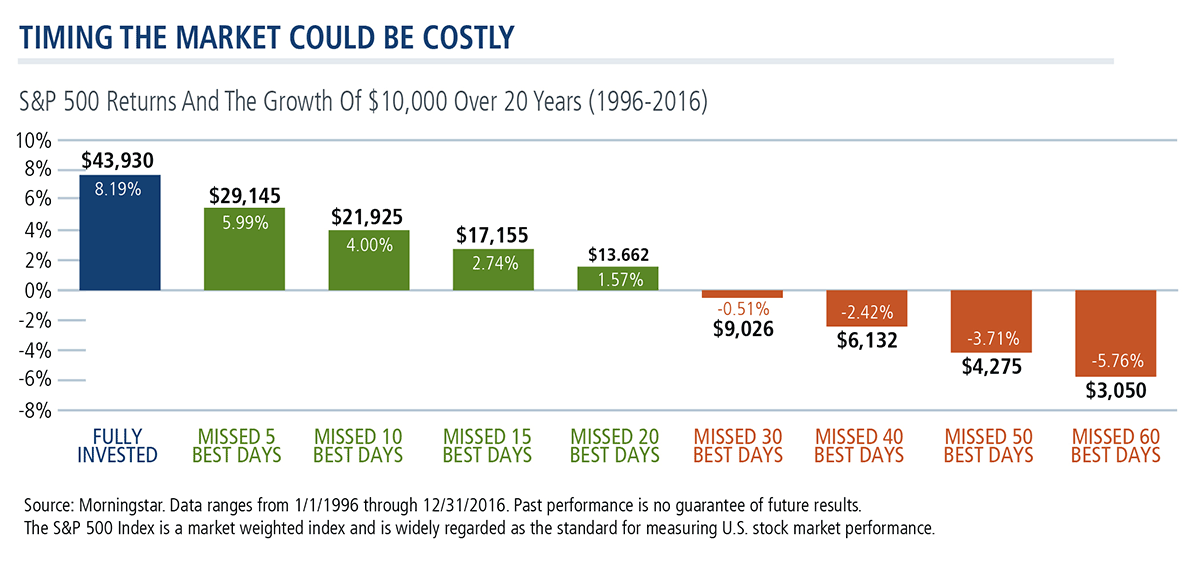

What’s the best time to get in the market? Most financial advisors would tell their clients that the answer to that question is Now. Historical data argues against efforts to time market entrances and exits (see chart below).

But if you are a financial advisor, and a client comes to you now—eight years into the equity bull market and 35 years into the fixed income bull market—with new money, you may be faced with a conundrum. Where do you go with that new money? What do you do with the intention of avoiding or minimizing a near-term decline in value?

At Calamos, we have a rich heritage of providing risk-managed investment solutions that seek to

- Dampen the effect of market volatility

- By providing downside protection

- That enables investors to remain invested throughout a full market cycle

Where could your clients’ new money go at this point?

Below we offer a cheat sheet that aligns common advisor objectives with the objectives and investment strategies of several Calamos risk-managed options. Of course, only you know your client’s overall portfolio, investment goals, time horizon, risk tolerance, etc.

| Your objective |

Rationale |

Consider |

| To be mindful of equity valuations |

You don’t want to miss out on equity exposure but at the same time you don’t want to pay premium prices.

For more, see Convertible Securities Provide Well-Priced Access to Growth

|

|

| To benefit from global economic growth |

The U.S. economy has been ahead of the rest of the world, parts of which just recently emerged from recession. Global equities—benefitting from improving economies including corporate earnings and continued accommodation in central bank monetary policies—offer earlier cycle growth.

Convertibles: Why Limit Yourself to Less Than Half the Market?

|

|

| To be mindful of income valuations |

Granted, fixed income isn’t cheap today. It nonetheless plays two important roles in a portfolio: produces income and hedges against more volatile asset classes.

|

|

| To manage equity and fixed income risk |

Risks can be managed. And, whether in index or individual stock volatility, opportunities can be found.

For more, see Managing Volatility-Aided Strategies in a Low Volatility Environment

|

|

| To hedge equity risk while maintaining equity exposure |

The management of risk includes selectively embracing it.

For more, see More Upside for Equities? CPLIX’s Grant Makes The Case

|

|

Advisors, for more ideas, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Past performance is no guarantee of future results. Opinions are as of the publication date, subject to change and may not come to pass. Information is for informational purposes only and shouldn’t be considered investment advice. Convertible securities entail interest rate risk and default risk.

Active management does not guarantee investment returns and does not eliminate the risk of loss.

The S&P 500 Index is a market weighted index and is widely regarded as the standard for measuring U.S. stock market performance.

The principal risks of investing in the Fund(s) include:

Convertible Fund: convertible securities risk, synthetic convertible instruments risk, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk and portfolio selection risk.

Emerging Market Equity Fund: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, mid-size company risk, small company risk, portfolio turnover risk and portfolio selection risk.

Evolving World Growth Fund: equity securities risk, growth stock risk, foreign securities risk, emerging markets risk, convertible securities risk and portfolio selection risk.

Global Convertible Fund: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

Global Equity Fund: equity securities risk, growth stock risk, value stock risk, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

Global Growth and Income Fund: convertible securities risk, synthetic convertible instruments risk, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk and portfolio selection risk.

Growth and Income Fund: convertible securities risk, synthetic convertible instruments risk, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, high yield risk and portfolio selection risk.

Hedged Equity Income Fund: covered call writing, options, equity securities, correlation, mid-sized company, short sale, interest rate, credit, liquidity, portfolio selection, portfolio turnover, foreign securities, American depository receipts, and REITS.

High Income Opportunities Fund: high yield risk, convertible securities risk, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk and portfolio selection risk.

International Growth Fund: equity securities risk, growth stock risk, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

Market Neutral Income Fund: convertible securities risk, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk and portfolio selection risk.

Calamos Phineus Long/Short Fund: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Total Return Bond Fund: interest rate risk, credit risk, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk.

800816 10/17