CMNIX’s Battle During the Market’s Worst Week

After the worst day in the stock market since Black Friday, 1987, we asked the portfolio management team of Calamos Market Neutral Income Fund (CMNIX) for an update and assessment of prospects going forward.

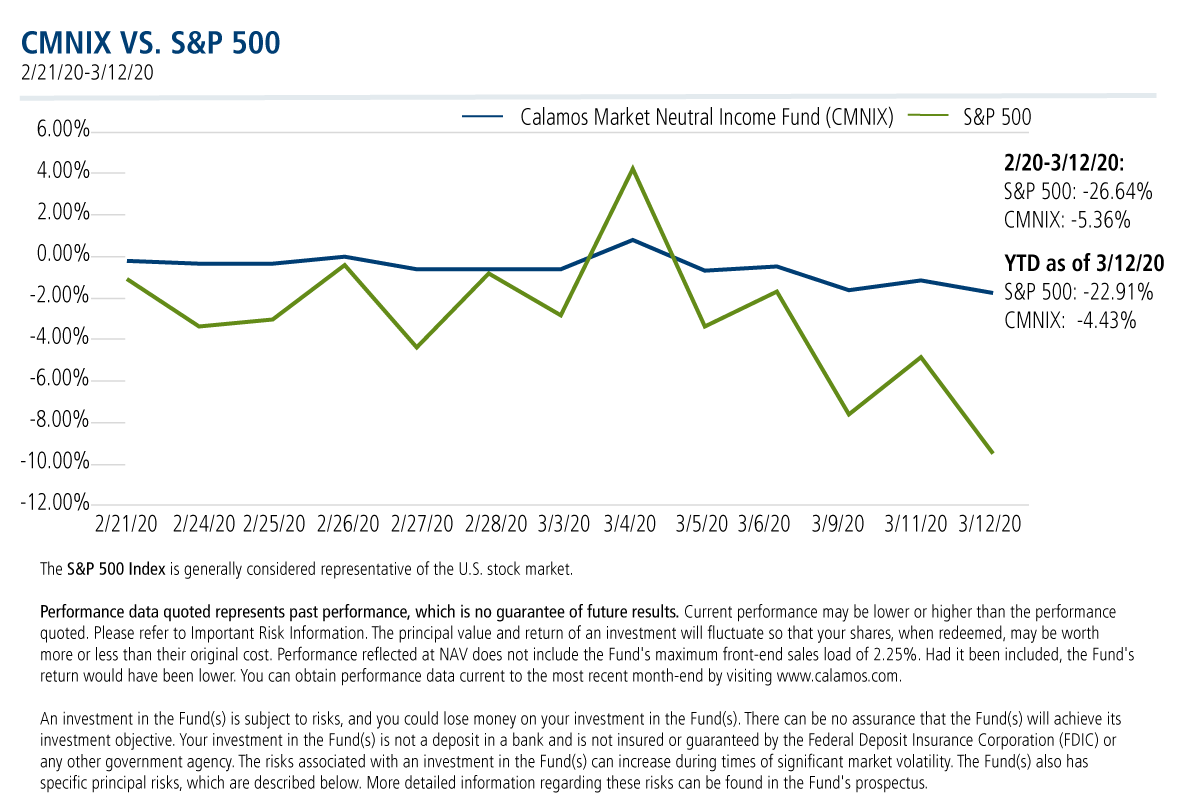

In general, while the team isn’t happy with how the markets have reacted to coronavirus concerns, they note that the strategy has held up much better than the equity market—better than might be expected given a historical S&P 500 beta of 0.24 and the S&P 500 down 26.64%. From the peak of the market on 2/20 through Thursday’s close, CMNIX was down 5.36%.

The volatility this week has “not been your average volatility,” said David O’Donohue, Senior Vice President, Co-Portfolio Manager, “it’s been more like 2008 volatility. On Thursday we went from down 8% to down 3% in 20 minutes.”

CMNIX uses the two strategies of convertible arbitrage and hedged equity with a goal of generating consistent income and capital appreciation.

Convertible Arbitrage Strategy

The convertible securities market presents opportunity.

During periods of market stress, convertibles often see significant structural cheapening (see 2005 and 2008 on the valuation chart, as published monthly in the Calamos U.S. Convertible Market Snapshot). So far, U.S. convertibles have cheapened from 0.5% rich on 2/29 to 2.0% cheap on 3/12. The team expects the fund may see a tailwind from its ability to invest in cheaper convertibles going forward (pricing arbitrage as valuations richen).

(For more on this, see our March 2, 2016, post The Convertible Trifecta, which commented on three positive factors in 2016: the expected narrowing of spreads, the expected comeback of the underlying equities of convertibles and attractive valuations at that time. The Convertible Trifecta, Revisited, an August 2016 post, reported on how the market dynamics played out.)

