Why Advisors Are Boosting Clients’ Exposure to International Markets

January 30, 2018

Elsewhere, our investment team has expanded on the opportunities for investing in global and international markets (see Heading into 2018, International Assets Are Positioned for Outperformance and our two-minute video takes).

But in this post, we’re going to let a few charts do the talking. They help explain why financial advisors are boosting clients’ allocations to non-U.S. markets this year.

Growth-Oriented Investors Need to Go Where the Growth Is

The world is back to growing again—albeit at different rates.

The United States economy was the first to emerge from the 2008 crisis, resulting in U.S. equities heading almost straight up over the last nine years. At this point, the U.S. is believed to be in a late stage while other economies are much earlier in their recoveries.

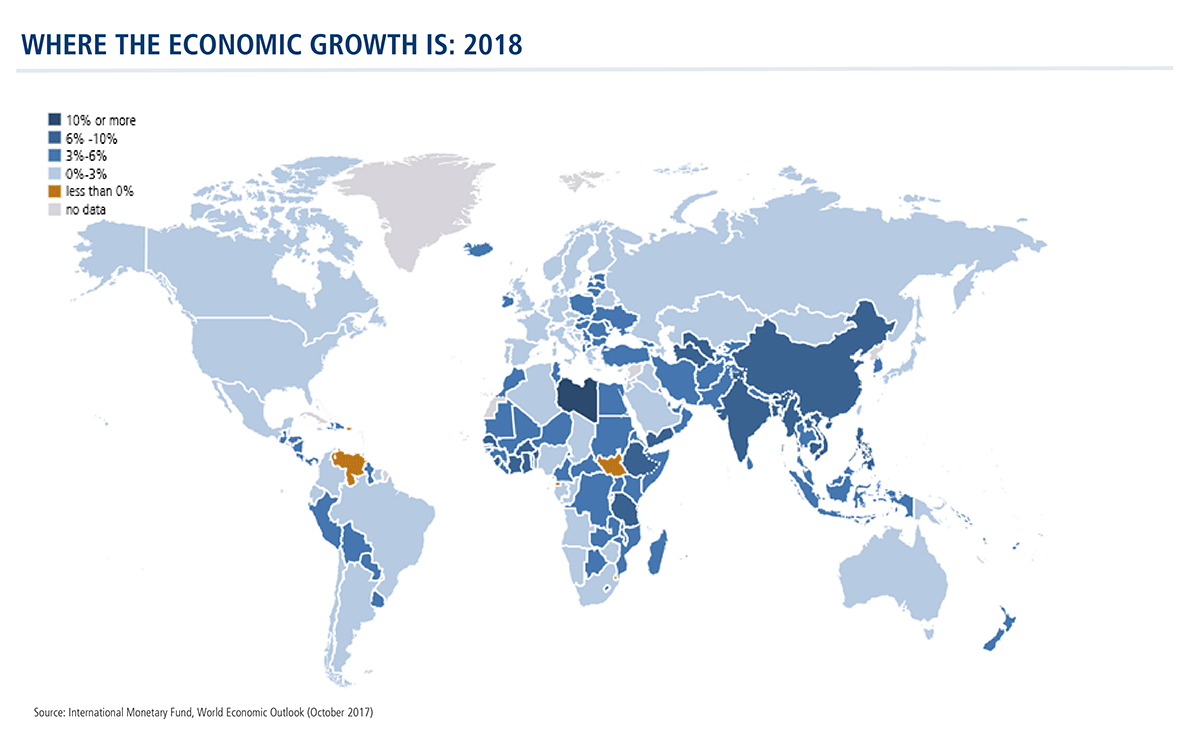

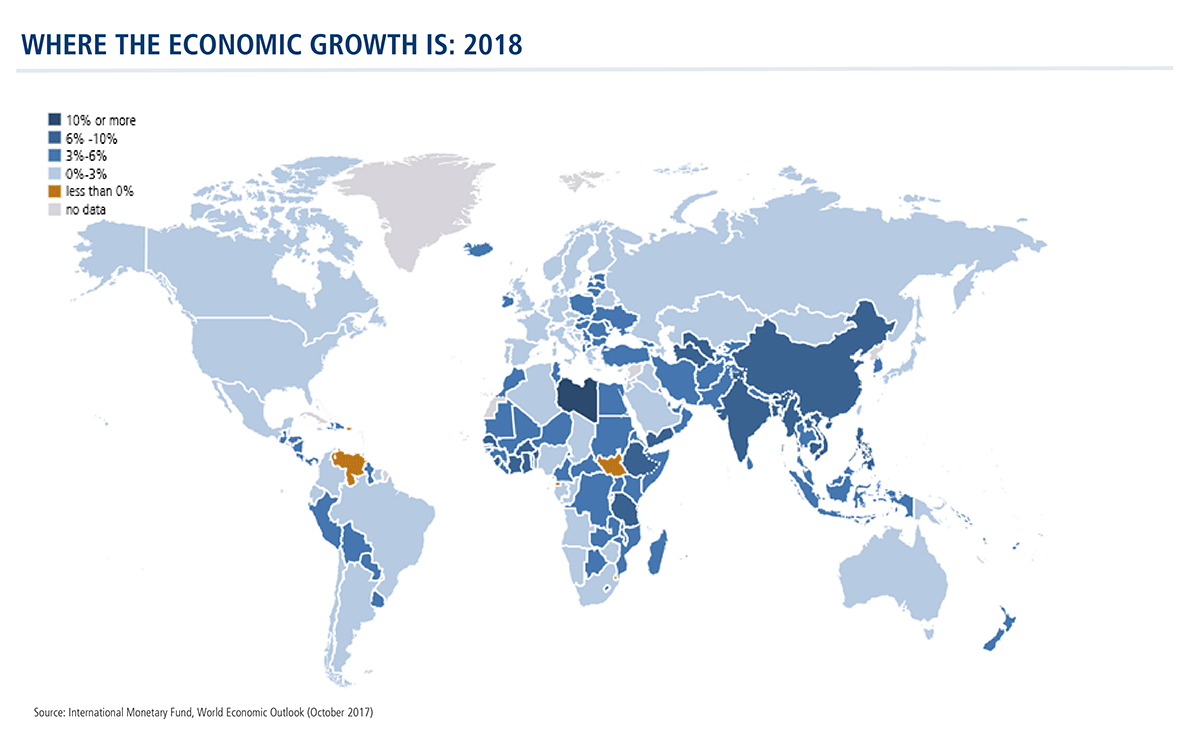

The map below from the International Monetary Fund provides a picture of synchronized global growth.

The U.S. growth continues, helped by lower corporate taxes, reduced regulation, job growth and consumer spending.

But note that the higher growth rates—the darker shaded areas—are outside of the United States. Which countries? Which sectors? Which companies? That’s where professional active management comes in.

