Investment Team Voices Home Page

Investment Team Voices Home Page

The Fed Rate Cut Is Met with an Unprecedented Reaction in Bonds: What’s Next?

Fixed Income Perspectives by Christian Brobst

Today, the Federal Reserve caught markets off guard with a surprise 0.50% cut to short-term interest rates. The dramatic measure came after the Fed and its G7 counterparts met this morning to discuss global monetary policy in the face of the coronavirus outbreak.

While the Fed intended to lessen market worries, the immediate-term effect has been the opposite. Stocks have fallen once again, and the yield of the 10-year U.S. Treasury Note has crossed below 1.00%--setting a new all-time low.

The market seems to be interpreting the cut as panic from the Fed, especially since the central bank took the unusual step of cutting rates ahead of a scheduled meeting in two weeks—something it just recently said was unnecessary.

Has the Fed done more harm than good? To us, it looks like the Fed has taken an unnecessary step, given that we don’t yet have a clear understanding of the long-term economic impact of the outbreak. Also, for many years, market participants have come to expect that when risk assets are pressured, the Fed will step in and take actions that stabilize prices. If investor confidence in the “Fed Put” has indeed been compromised, expect more volatility.

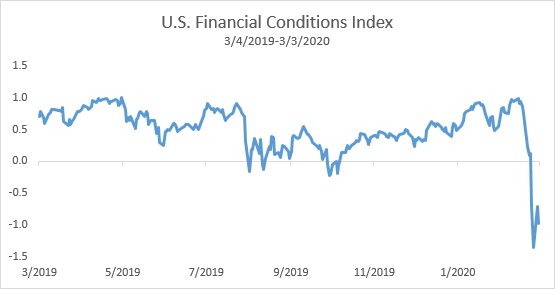

The Fed undoubtedly thought that cutting short term rates will lead to easier financial conditions, and while it’s too soon to gauge the impact of its move, the market’s initial response suggests otherwise. Our team continues to monitor financial conditions. Any further deterioration will likely necessitate more action from the Fed, which will be more challenging as a good amount of powder was spent today.

Past performance is no guarantee of future results. Source: Bloomberg.

So, what should investors do next? In his post yesterday, Global Chief Investment Officer John P. Calamos, Sr. outlined the steps that investors should take in this environment—be braced for more volatility, take a long-term view, avoid timing and sudden shifts, and de-risk strategically.

Even in the face of unprecedented conditions, there are still opportunities, although they may be less obvious to the markets at large. What we are seeing today affirms we are in an environment that is more likely to reward active, non-traditional approaches guided by a clear risk management discipline.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific companies, securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to buy or sell. Investing in non-U.S. markets entails greater investment risk, and these risks are greater for emerging markets. The above commentary for informational and educational purposes only and shouldn’t be considered investment advice.

The Bloomberg U.S. Financial Conditions Index tracks the overall level of financial stress in the U.S. money, bond, and equity markets to help assess the availability and cost of credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis norms.

18769 0320

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.