This post was written by Christian Brobst, Calamos Vice President, Portfolio Specialist.

The first two months of the year leave no doubt that conditions have changed in 2018 for investors. Equities corrected early in February, resetting some expectations and raising new concerns. Lately the focus has been on the steady march of the 10-year Treasury toward 3% and the prospects for higher inflation.

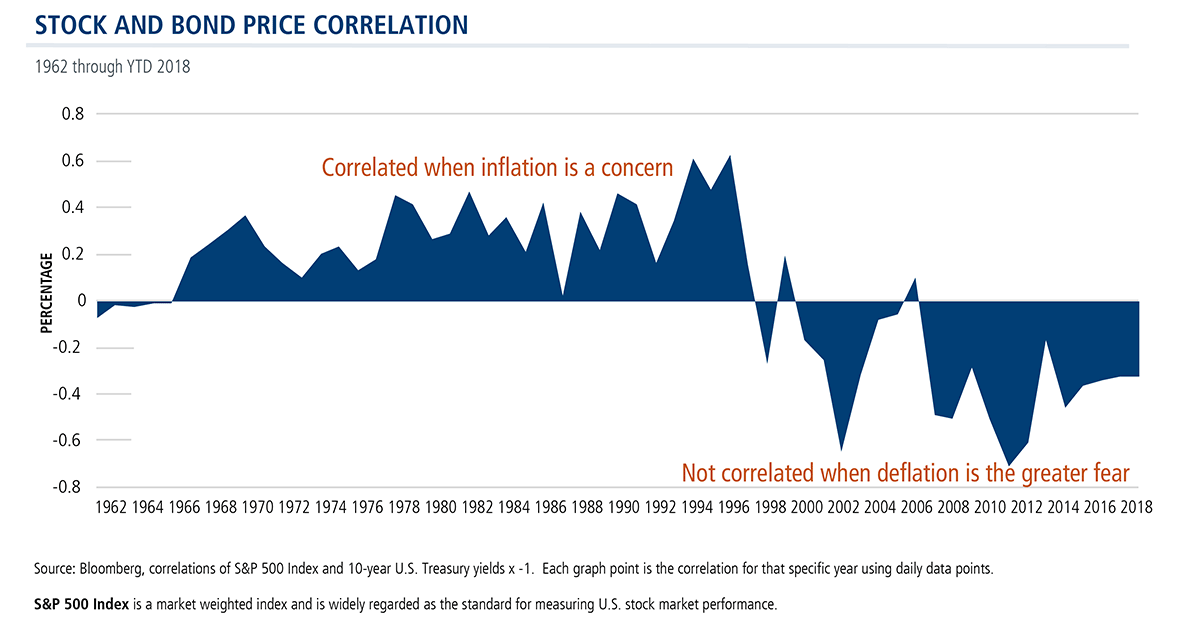

For as long as there have been no signs of unbridled inflation—and this has been true of the last 18 years—equity investors didn’t really need to concern themselves with higher interest rates. As shown below, stock prices were negatively correlated with bond prices.

But prior to that, starting in the 1970s and running through the 1990s, runaway inflation was a persistent fear. Less inflation was good—for both stock prices and bond prices at the same time.

In 2018 we’re back to an economy where inflation and not deflation is the greater fear. If the historic correlation relationship were to return, the correlation of stock and bond prices would flip back to positive: Lower bond prices (higher yields) could signal lower stock prices.

And, there are a few additional challenges for equity investors in a rising rate environment.

Equity Valuations

Discounted cash flow models are not necessarily in style in a growth-y/tech-dominated market like today’s, but higher risk-free discount rates inherently result in lower valuations, all else unchanged.

The impact of higher borrowing rates on corporate profit margins also is negative. Again, holding everything else constant, higher debt service costs over time result in lower margins—and that also hurts stock valuations.

Related: The current bull market has been fueled in part by shareholder-friendly behavior funded by debt issuance (i.e., special dividends and heavy share buybacks). When the cost of borrowing increases, the economics for this type of management behavior changes, which also could take some wind out of sails.

Of course, none of the above happens in a vacuum, and typically higher rates accompany periods of stronger economic growth that can drive stock prices and offset some of these impacts. But these are some of the fundamental reasons that equity investors are back to worrying about rising interest rates.

Advisors, for more information and ideas on risk managed strategies, please talk to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.