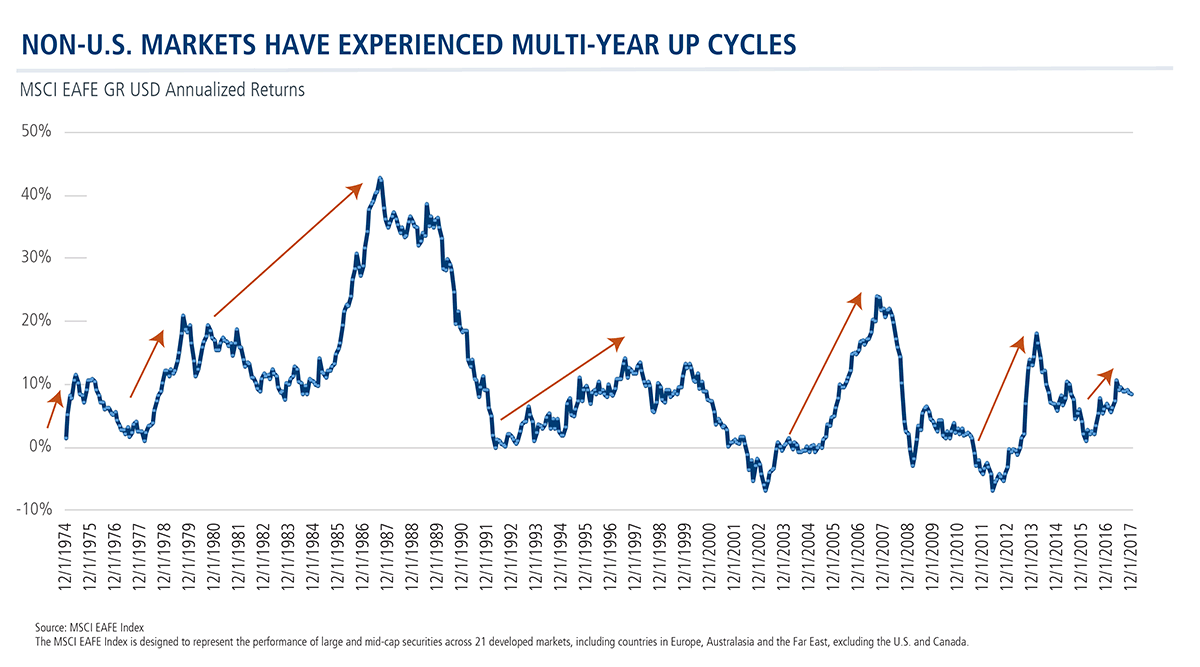

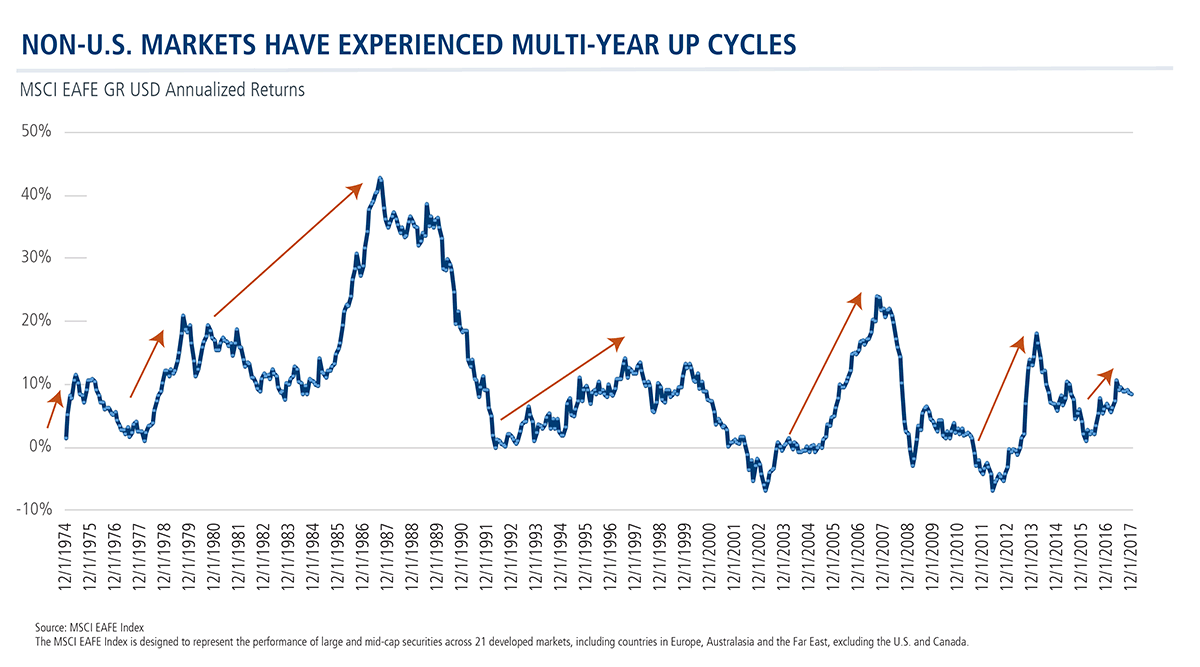

This Could Go On for a While

Some investors look at last year’s 27.8% return of the MSCI ACWI ex-U.S. Index and the 37.8% return of the MSCI Emerging Markets Index and worry that they missed the international rally.

