This post was written by Calamos Senior Vice President and Portfolio Specialist Todd Speed.

Given today’s shifting geopolitical landscape, many surprising developments can happen in 18 months. The UK voted to leave the European Union, the Trump administration rode a wave of change into power in the U.S., India implemented a massive demonetization initiative in its economy, and China’s steps to open markets to foreign capital mean that it will play an even larger role in the global investing landscape in the future.

Almost none of this was anticipated on January 21, 2016, when emerging market equities reached a major low point against a backdrop of slowing economic growth, weaker currencies and the prospect of higher interest rates and monetary tightening in the U.S.

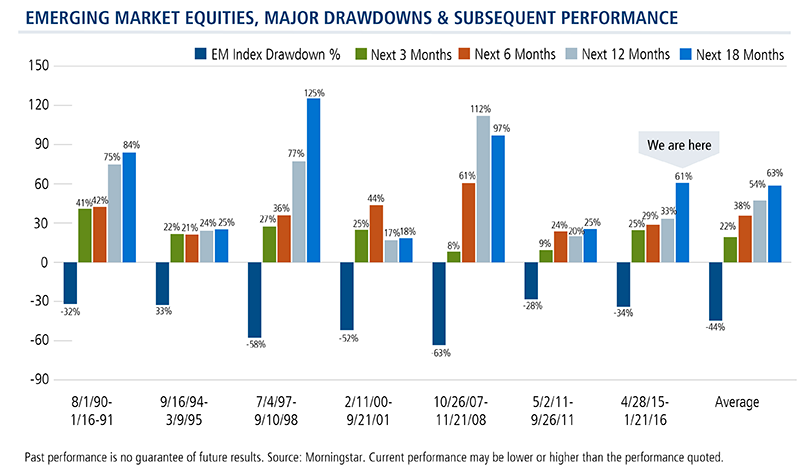

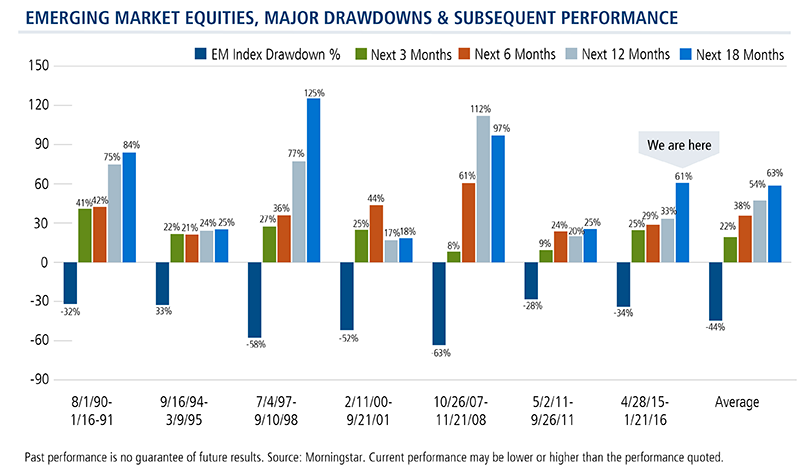

What we knew then, however, is that emerging markets have historically bounced back, rewarding the investor who has conviction.

We’ve been checking in on EM’s rebound every six months, and it has mostly tracked previous trends. EM equities’ previous six major drawdowns have been followed by roaring recoveries.

And the last datapoint in the 18-month series confirms that this was true of the 2016-2017 rebound, too: From January 21, 2016 to July 21, 2017, the MSCI EM Index returned more than 60%. This is in line with the average 63% bounceback after the previous six drawdowns. Emerging market equites roared back yet again.

From January to June alone the MSCI Emerging Markets Index gained 18.60%, twice the S&P 500 return of 9.34%. Given the positive environment, there may still be some gas left in the tank for at least the second half of the year (see post).

As noted in our July Economic Outlook, we continue to identify a breadth of opportunities in emerging markets. Many countries are benefiting from strengthening economic fundamentals. Liquidity conditions are improving across many economies as inflation has eased and higher interest rates have attracted capital flows. Emerging markets companies are delivering leading earnings growth and improved balance sheets, reflecting their high degree of competitiveness.

Financial advisors, for more information about investing in emerging markets our way, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Foreign Securities Risk: Risks associated with investing in foreign securities include fluctuations in the exchange rates of foreign currencies that may affect the U.S. dollar value of a security, the possibility of substantial price volatility as a result of political and economic instability in the foreign country, less public information about issuers of securities, different securities regulation, different accounting, auditing and financial reporting standards and less liquidity than in U.S. markets.

Emerging Markets Risk: Emerging market countries may have relatively unstable governments and economies based on only a few industries, which may cause greater instability. The value of emerging market securities will likely be particularly sensitive to changes in the economies of such countries. These countries are also more likely to experience higher levels of inflation, deflation or currency devaluations, which could hurt their economies and securities markets.

The MSCI Emerging Markets Index represents large and mid-cap companies in emerging markets countries. Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE