Price Momentum, Fundamental Strength and An Inexpensive Asset Class—What’s Not to Love About Small Caps Today?

This is a unique period to be investing, according to Calamos Senior Portfolio Manager Brandon M. Nelson, because “there are so many factors enabling growth.”

“We’re coming out of a recession, we have a dovish Fed, there’s so much stimulus, we see a lot of operating leverage for a lot of different companies in a lot of different sectors. Companies got lean during the downturn and now their revenues are coming back and that is resulting in explosive margin expansion,” Nelson said on yesterday's CIO call (listen to the call here).

While acknowledging others’ concerns about equity valuations, he said, "Valuations are high, but they should be high given the low interest rate environment. Additionally, it’s important to remember that many companies are under-earning now as we come out of recession. This under-earning is temporarily inflating valuation multiples until earnings catch up with stock prices."

"Importantly, on the subject of valuation," Nelson added, "small caps continue to look very inexpensive vs. large caps, despite the recent rally in the asset class.”

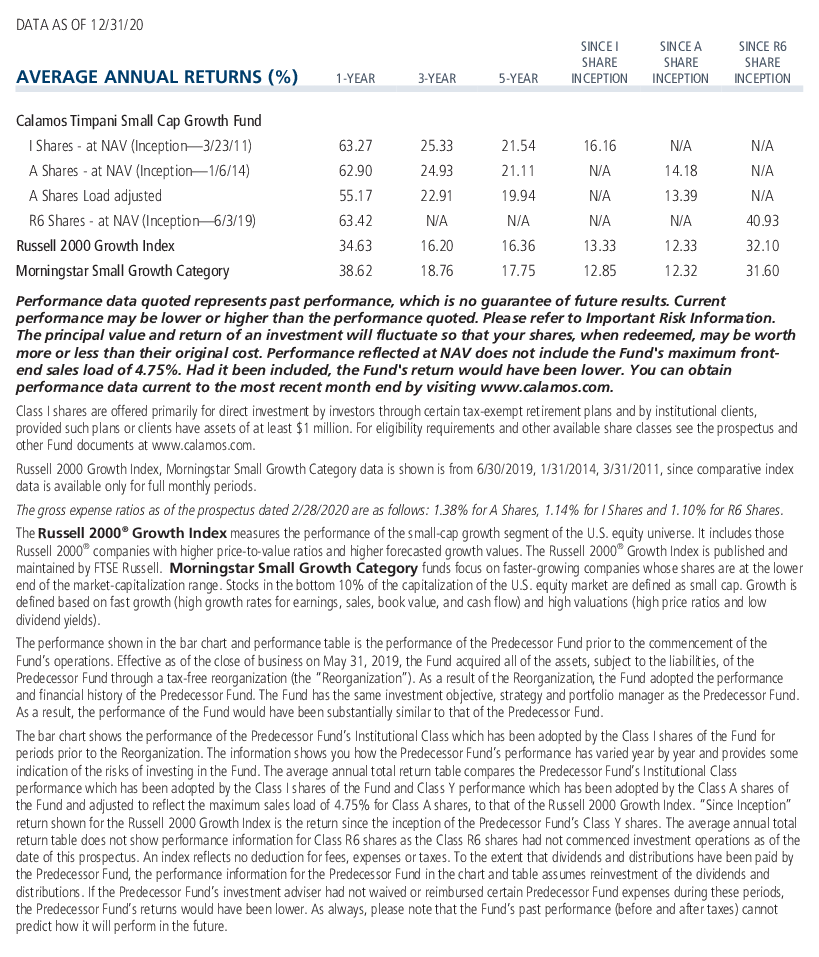

This overall bullishness provided a backdrop for Nelson’s specific update on small cap outperformance that began in early September. Although his Calamos Timpani Small Cap Growth Fund (CTSIX) was well ahead for the year by then, the small cap asset class underperformed for the first three quarters of the year, staged a record-breaking November for the Russell 2000 Index and finished 2020 just about even with the S&P 500 (19.96% versus 18.4%, respectively). CTSIX finished with a 63.27% return for the year.

“We think the Q4 rally marked a significant regime change for small caps,” Nelson said. “When a regime change like that takes place, history shows us that it tends to sustain for long periods of time—on average seven years. We’re in the fifth month of what could be a multi-year move. The shortest [period of small cap outperformance] was 3.5 years. We have much longer to go here, if history repeats itself.” (See this post.)