While no one knows what 2018 can bring, a look at previous rallies reveals that they have tended to extend over multiple years. Indeed, that’s what our investment team expects to happen this year.

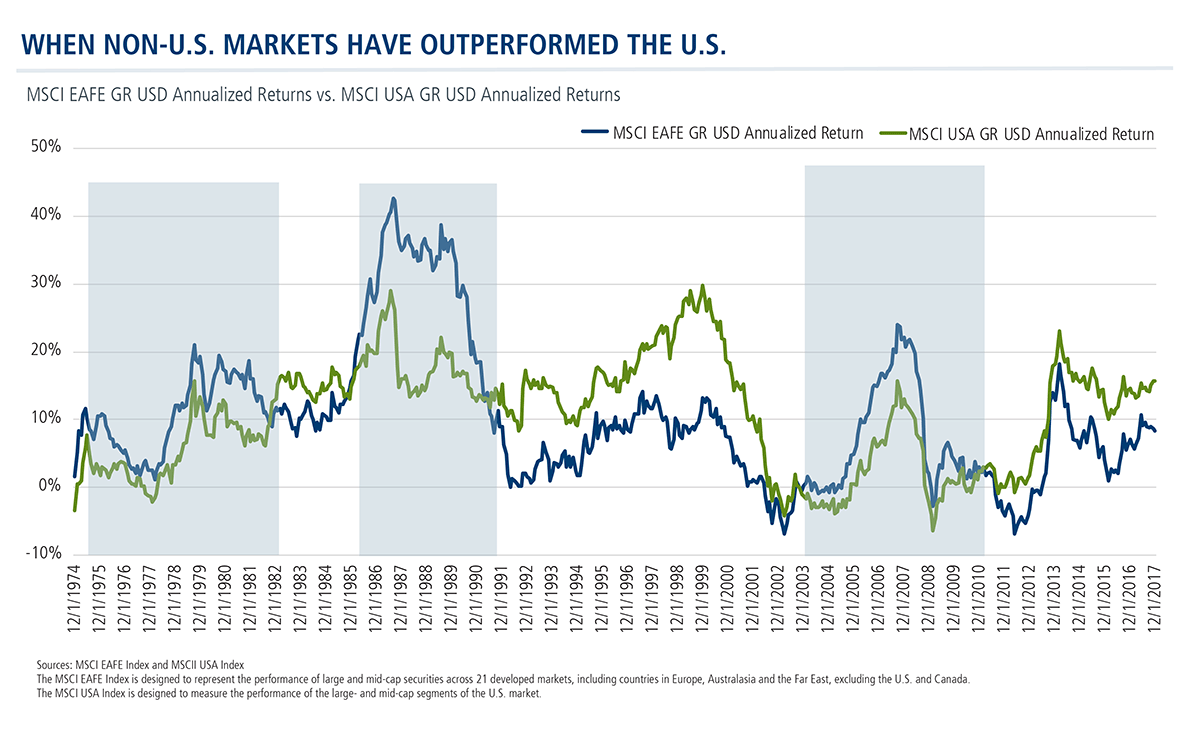

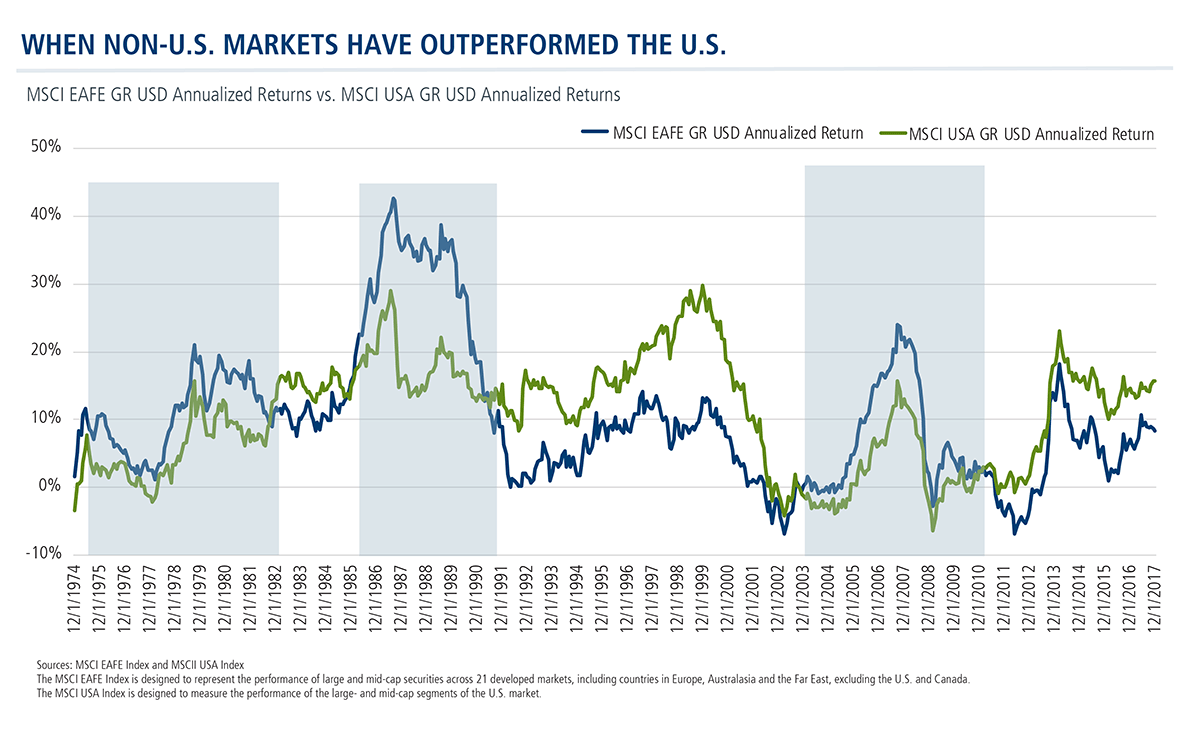

No Need to Take Turns

Both the U.S. and non-U.S. markets can be up at the same time. Below you’ll see the periods of such synchronization. But the chart also shows the trade-offs—at times the U.S. index has been up more, followed by leadership by the non-U.S. index.

Financial advisors, Calamos offers five ways to get your clients exposure to International and Global Markets. See how our suite aligns with your objectives (5 Ways to Get Your Clients Exposure to International/Global Markets).

For more information, talk to a Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Foreign Securities Risk—Risks associated with investing in foreign securities include fluctuations in the exchange rates of foreign currencies that may affect the U.S. dollar value of a security, the possibility of substantial price volatility as a result of political and economic instability in the foreign country, less public information about issuers of securities, different securities regulation, different accounting, auditing and financial reporting standards and less liquidity than in U.S. markets.

Emerging Markets Risk—Emerging market countries may have relatively unstable governments and economies based on only a few industries, which may cause greater instability. The value of emerging market securities will likely be particularly sensitive to changes in the economies of such countries. These countries are also more likely to experience higher levels of inflation, deflation or currency devaluations, which could hurt their economies and securities markets.

Important Risk Information. An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The Fund also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

MSCI ACWI ex U.S. Growth Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets excluding the United States, and emerging markets.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that represents large- and midcap companies in emerging market countries. It includes market indexes of Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

800995 118