market has delivered strong returns over recent years. If that’s true, why should investors include—or increase—allocations to mutual funds that invest in the global stock market?

Nick Niziolek: There are exciting growth trends and innovative companies all over the world, and global funds can draw from a wider pool of these opportunities. In Calamos Global Equity Fund (CIGEX), we provide shareholders with access to growth potential in the U.S. and around the world.

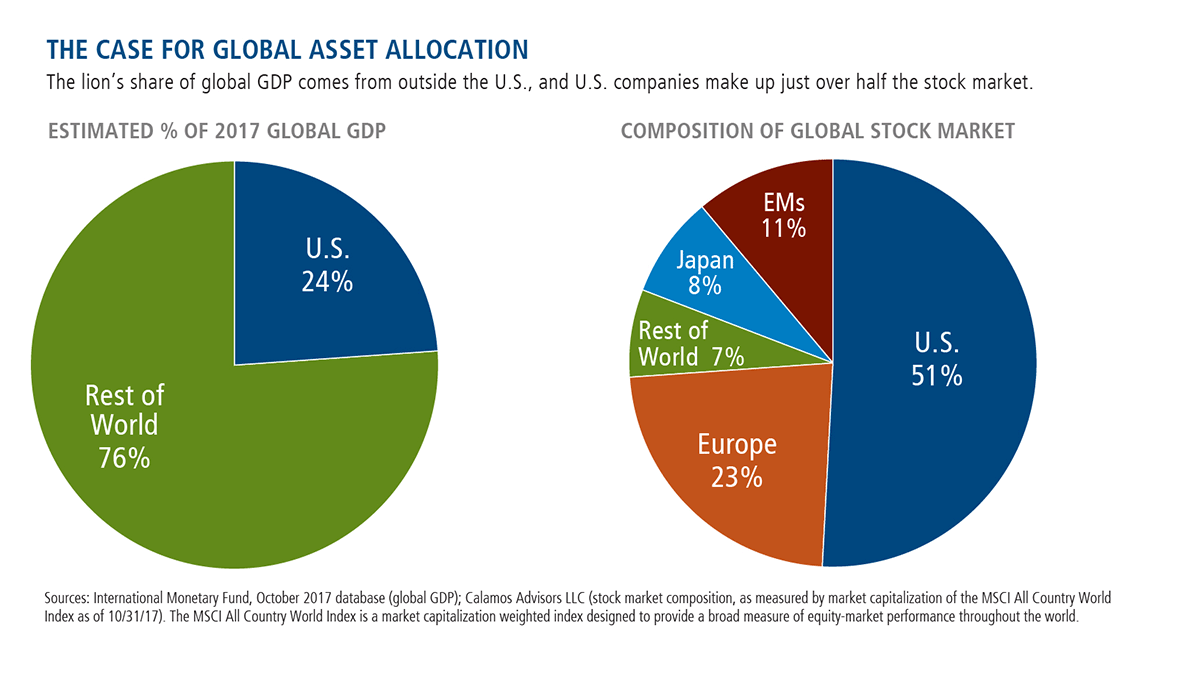

This is important because although the U.S. economy may be the largest in the world, it accounts for less than one-quarter of the global economy, and non-U.S. companies already represent nearly one-half of the global equity market. Also, while the U.S. economy is expanding, there are also positive economic trends in Europe and many emerging markets. A number of these countries outside the U.S. are in earlier phases of the economic cycle and may grow faster than the U.S. over the next few years.

Q. Nick, tell us about some countries your team currently favors.

NN: We’ve found many opportunities in India, where economic reforms are creating tailwinds for growth. In my view, media reports often understate the pace and scope of these reforms and overemphasize some of the near-term headaches associated with these positive changes. We’ve visited India many times and have gained valuable perspective from local business owners and executive management teams. At times our optimism about India has run counter to market sentiment, but I believe it has served us well. (See this March 2017 post and this December 2016 post.)

We’ve also identified a diverse group of Chinese companies with compelling fundamentals that we believe can benefit from long-term growth themes, such as the rise of the global consumer. (See this related blog post.)

Q. Would you give us another example of a global growth theme reflected in your positioning?

NN: We believe the expansion of financial technology, or FinTech, can support the long-term growth prospects of many companies around the world. Our enthusiasm for FinTech reflects the insights we’ve gathered in our travels. Many emerging markets are much more advanced than the U.S. in their adoption of FinTech. In China, for example, we’ve seen street musicians put out QR codes instead of passing the hat for donations, and cash is rarely used in local markets.

Q. John, you’ve been investing for 48 years. What closing advice do you have for investors regarding global asset allocation?

JC: Globalization has provided some of the most exciting opportunities I’ve seen during my investment career, and I expect this to continue. However, because investing in global stocks is a long-term proposition, investors should approach global asset allocation strategically.

Don’t try to “time” the market. Over the short term, markets can move up and down quickly in response to events or even just headlines. Investors who respond to this noise by changing their allocations are more likely to get whipsawed and miss the good days. (See these charts for the impact on an investment portfolio when investors miss out on just 5 days of non-U.S. developed markets or emerging markets.)

Instead, work with your financial advisor to develop a strategic plan based on your long-term financial objectives and risk tolerance.

Financial advisors, for more information about Calamos global and international strategies, please talk to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.