Financial advisors frequently spread an international equity allocation across more than one fund, in pursuit of a combination that balances risk and reward.

When asked to evaluate thousands of advisors’ asset allocations and models, our Product Management and Analytics group looks at a wide range of metrics to improve an allocation, including risk/return statistics and qualitative factors such as sectors and countries.

“Often,” says Shawn Park, Director of Product Management and Analytics, “the allocations reviewed are exposed to risks that advisors may not be aware of, but we are able to offer potential solutions to improve the outcome.”

Ultimately, advisors want to help their clients reach their goals and that’s usually through a targeted return objective based on various risk tolerances. Our group helps by reviewing an allocation to see where it can be improved.

“Typically we talk about traditional correlations, which really applies to building a portfolio as a whole and combining different asset classes, such as equities and bonds or equities and commodities,” says Park. “They tend to have negative correlations, which historically has minimized the impact of one specific asset class.”

However, performance within asset classes—a value manager and a growth manager within international equities, for example—tends to be highly correlated. The different portfolios can move together, regardless of their style.

“In other words, if the international markets are positive for the year, in most cases, one would expect all international funds to be positive for the year, despite whatever factor they are exposed to—value, growth or momentum,” he says.

How is this addressed when considering international allocations, or any allocations for that matter? “Our preference, at the asset class level,” Park explains, “is to combine two managers expected to outperform in different market cycles. That’s how we can diversify an allocation.”

Excess Return Correlations

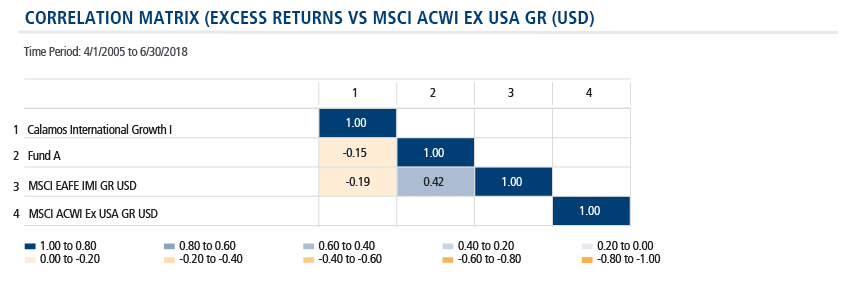

What Park’s group recommends: To diversify by combining funds with low excess return correlations relative to a benchmark index.

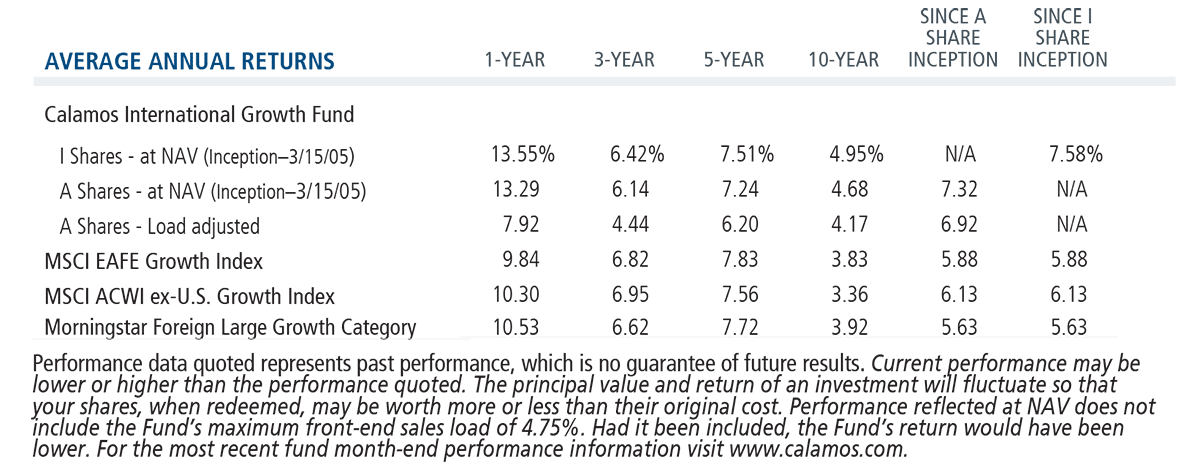

Consider the comparison between Calamos International Growth Fund (CIGIX) and another prominent fund from the Morningstar Foreign Large Blend Category that we’ll call “Fund A.”

As shown in the correlation matrix above, the excess returns generated by these two funds were not highly correlated. They have delivered different outcomes in different markets—in other words, when one of them zigged, the other one typically zagged. The result was an allocation that helped smooth out the variances in index performance.

Performance correlation is just one dimension the group considers. Others include the correlation of factor exposures, such as sector, country, size, growth/value orientation, momentum and other portfolio traits.

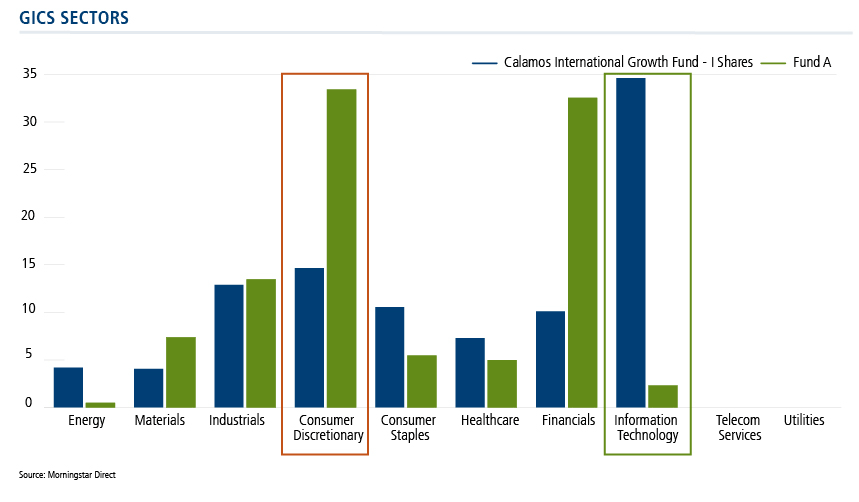

Here again, analysis shows that CIGIX and Fund A differ significantly in specific sector weightings, as shown below.

Data as of 6/30/18

Here’s how the dynamic plays out over time. The historical result of combining the two is that the paired funds have taken turns outperforming the benchmark index (and one another). The boxed areas in the chart below indicate rolling periods when CIGIX outperformed, picking up the slack when the index (and the paired fund) lagged.

“Over time,” Park says, “structuring allocations in this way can help deliver more consistent excess returns relative to the index while maintaining desirable risk/reward outcomes.”

Financial advisors, for more about CIGIX and how it could contribute to your international allocations, talk to a Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.