Market Volatility Tests Investors’ Ability to Buy and Hold

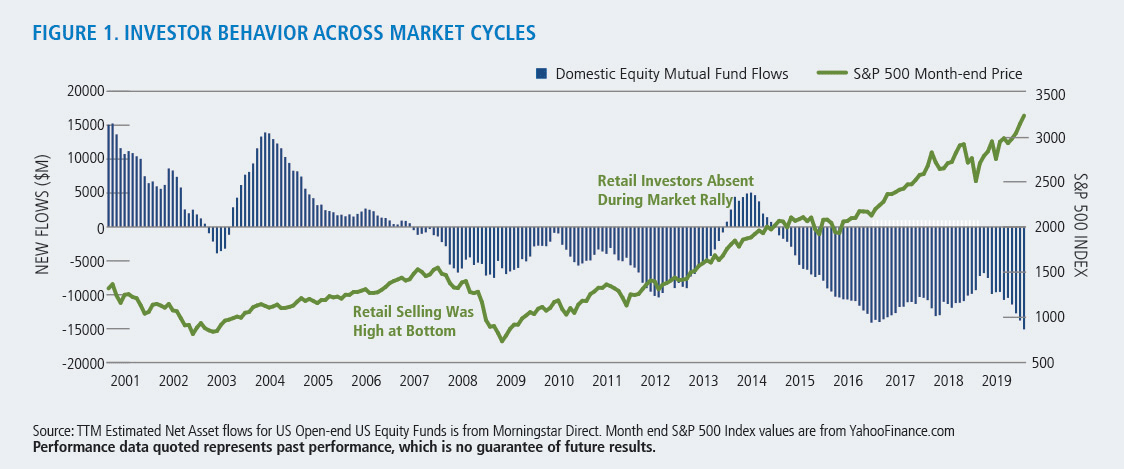

In December 2018—the worst December for the S&P 500 since 1931—a record $89 billion flowed out of equity mutual funds.

Can you guess what happened in the weeks that followed?

The S&P climbed 7.9% in January, booking its best performance in 30 years. This is a fresh version of an old story. Attempts to time the market—to invest at the right time and to sell at the right time—don’t work. Investors tend to enter markets late and leave too early. They have not demonstrated an ability to buy and hold unhedged equities across recent full market cycles, as this chart shows.

The blue bars in Figure 1 illustrate the buying and selling patterns of investors, represented by trailing 12-month domestic equity mutual fund flows. Since 2000, the peak selling over the past two cycles occurred at market bottoms, and the selling continued after the financial crisis ended. Investors were largely absent from the post-crisis rally, which many believe was partly caused by the recent volatility triggering emotional reactions.

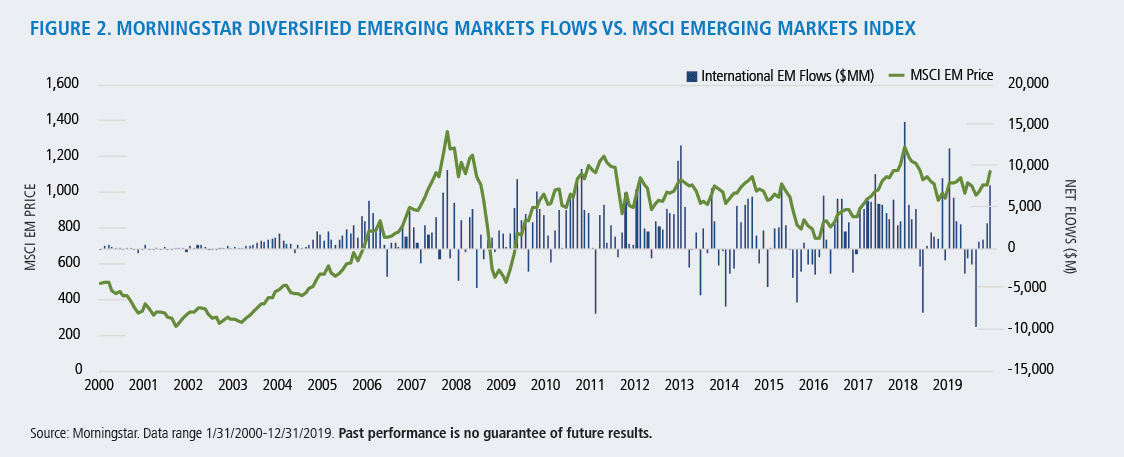

Markets can be volatile, and that volatility can test an investor’s ability to buy and hold. This is true of investing in established U.S. markets and it’s also true of investors in emerging markets. Investors who sell when they’re uncomfortable tend to have unfortunate timing—selling at a market’s bottom and missing when the markets rally.

Figure 2 tracks the growing investment, via mutual funds, in emerging markets since 1993. In February 1993, the first month Morningstar began reporting Diversified Emerging Markets category net flows, $39 million was in funds whose benchmark was the MSCI Emerging Markets Index.

The blue bars in Figure 2 illustrate the buying and selling patterns of investors, represented by the estimated net flows into the category. The green line illustrates the jagged ascent of the index. As can be seen at multiple times over the years, those who took part in peak selling at market bottoms were largely absent from rallies that followed.

Disclosure

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Past performance is no guarantee of future results.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

The S&P 500 Index is considered generally representative of the U.S. stock market. Indexes are unmanaged, do not entail fees or expenses and are not available for direct investment.

MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of developed market countries in North America, Europe, and Asia/Pacific region.

The MSCI Emerging Markets Index represents large and mid-cap companies in emerging markets countries.

The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options.

The Morningstar Diversified Emerging Markets Category is comprised of funds with at least 50% of stocks invested in emerging markets.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.