Investment Team Voices Home Page

Investment Team Voices Home Page

Green Shoots in China

Global Perspectives by Nick Niziolek, CFA and Todd Speed, CFA

Heading into 2019, our view was that global growth would likely “re-synchronize” this year, following 2018 when fiscally induced economic strength in the U.S. offset weaker economic conditions in China as Beijing tightened liquidity conditions and implemented reforms.

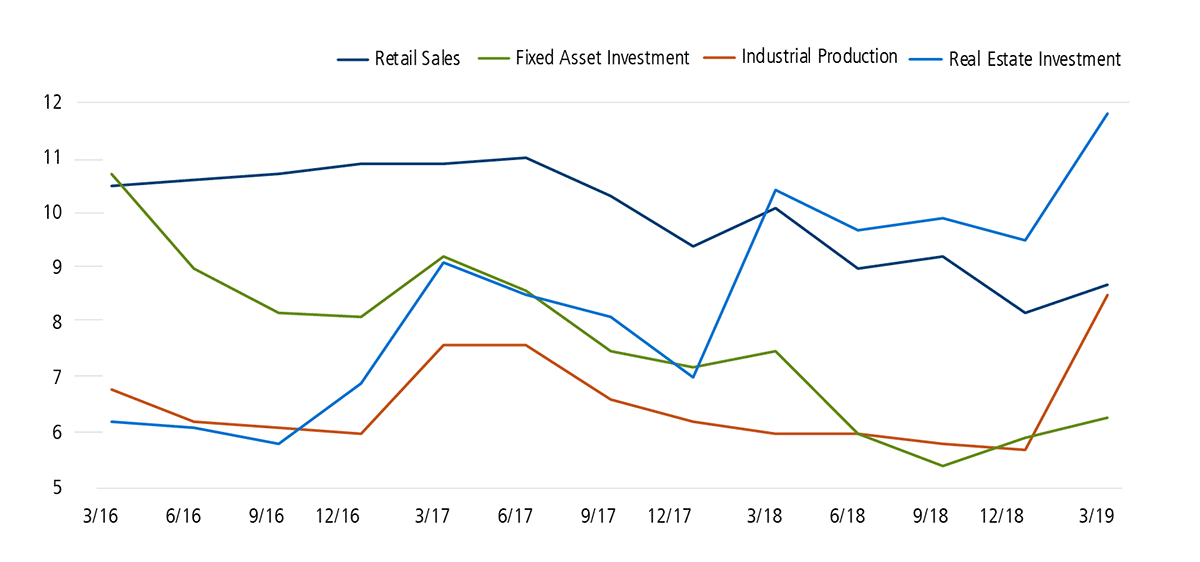

Although data is mixed, key indicators have affirmed our positive bias toward China. In our most likely scenario, the U.S. and Chinese economies stabilize in coming quarters, with good potential for moderate re-acceleration during 2H19. Recent economic data out of China points to stabilization as looser liquidity conditions and increased fiscal stimulus work through the system.

On the whole, March figures point to broad based strength across both consumer and industrial activity, as well as in key credit data.

- Industrial production surprised on the upside, with better-than-expected export levels.

- Retail sales were also stronger than expected, with March data rising 8.7% versus the prior year, as auto sales picked up in the wake of targeted programs for new vehicle purchases.

- Investments in infrastructure and real estate also notched higher in March, benefiting from growth on the heels of policy support.

Even when weighed against the more tempered comments from the Chinese government, these green shoots are encouraging. The resumption of trade negotiations with the U.S. in the coming days will provide another key signpost as the two sides make progress toward what we hope is a durable agreement.

China: Signs of Stabilization and Positive Inflection Points

Year-over-year change (%)

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

18718 0419OC

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.