We Agree with Barron’s: Meet That 8% Inflation with Convertible-using Closed-end Funds

Two Calamos closed-end funds—Calamos Convertible & High Income Fund (CHY) and Calamos Convertible Opportunities & Income Fund (CHI)—get a shout-out from Barron’s today as an “8% solution for inflation.”

Sometimes the best defense is the best offense, Barron’s writes, explaining its search for an income-producing investment that meets the 8% inflation rate reported yesterday. With a passing nod to I bonds (too limiting) and Treasury Inflation Protected Securities (recent disappointing performance), the article settles on closed-end funds “where the biggest yields are available, mainly because of their leverage.”

The article acknowledges leverage’s ability to boost returns while raising risk, adding “closed-end funds also have the possibility of buying assets at a discount, which may offer a margin of safety on the downside and the potential of appreciation if the discounts narrow.”

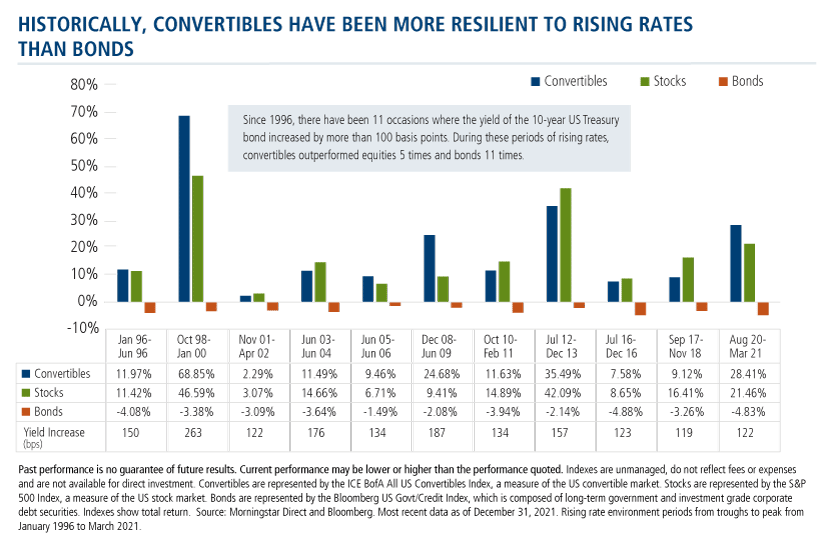

In the screen for funds that pay over 8% now and have returned at least that much over the past five years, four funds use convertible securities to some extent. “Convertibles have hybrid characteristics, capturing much of the return potential of stocks with some risk cushion from bonds,” Barron’s notes. (And see our most recent commentary about convertibles.)

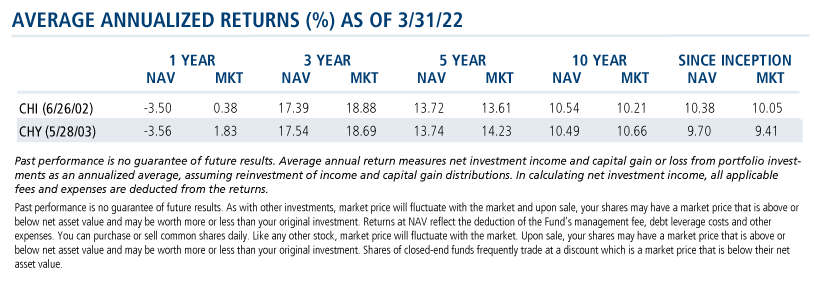

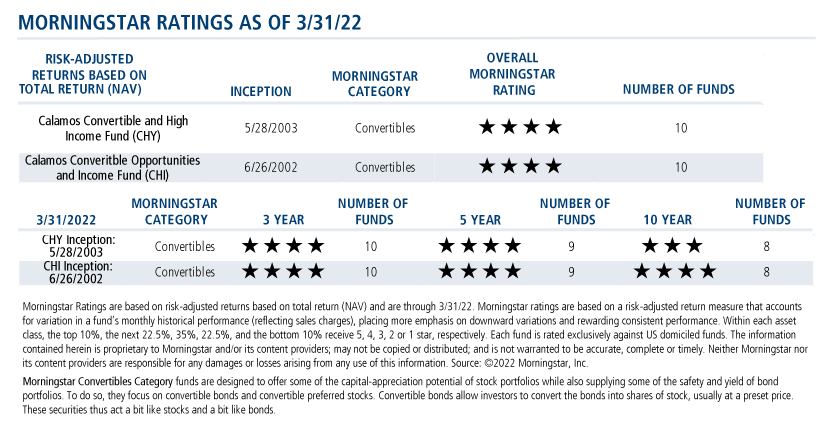

CHY and CHI place second and third on the list, with among the highest returns and among the smallest discounts. Calamos specializes in convertibles, as the article acknowledges.

“As of 4/12/22, all three Calamos convertible-focused closed-end funds (CHI, CHY and Calamos Dynamic Convertible and Income Fund (CCD) were trading at premiums to NAV," commented Robert F. Bush, Jr., Calamos Senior Vice President and Director of Closed-End Fund Products. “Much of this is attributable to portfolio performance, as well as confidence that convertibles performed extremely well relative to both bonds and equities during periods of market volatility.”

Calamos CEFs have historically traded close to their respective NAVs, Bush adds. “Even during recent periods of market volatility due to geopolitical conflict and rising interest rates, our convertible funds have traded well,” he says.

