Investment Team Voices Home Page

Investment Team Voices Home Page

Short and Sweet: The Opportunity of Short-Term Bonds

Fixed Income Perspectives by Matt Freund, CFA and Christian Brobst

Over recent years, many investors have stretched for additional return by increasing risk. The volatility we’ve seen so far this year—and the probability it will continue as elections approach—may make “risk-on” a less comfortable strategy in the future. For investors seeking to smooth out the bumpier ride we expect, short-duration bonds can be a good way to reduce risk while staying invested, providing an attractive alternative to money market funds.

Short-term bonds are an appropriate core allocation for risk-conscious investors, regardless of market conditions. However, the case for the asset class is especially strong today. A flat yield curve environment—what we have today—is an opportune time to shorten duration. When the yield curve is flat, investors don’t have to sacrifice as much income to reduce duration risk versus when the curve is steeper.

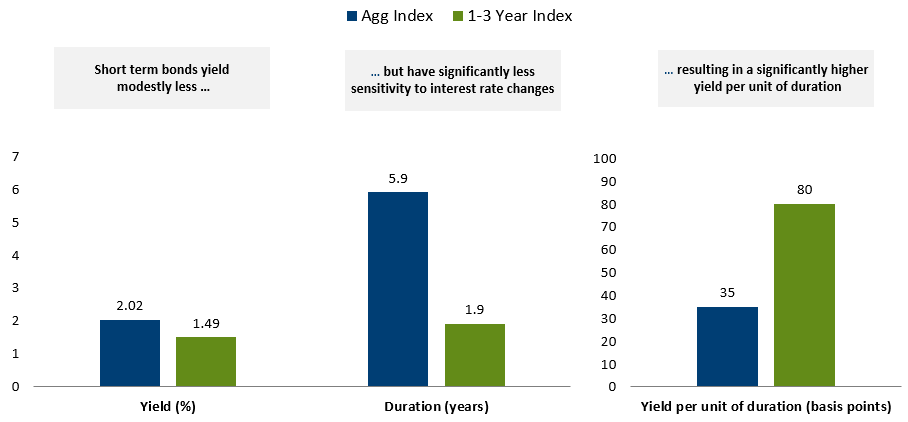

At Calamos, our goal is to make sure that our portfolios are well compensated for the risks they take. One concept we pay close attention to is “yield per unit of duration.” In other words, you need to look beyond the yield a bond offers, to consider the underlying risks, including duration and credit risk.

Yield per unit of duration weighs yield against interest rate risk. The longer a security’s duration, the more sensitive it is to a change in interest rates.* Based on this metric, short-term bonds can have added appeal.

For example, at the end of January, the yield of the Bloomberg Barclays U.S. Aggregate Bond Index was 2.02% and its duration was 5.9 years. The Bloomberg Barclays 1-3 Year U.S. Government/Credit Index yielded 1.49% with a duration of 1.9 years, offering investors the opportunity to shorten duration four years, while only giving up approximately 50 basis points of income. So, this gives us a yield per unit of duration of 35 basis points for the Aggregate Index and 80 basis points for the 1-3 Year Index.

Past performance is no guarantee of future results. Source: Barclays. Year to date returns through January 31, 2020.

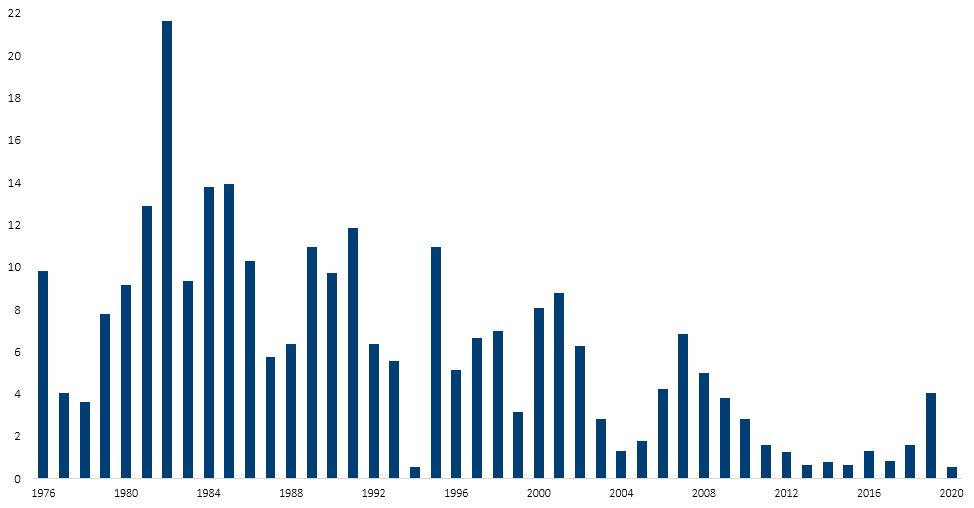

While it’s true that short-term bonds have reduced capital appreciation potential compared to longer-duration bonds, short-term bonds have provided consistently positive historical returns—for decades. Since its inception in the 1970s, the 1-3 year U.S. Government/Credit index has never had a negative calendar year return.

Past performance is no guarantee of future results. Source: Morningstar. Year to date returns through January 31, 2020

Conclusion

At Calamos, we believe it’s a market of bonds, not a bond market. Our team takes a non-traditional approach, often playing at the edges of fixed income style boxes. Thanks to this approach, we believe we can find pockets of opportunity in any environment—and in the current climate, short-term bonds are among the standouts.

Please remember that past performance may not be indicative of future results. Indexes are unmanaged, do not entail fees or expenses and are not available for direct investment.

*Duration is a measure of interest rate risk. As interest rates fall, bond prices rise and as interest rates rise, bond prices fall.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market of SEC registered securities. The index includes bonds from the Treasure, Government-Related, Corporate, MBS (agency fixed rate and hybrid ARM pass-throughs), ABS, and CMBS sectors. Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. The Bloomberg Barclays U.S. Government/Credit 1-3 Years Index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of between 1 and 3 years and are publicly issued. Indexes are unmanaged, do not include fees and expenses and are not available for direct investment.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. Fixed income securities entail interest rate risk and default risk.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice.

18763 0220O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.