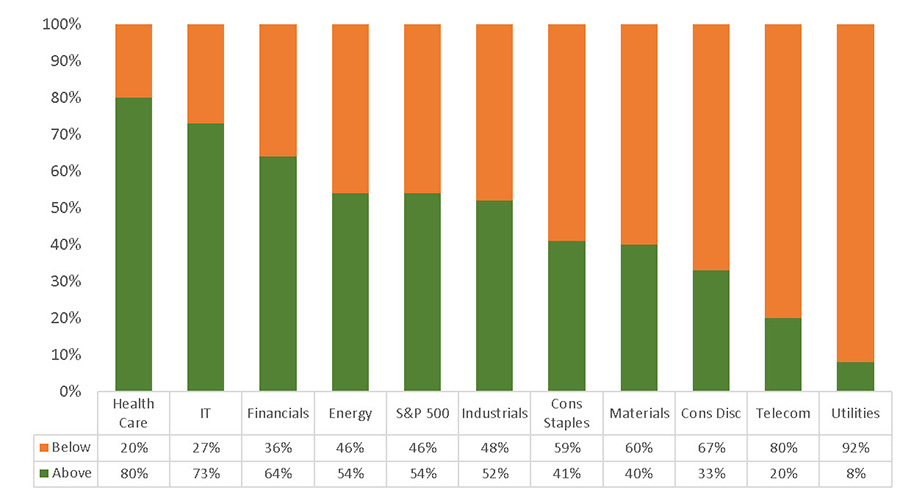

In their most recently quarterly outlook, our Investment Committee discussed their concerns about the stretched valuations of low-to-no growth “safety stocks.” Recent data from FactSet supports their view that the expectations for many safety stocks and dividend stocks/bond surrogates have been too high. As Figure 1 shows, the revenues of S&P 500 constituents in the consumer staples, telecommunication services, and utilities sectors have fallen short of expectations more often than not. (This chart is based on 86% of the S&P companies that reported as of August 5.) In contrast, the majority of health care and technology companies have exceeded revenue expectations.

The U.S. Growth Equity team continues to believe that growth-oriented stocks are positioned for sustained outperformance in an environment of choppy economic growth.

Figure 1. S&P 500 Company Revenues: Above and Below Estimates, Q2 2016

Source: John Butters, “FactSet Earnings Insights-S&P 500,” August 5, 2016. Past performance is no guarantee of future results.