Declining interest rates have been both a hindrance and a help to the fund, according to the team. The lower fed funds rate has reduced convertible arbitrage short interest carry (although it remains positive as long as the fed fund rate exceeds 35 bps—the current average cost of borrowing shares of stock to sell short). The convertible’s bond component has increased in value as intermediate term rates have declined. Overall, declining interest rates have likely been a net negative as convertible arbitrage returns typically fall into a fed funds plus 300 to 400 bps range.

Higher volatility is creating increased opportunities to adjust the hedge in convertible arbitrage, which may allow the fund to realize some gains, and the team has seen a signficant increase in hedging-related trades.

“Convertible arbitrage has always been a long volatility strategy,” notes Eli Pars, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager, “and we’ve seen significantly increased convertible arbitrage gamma trades.” (For more on this, see Gamma Trading: Why Big Market Swings Can Be Good News by O’Donohue and Jason Hill, Senior Vice President, Co-Portfolio Manager.)

Hedged Equity Strategy

On the hedged equity side, heightened volatility has significantly improved the prospects for our traditional (North Star) trade (for more, see this video). The elevated volatility has resulted in flatter skew and improved net option premium capture. The North Star trade is a short volatility trade that the team expects to benefit when volatility eventually declines.

Financial advisors, for more information about CMNIX, please talk to your Calamos Investment Consultant. Calamos is the largest provider of liquid alternative funds based on Morningstar AUM data as of 2/29/20. You can reach him or her at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Alternative investments may not be suitable for all investors.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Convertible Arbitrage involves buying convertible bonds and short selling their underlying equities to attempt to hedge against equity risk, while still providing the potential for upside returns.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also may have an effect on the convertible security’s investment value.

Convertible Hedging Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

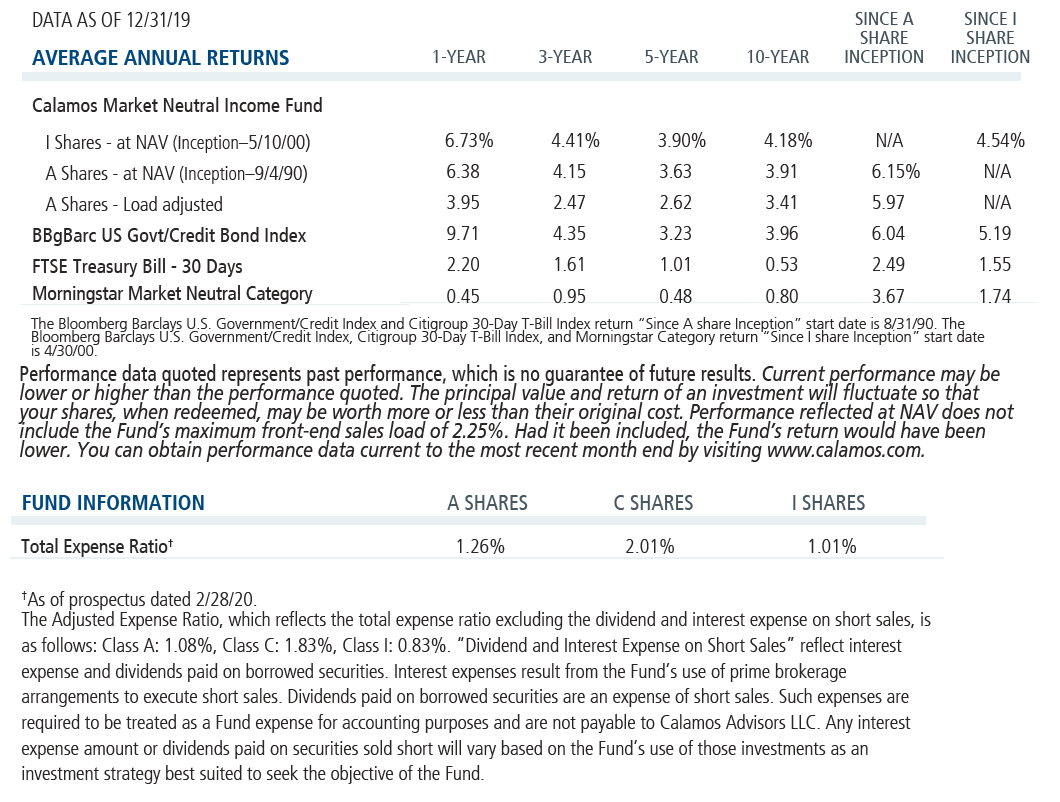

The S&P 500 Index is generally considered representative of the U.S. stock market.

The Bloomberg Barclays U.S. Government/Credit Bond Index includes treasuries and agencies that represent the government portion of the index, and includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests.

The FTSE 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments.

Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Skew describes asymmetry from the normal distribution in a set of statistical data.

Premium capture refers to the contract price earned when an option is written or sold.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

801941 320

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 13, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.