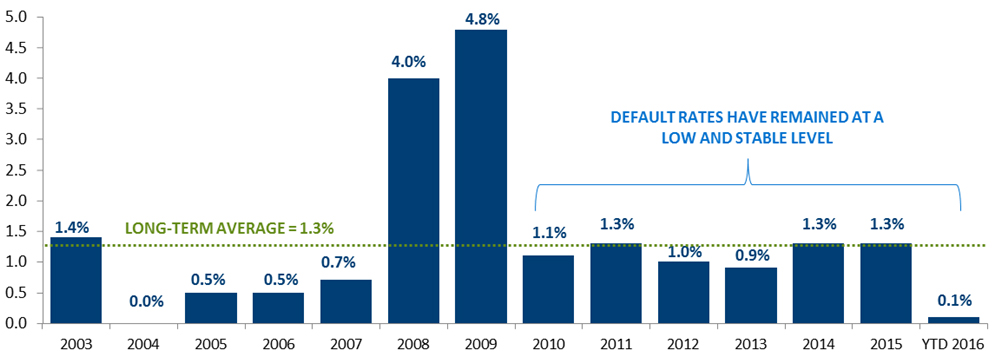

We’re often asked about convertible default rates. Recently I read a report from Barclays,* which confirmed that the overall default rate in the U.S. convertible market remains low and stable. As Figure 1 shows, the overall default rate for 2015 is in line with 2014 and the average since 2003—and far below the peak levels seen in 2008 and 2009.

Figure 1. Annual Default Rate, U.S. Convertibles (%)

Source: Barclays Research (see end notes). All securities including mandatory convertibles.

While defaults are likely to remain low, we do expect them to rise. That said, these increases are likely to be largely confined to sectors where companies have been roiled by declining commodity prices. Although the percentage of distressed credits in the convertible market (which Barclays defines at bonds trading below 60% of par) has increased to 9.1% of overall face value versus 2.3% in 2014, nearly three-quarters of the distressed securities hail from the energy and materials sectors. Importantly, these two sectors make up just 7% of the U.S. convertible universe, versus 24% of the high yield universe.

In contrast, there are far fewer distressed convertible credits within the more-growth oriented tech and health care sectors, which make up 32% and 19% of the U.S. convertible universe, respectively. These are the sectors which we have historically favored.

Even though we believe we are unlikely to see a ripple effect across the market, the rising level of distressed credits highlights the importance of independent credit research.