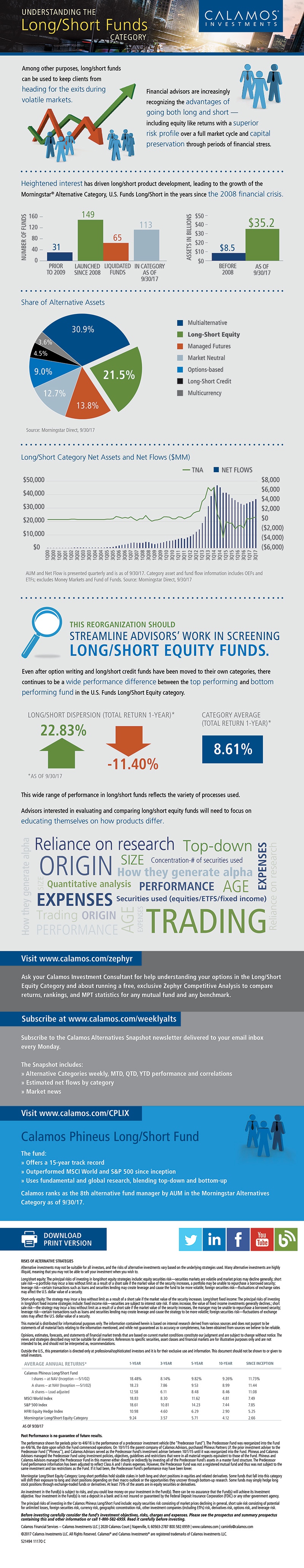

The objective of the long/short equity fund is to provide positive returns whether markets rise or fall. That’s a relatively new concept, and one that financial advisors have gravitated to as a means of keeping clients from heading for the exits during volatile markets. But the number of funds in the Morningstar Alternative Category, Long/Short Equity has ballooned in the years since the 2008 financial crisis.

In 2016, Morningstar reorganized its alternatives categories in an attempt to streamline advisors' screening of long/short equity funds. This infographic (download PDF) covers the highlights.

Even after the restructuring, there continues to be a wide performance difference between the top performing and bottom-performing fund in the category, reflecting the variety of strategies used.

Advisors interested in evaluating and comparing long/short equity funds will need to focus on educating themselves on how products differ.

Download the infographic.

Print the infographic.

To learn more about long/short investing or our Calamos Phineus Long/Short Fund, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.