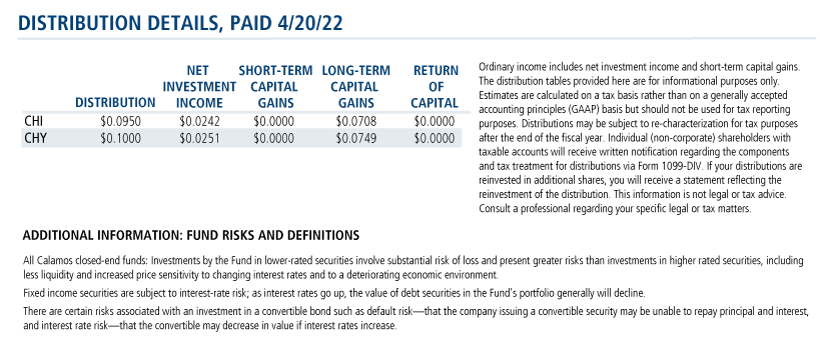

Further, according to Bush, Calamos has managed the convertible CEFs “to optimize price returns to shareholders by offering significant distribution increases, which helped mitigate discounts while putting more returns in the pockets of shareholders.” Such was the case in February 2021, when Calamos increased the distribution levels in five CEFs, including all three convertible-focused funds.

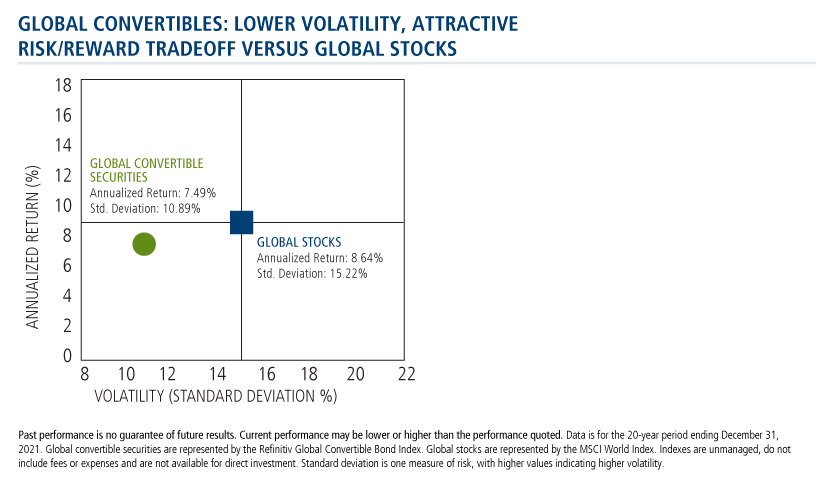

Convertibles have historically offered comparable returns to equities, with roughly two-thirds the volatility, as shown in this risk/reward chart of global convertibles vs. global stocks.

The convertibles that Calamos invests in are highly liquid securities, adds Bush. They are typically not privates or illiquids, which can be more vulnerable to market declines. In addition, the portfolios are blended with multi-cap issuers, and “are not encumbered” by minimum investments in micro or small cap companies, he notes.

Below we show an excerpt of the Barron’s table, followed by standard performance data.

An 8% Solution for Inflation

Two Calamos closed-end funds place on Barron’s April 13, 2022, list of seven

| Fund / Ticker | Yield | Discount | Return |

|---|---|---|---|

| Calamos Convertible & High Income / CHY | 8.93% | -1.47% | 14.21% |

| Calamos Convertible Opportunities & Income / CHI | 8.99% | -2.01% | 13.53% |

Barron’s, April 13, 2022. Note: Data as of April 8, 2022.

Investment professionals, for more information on CHY, CHI, CCD or any of our seven closed-end funds, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. You can purchase or sell common shares daily. Like any other stock, market price will fluctuate with the market. Upon sale, your shares may have a market price that is above or below net asset value and may be worth more or less than your original investment. Shares of closed-end funds frequently trade at a market price that is below their net asset value.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

The goal of the managed distribution policy is to provide investors a predictable, though not assured, level of cash flow. Monthly distributions paid may include net investment income, net realized short-term capital gains, net realized long-term capital gains and, if necessary, return of capital. Maintenance of this policy may increase transaction and tax costs associated with the fund.

A credit rating is a relative and subjective measure of a bond issuer’s credit risk, including the possibility of default. Credit ratings are assigned to companies by third-party groups, such as Standard & Poor’s. Assets with the highest ratings are referred to as “investment grade” while those in the lower tiers are referred to as “noninvestment grade” or “high-yield.” Ratings are measured using a scale that typically ranges from AAA (highest) to D (lowest).

Leverage creates risks which may adversely affect return, including the likelihood of greater volatility of net asset value and market price of common shares; and fluctuations in the variable rates of the leverage financing. The ratio is the percent of total managed assets. The fund may invest in foreign securities and invest in an array of security types and market-cap sizes, each of which has a unique risk profile.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities. These include fluctuations in currency exchange rates, increased price volatility, and difficulty obtaining information.

There are certain risks associated with an investment in a convertible bond such as default risk—that the company issuing a convertible security may be unable to repay principal and interest, and interest rate risk—that the convertible may decrease in value if interest rates increase.

Investments by the fund in lower-rated securities involve substantial risk of loss and present greater risks than investments in higher-rated securities, including less liquidity and increased price sensitivity to changing interest rates and to a deteriorating economic environment.

Fixed income securities are subject to interest rate risk; as interest rates go up, the value of debt securities in the fund’s portfolio generally will decline. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The fund may invest in derivative securities, including options. The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. There is no assurance that any derivative strategy used by the fund will succeed. One of the risks associated with purchasing an option is that the fund pays a premium whether or not the option is exercised.

810004 422

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on April 13, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.