Introducing Calamos International Small Cap Growth Fund (CSGIX)

Calamos International Small Cap Growth Fund (CSGIX), launched today, provides investors exposure to an asset class typically under-represented in clients’ portfolios, offering the potential for significant equity upside.

CSGIX offers:

- Meaningful diversification. International small cap stocks are less correlated to the US large and small cap markets, which makes them a substantive means for diversifying a portfolio. Non-US small caps are tied more closely to their local economy, serve different customers, operate in different macroeconomic environments and thereby provide a different source of earnings, according to Co-CIO, Head of Global Strategies and Senior Co-Portfolio Manager Nick Niziolek. The fund will invest in companies with superior earnings growth potential coupled with financial strength and flexibility.

-

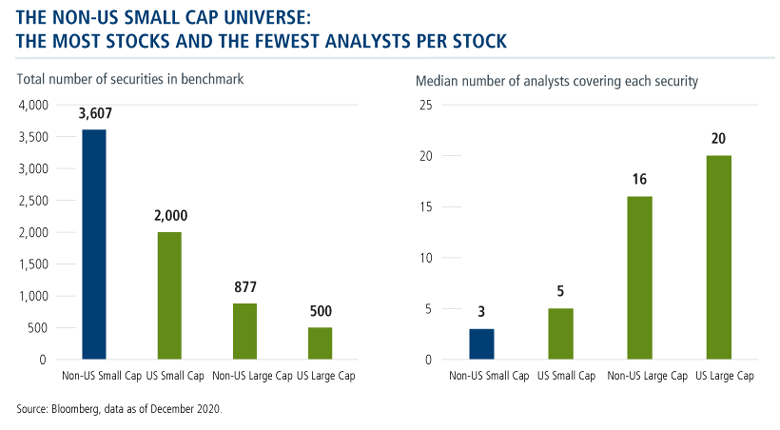

The potential to add alpha. The international small cap universe has the most stocks and fewest analysts per stock. This lack of coverage creates an opportunity for the Calamos Global team to uncover misunderstood or ignored companies, recognizing opportunity in advance of the market, and flexibility.

- The potential for attractive risk-adjusted returns. Over time, international small cap stocks have delivered higher returns with similar volatility versus international large caps.

- An offset to a large cap bias found in most international allocations. While most investors are overweight non-US funds benchmarked against broad international indexes, small cap exposures are estimated at less than 1%.

The new fund builds on the team's historical success in identifying smaller cap companies within several secular themes—mobile and connectivity, mass digitization, artificial intelligence and automation, global demographic shifts and advances in nanotech, biotech, and genetics—that were significant contributors to other funds in the Global suite.

CSGIX becomes the 50th fund in Morningstar’s Foreign Small/Mid Growth category, 12 of which are closed to new investors.

Investment professionals, for more information about CSGIX, please reach out to your Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

Morningstar Foreign Small/Mid-Growth Category funds invest in international stocks that are smaller, growing faster, and higher-priced than other stocks. These portfolios primarily invest in stocks that fall in the bottom 30% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in US stocks.

809983 322

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 31, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.