Investment Team Voices Home Page

Investment Team Voices Home Page

Airlines: Positioned for Take Off?

Jay Stewart, CFA

The recent string of announcements about Covid-19 vaccines has raised the spirits of Wall Street and Main Street alike, as it moves the world a step closer to ending lockdowns and restrictions on travel. While final approval and deployment of vaccines will likely keep movement restricted to some degree through the better part of next year, the vaccine news means we are starting to see the light at the end of the tunnel. It’s likely that a broad resumption of travel globally, whether for work or leisure, could happen as early as next fall or winter. This excitement has led to a sharp rise in transport stocks, such as airlines.

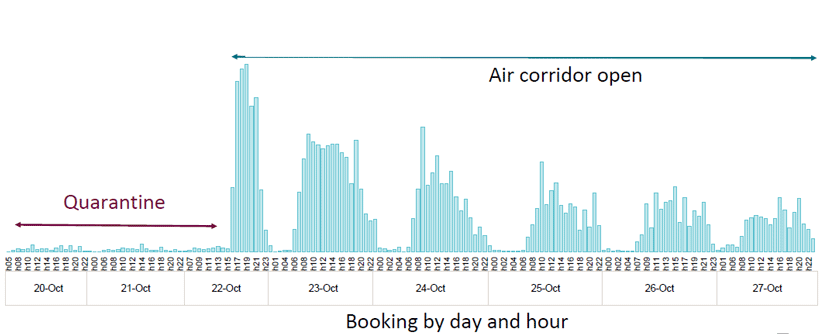

After a nearly 100% decline in air travel in April, we have seen varying degrees of recovery globally as countries and borders have reopened. While demand in the U.S. remains depressed, down 65% year over year in September, China has seen a sharp recovery in its domestic market, down only 2.8% year over year in September. This shows that once restrictions are lifted, demand can rebound quickly, even if the virus is not completely contained (China has seen a steady improvement since February, when its highest levels of Covid infection were reported). The chart below is a good example of how quickly demand returns when restrictions are removed.

British Airways revenue intakes to Canary Islands for travel

Source: International Airlines Group, IAG Results Presentation, October 30, 2020. Includes Las Palmas, Tenerife and Lanzarote.

A vaccine will have positive implications for cyclicals as economic growth should improve after restrictions on movement and in-person interaction are lifted. Airlines have been one of the most negatively impacted industries, as global shutdowns restricted air travel in the early days of the virus, and a lack of consumer confidence has kept demand depressed. An effective vaccine could be a game changer for global airlines, as consumers return to the skies to visit family and friends, take a much-needed vacation, or resume work-related travel. While a near-term pickup in virus cases will continue to weigh on the recovery in early 2021, we believe vaccine implementation through the year will bode well for a sharp recovery heading into 2022.

Since the pandemic began, airlines have taken major steps to shore up their balance sheets and liquidity positions through issuing a mix of debt and equity. Many have used convertible bonds for the first time in years. We have a favorable view toward airlines with flexible cost structures, strong liquidity positions, and good mixes of leisure-to-business travel. Airlines with these characteristics could exit the pandemic in a stronger competitive position and take market share from heavily leveraged incumbents that are pulling back on service offerings, potentially leading to higher margins than previous peak. If demand returns faster than previously expected, airlines could have significant upside to current levels as better passenger yields and load factors lead to better cost absorption and rising cash flow. The best positioned airlines could see earnings levels return to FY19 levels within the next two to three years, sooner than we think current share prices are reflecting, despite recent moves. Our global portfolios are positioned to benefit from this eventual recovery as we continue to monitor the vaccine news for an updated timeline—and begin planning our next vacation.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

18851 1120 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.