Here at the house that convertibles helped build, we believe that convertible securities should be a core allocation in investors’ portfolios across full and multiple market cycles. Day in, day out, rain or shine, you can expect at least one Calamos associate to be talking convertibles to someone somewhere.

But every few years—especially late in a cycle—nearly everyone (including issuers, advisors, investors, the media, other fund providers) gravitates to convertibles and their potential to reduce risk in a portfolio.

That’s the case today. Here’s why convertible bonds are in the spotlight now:

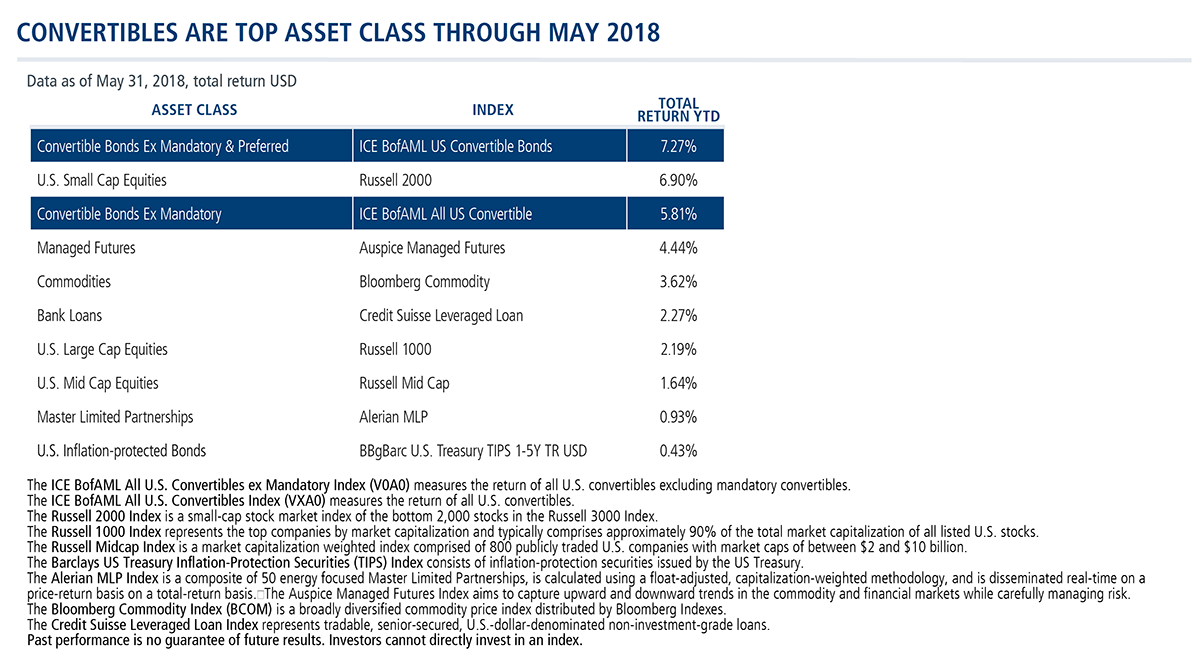

- Convertibles are one of the year’s top-performing asset classes.

- U.S. convertible issuance—$30.7 billion through June 14—is at a decade-high. At this rate, issuance could approach $60 billion for the year.

We made our case in a February blog post (see 4 Reasons Convertible Securities Issuance Is Taking Off in 2018), but see Barclay’s even longer list of issuers’ advantages in a report (subscribers only) published this week:

- Higher interest rates and credit yields

- The new tax policy that enhances the relative coupon savings and tax shield benefits of convertibles versus straight debt

- Strength in equity valuations, making issuers more willing

- Robust demand conditions leading to attractive terms for issuers

- Healthy economic environment driving demand for growth and expansionary capital

- Speed to market advantages

- Highly flexible and accommodative asset class that enables issuers to fine-tune their exposure in terms of coupon rates, premiums, maturity, lower effective dilution via call spreads, and tailored structures.

- The argument for using convertibles tactically is likely to continue, as rates continue to rise and markets remain volatile. (See this post for how Calamos convertible-using funds have performed in rising rate environments.)

What We’ve Learned about Convertibles

Our Founder, Chairman and Global CIO John P. Calamos, Sr. pioneered the use of convertible securities and led investor education in the asset class (see Convertible Securities: Structures, Valuation, Market Environment, and Asset Allocation, a PDF excerpted from one of John’s books). So, of course, we welcome all fresh attention to the asset class.

Today it’s possible to access convertible securities multiple ways (e.g., mutual funds, closed-end funds, ETFs, even directly).

When we talk to advisors, we draw on our 40 years of experience of actively managing convertible portfolios. Here’s what we’ve learned: To achieve the long-term performance advantage possible—to participate in the majority of equity upside while building resilience against unforeseen downturns—requires active management capable of understanding the risks, evaluating each issuer’s capital structure and positioning an overall convertible portfolio. For an elaboration on what drives convertible bond performance, please see this recent post.

Advisors, please talk to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com for more information about convertibles or about our convertible-using funds, including:

- Calamos Convertible Fund (CICVX)

- Calamos Global Convertible Fund (CXGCX), the only U.S.-based global convertible fund (see this post)

- Calamos Market Neutral Income Fund (CMNIX)

- Calamos Growth and Income Fund (CGIIX)