The market’s correction is not complete, Calamos Co-CIO and Senior Portfolio Manager Michael Grant told a group of investment professionals last week. Historically, pullbacks during ongoing expansions have been sharp but short in duration—“three to four months rather than the six- to 12-month affairs associated with profit recessions.”

He looks for the relapse to conclude by the end of April, with 5% further downside as investors explore what he described as “the frontier of the correction zone.”

Grant attributed the latest volatility to rising rates, as he said the investment consensus has finally understood the secular trend reversal in U.S. debt markets and Central Bank intervention.

However, he said, “There is a window where corporate fundamentals can overcome higher rates.” Based upon his team’s analyses of rate levels, the “zone of disruption” for equities, he said, is a 3.2% to 3.5% 10-year Treasury yield. This tension between earnings and rates will characterize the remainder of the bull market.

While the pace of global economic growth will climax by the middle of this year, Grant sees little U.S. recession risk until 2020 or 2021. The correction of 2018 is not a replay of the deflation anxiety that became so familiar post-2008.

The Battle for Equity Leadership

Instead, Grant argued that the central question for clients is “How to turn defensive when interest rates are now the enemy?” The striking feature of this pullback, he said, is that the traditional defensive sectors did not outperform.

This conundrum is equally apparent as investors sense the turn against the high momentum technology stocks. “Growth momentum is the longest duration asset within equities,” said Grant, so it is unsurprising that higher rates would create anxiety among these leaders.

Grant sees the correction as a leadership battle and watches “for the incipient shift toward higher quality, more secure growth as a sign the correction is maturing.”

Grant continues to be positive about the United States. “What other economic region can compete with the U.S. fiscal initiatives to replace the tired monetary accommodations that are being unwound globally?” he asked.

The good news, he said, is that the monetary tide is turning very slowly, inflation is not a concern and there is no prospect of genuinely restrictive policy anytime soon. Even so, Grant described the recent equity turbulence as a “foretaste of greater upheavals to come.”

Trump, Trade and Tariffs

On the subject of trade and tariffs advanced by the Trump administration, Grant said, “Trump believes it is better for some Americans to have jobs even if other Americans have to pay more for imports.”

Grant envisages a long period of “conflictual re-negotiation” of U.S. trading relationships and of the U.S.-China relationship, in particular. He said Trump’s objective is to end China’s manipulation of trade and investment in the interests of its great power agenda. And Beijing is “much more constrained in its ability to retaliate than most realize.”

The world economy has become excessively dependent upon the American consumer of last resort, according to Grant. He went on to predict that China will agree to some compromise that will prevent the escalation into an outright trade war. China Premier Li’s quick concession this week promising no mandatory technology transfers in China’s manufacturing sector is revealing, Grant said. “It will confirm Trump’s instincts that America, as the ultimate buyer of goods, has leverage,” he added.

Trump’s secondary goal is to address Europe’s huge trade surplus with the U.S., which is “a debate for the entire European region.”

Investors should not focus on the details of the tariff squabbles, partly because the odds of an authentic trade war are low as “both sides have vested interests that would be damaged.” In Grant’s view, the historical judgment is clear: “In any generalized trade dispute, a diversified economy with a large deficit holds all the best cards.”

Equally important, he said, much of the Eurocracy recognizes that there is substance to Trump’s complaints.

Grant believes that “capital flows will respond to perceptions of the new Trump policy regime, which would be very positive for the U.S. economy.”

In contrast, he thinks Europe faces a “reckoning” and will retain a political risk premium for some time. According to Grant, Brexit implies the Euro project will become “more French” in coming years: more protectionist, more technocratic and more statist. “And what kind of future is that for investors?” he asked.

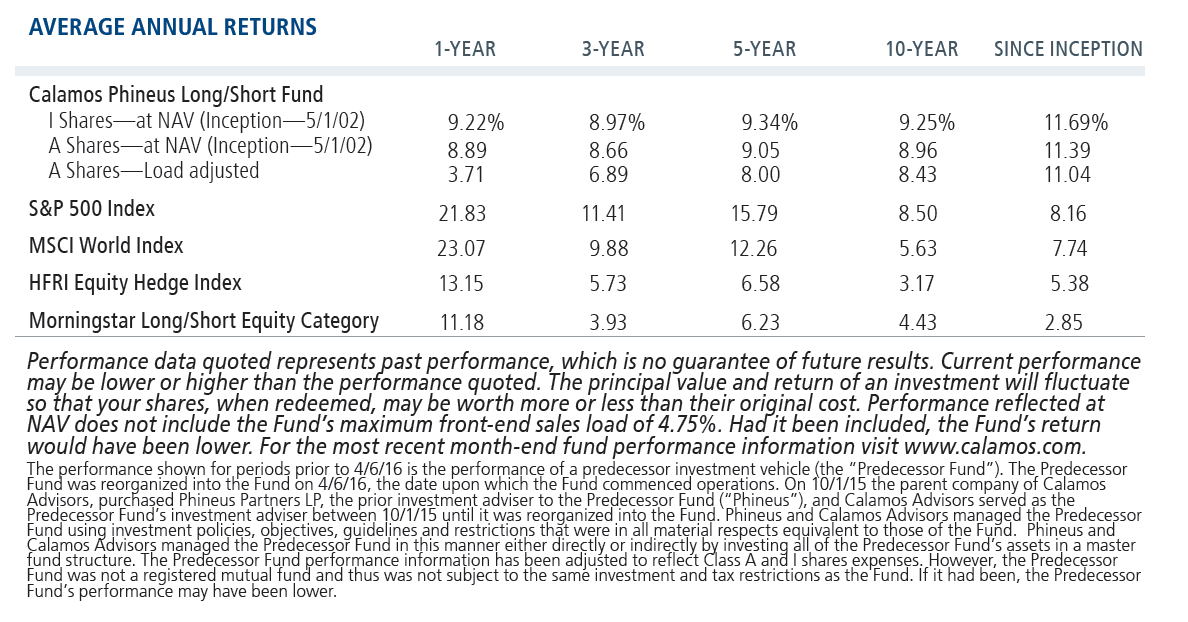

CPLIX Update

In a Calamos Phineus Long/Short Fund (CPLIX) update, Grant said the fund has done what a risk-managed long/short global equity fund is expected to do during market volatility.

The fund declined less than 2% during two tests—from January 26 to February 8 and from March 15 to March 23, as shown below. This bested both the S&P 500 and the fund’s peer group, the Morningstar Long/Short Funds category.

Throughout the period, Grant and team have been actively:

- Reducing short exposure after the first pullback, resulting in an increase in delta-adjusted exposure from 13% (21% on a cash basis) at December 31, 2017, to 36% as of February 28.

- Addressing sector weightings, including trimming the long Technology exposure. Financials remain the largest sector long exposure as of February 28.

Full portfolio analytics will be provided in the upcoming quarter-end performance update and commentary, to be published in April. Advisors, for more information about CPLIX, talk to a Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.