CTSIX’s Pursuit of Fundamental Momentum

Nelson described the traits of stocks the team looks to include in the CTSIX portfolio.

“We want to see robust sustainable growth…We like to see at least 10% revenue growth and at least 15% earnings per share growth, and not just this quarter or next quarter but something that’s believable that can be sustained for, hopefully, multiple years.

And the second big thing we’re looking for is underestimated growth. We want the companies we’re investing in to not only be growing fast, but to be meeting and exceeding investor and analyst expectations. When that’s happening and they’re growing quickly and you see those sell-side analyst revisions go higher and higher, the market eats that up, they love it—and they reward that stock typically with higher and higher valuations.

We’ll go along for the ride for that positive revision where, let’s say a $1 earnings per share goes to $1.50 to $2.00 throughout the year but maybe that valuation is expanding at the same time. Let’s say it’s trading at 20 times earnings when it was $1 and by the time it’s being revised to $2, the market will say, ‘You don’t deserve to trade at 20 times earnings, you deserve to trade at 35 times earnings.’

When that happens, you win on a couple of fronts: on the trajectory of the revision changes as well as the valuation expansion.”

It’s important to note, he said, “that long term, small caps tend to win. It’s easy to forget that for the last 9.4 years large caps have outperformed, we’ve been lulled into thinking that’s normal. The opposite is what’s normal,” adding that valuations are stretched on the basis of many metrics (see this post for more).

“You put together price momentum, fundamental strength and an inexpensive asset class. That’s a possible hat trick that could result in further price momentum,” said Nelson.

Buy Ideas Outnumber the Sell Ideas

The CTSIX team, in particular, is finding plenty of stocks that meet the fund’s fundamental momentum objective. The portfolio is diversified, with exposure to nearly every sector but tilted more toward secular stocks, where sustainable growth is more commonly found in technology, health care and consumer discretionary sectors, for example. Cyclical stocks “with sizzle” in financials, industrials, materials have been added at the margin.

Currently, Nelson said, the CTSIX team finds itself in a “lopsided” position where the buy ideas outnumber the sell ideas.

“We have a diversified portfolio where there’s a lot of exciting things going on in several different pockets of the economy,” said Nelson. “Honestly, our biggest challenge day to day is what are we going to sell to fund the purchase of this other great idea that we want to own, or to fund the purchase of getting bigger in an existing holding. It’s a constant struggle to figure out what to reduce exposure to.”

Nelson also mentioned the fund’s relatively small size ($187 million in assets under management as of 12/31/20) as an advantage over larger small cap funds. “In an environment like this, where we think we’re in the early stages of a small cap regime, further down the market cap spectrum is where the action is.”

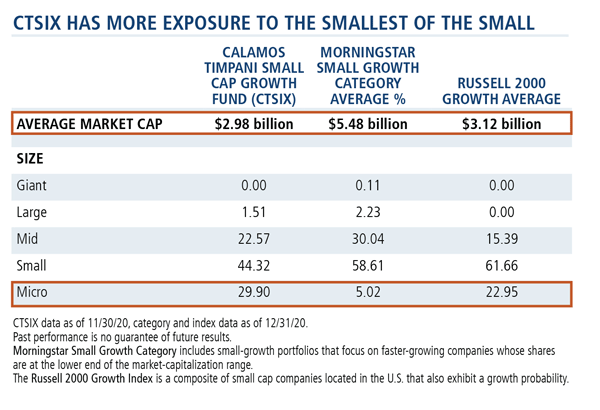

The fund’s average market cap was $2.98 billion as of 11/30/20. This compares to the Morningstar Small Growth category average of $5.48 billion and Russell 2000 Growth average of $3.12 billion. “We’re already there and we can get there in a bigger way if we want to,” said Nelson, noting that large funds don’t have similar flexibility.

“Let’s face it,” he said, “there’s more inefficiency further down the market cap spectrum. The opportunity to find home runs is greater.”

Investment professionals, for more information about CTSIX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Morningstar RatingsTM are based on risk-adjusted returns for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc. All rights reserved.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

802276 0121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 20, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.